Stock turnover falls as big investors stay on the sidelines

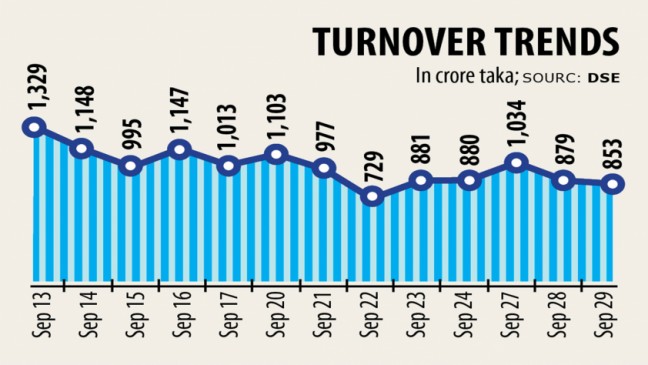

Following a insufficient participation from institutional investors for recent days, turnover, a crucial indicator of the stock market, decreased by about 3 % going to Tk 853 crore yesterday.

Many institutional investors are waiting on the sidelines and expecting a correction because they recently saw many stocks skyrocket by as much as 20 to 30 %, according to a stock broker.

Meanwhile, DSEX, the benchmark index of the Dhaka STOCK MARKET (DSE), edged downwards by 21.53 points, or 0.42 per cent, to 4,982.

"Some investors are taking profits now, which is impacting the index," he said, adding that the index will go down after any significant rise in profit booking.

The DSEX rose by 31 % or 1,200 points to 5,160 over the last 90 days, DSE data shows.

Some investors are forced to look at the wait-and-see approach because of all the economic uncertainty brought about by the ongoing Covid-19 crisis.

Besides, the government fears another wave of infections may arise in winter, he added.

Institutional investors are focusing on buying initial public offerings (IPO), as a result of which the market gets dry out, said a senior official of an asset management company.

Several subscriptions and bidding on IPOs have been ongoing for the past three weeks, he added.

The IPO bidding process for Associated Oxygen, Mir Akhtar Hossain and Energypac Power Generation were held in September, according to the DSE data.

The IPO bidding for three others is coming in October.

So, investors are saving cash by selling their shares in the secondary market, in line with the official.

However, a merchant banker said that they usually keep a fund aside for buying the primary market.

Besides, issuing way too many IPOs in a short period of time will discourage the rise of newly listed stocks, he added.

Meanwhile, Beximco topped the turnover list with shares worth Tk 34 crore changing hands, accompanied by Beximco Pharmaceuticals, Paramount Textile, Nitol Insurance and Sandhani LIFE INSURANCE COVERAGE.

Paramount Textile topped the gainers' list with a 9.92 % increase accompanied by Express Insurance, EBL first mutual fund, Karnaphuli Insurance and Green Delta Mutual Fund.

United Airways shed most, dropping 7.69 % followed by Fine Foods, GQ Ball pen, First Finance and Orion Infusion.