Loan write-offs rocket

Loans written off by banks escalated 42.66 percent year-on-year to Tk 1,640 crore in the first nine months of the year as lenders, awash with default loans, endeavoured to clean up their balance sheets.

The upward trend of written-off loans will help lenders paint a rosy picture of their health only for the time being, said Zahid Hussain, a former lead economist of the World Bank’s Dhaka office.

“But this will not bring anything positive as recovery of such delinquent loans is incredibly tough,” he added.

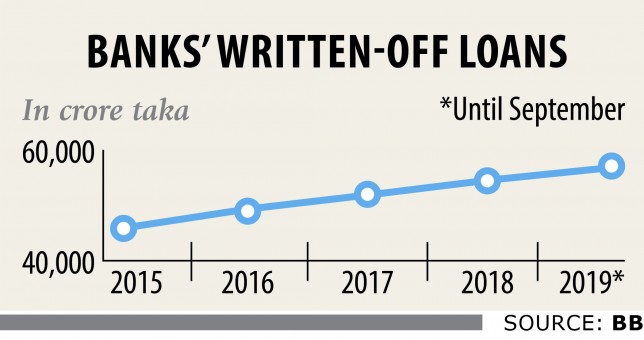

As of September, the banking sector’s total written-off loans stood at Tk 55,055 crore, up 10 percent from a year earlier, according to data from the Bangladesh Bank.

Banks have failed to recover 75 percent of the total written-off loans since January 2003, when the central bank introduced the policy. Unrealised delinquent loans stand at Tk 41,461 crore as of September.

Although banks have to file cases with the money loan courts to write off loans, the legal process hardly brings any positive result when it comes to recovery of delinquent loans, Hussain said.

“It is just a symbolic exercise,” he added.

Earlier in February, with a view to cutting down the stockpile of defaulted loans, the BB relaxed the policy to allow banks to write off default loans that have been languishing in the bad category for three years, down from five years previously.

Furthermore, lenders do not have to file any case with money loan courts to write off delinquent loans worth Tk 2 lakh, up from Tk 50,000 previously.

“There is no scope to hold back written-off loans unless and until default loans are checked,” Hussain said, adding that the central bank continues to give regulatory forbearance to banks, fueling defaulted loans in recent months.

In the first nine months of 2019, an eye-watering Tk 22,377 crore of outstanding loans turned red.

Banks have to keep 100 percent provisioning against written-off loans that erodes their capital base and available loanable funds.

“They should strengthen their financial health first before they can write off loans,” said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

But the ongoing situation is the opposite due to the upward trend of default loans. Loan write-off is a global practice but this not an ultimate solution to showing off a better financial health, he said.

Many weak lenders have even lost their capability to write off default loans as they have to keep 100 percent provisioning against the loans.

The central bank should impose an embargo on banks from giving out dividends in case of failure to maintain required provisioning, said Mansur, also a former official of the International Monetary Fund.

“Punitive measures should be taken to put the brakes on rising defaulted and written-off loans,” said Khondker Ibrahim Khaled, a former deputy governor of the central bank.

Passports should be confiscated as soon as borrowers enter the default zone, he said, while also calling for defaulters not to be bestowed with the status of commercially and very important persons.

Banks are facing a challenge in writing off defaulted loans as many of them are cash-strapped, said Syed Mahbubur Rahman, chairman of the Association of Bankers, Bangladesh, a forum of managing directors of private banks.

“They should speed up the recovery of defaulted loans. This will help them bring down such loans,” said Rahman, also the managing director of Mutual Trust Bank.