BB to relax rules for unintentional defaulters

The loan payment process will be eased for unintentional defaulters if they have valid grounds for their failure to clear the loans, said Bangladesh Bank Governor Fazle Kabir yesterday.

The law has clearly defined what will be considered a nonperforming loan (NPL) and who will be called wilful and unintentional loan defaulters, he said.

Entrepreneurs, who failed to repay loans for reasons they cannot be held responsible for, such as delays in getting utility connections and in loan approval process, might get special consideration, he said.

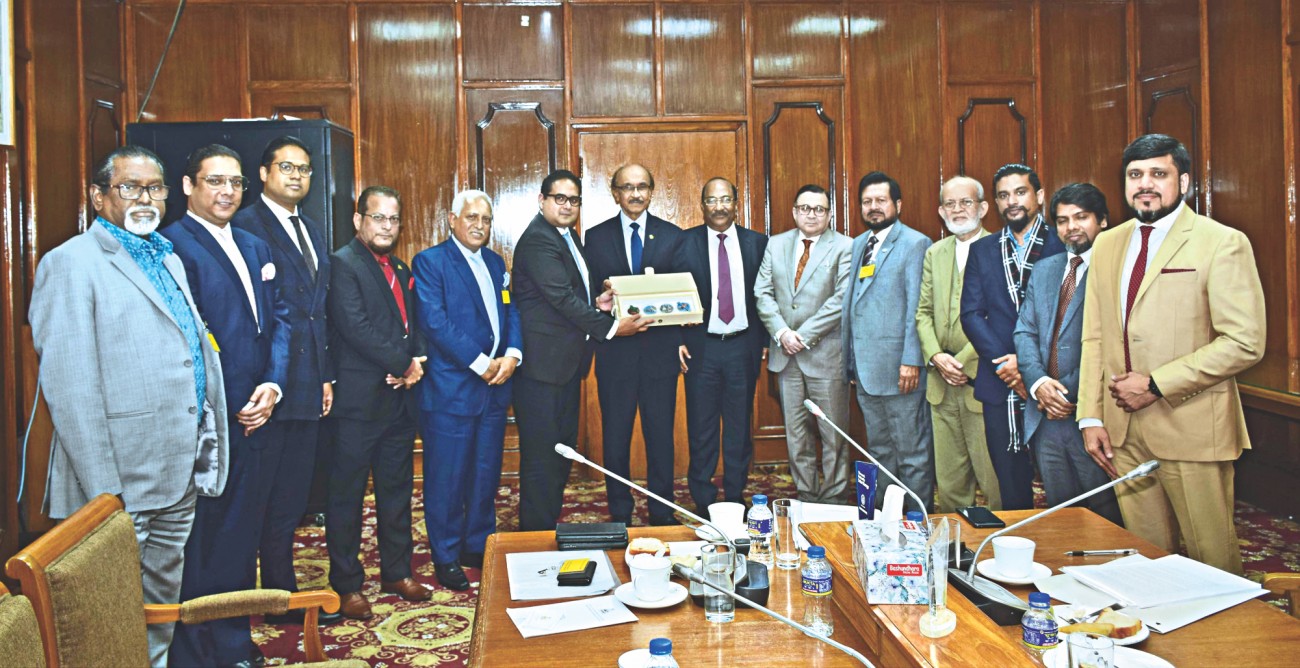

Kabir spoke at a meeting with the newly elected board of directors of Dhaka Chamber of Commerce and Industry (DCCI) when they came to meet with him at his central bank office in Dhaka.

As the Bangladesh economy mostly depends on the banking financial system, the government plans to bring down the lending interest rate to single digit from April this year, he said.

The government has also taken various infrastructure development projects where private sector’s intervention would be much appreciated, he said.

Recently, the National Board of Revenue withdrew stamp duty, which will help flourish the country’s bond market system.

Bangladesh should have a strong secondary bond market as a long-term financing mechanism, he said.

He also sought cooperation of the business community for effective use of the $300 million Export Development Fund, money from which is disbursed by the banking watchdog through authorised dealer banks.

Despite an over 8 percent growth of the gross domestic product, private investment has remained stagnant at 22-23 percent of the GDP, Shams Mahmud, the newly elected DCCI president, said at the meeting. The situation is aggravated by the slowdown in the private sector credit growth, which was 9.87 percent in November 2019.

The high cost of bank loans is one of the reasons for the fall in private investment, he said. The lending rate should be brought down to single digit and a mechanism should be developed to identify wilful and unintentional defaulters, Mahmud said.

To improve in the ease of doing business index, he suggested for amending the Section 42 (c) of the Bangladesh Bank Order 1972 for collecting and distributing credit information data from sources other than banks. He also wanted the Section 46 (3) of Bangladesh Bank Order 1972 to be amended to allow private firms and individuals to access their own credit information.

Access to finance and more export markets should be ensured along with building necessary infrastructure for the SMEs, which are the lifeline of the industry, he said.

In order to reduce the dependence on finances from the public and banks, the government should develop alternative sources of long-term financing for infrastructure and industrial projects.

Devaluation of the taka against the US dollar may have a negative impact on the economy, he said. “Additional cash incentives may be extended to major export sectors as Bangladesh’s export dependent businesses rely on import of raw and intermediary goods.”

Bangladesh Bank will amend its rules and regulations if necessary to upgrade the overall banking eco-system, build a healthy money market and achieve targeted economic growth, said SK Sur Chowdhury, banking reform adviser of the banking regulator.