Coronavirus fears grip Dhaka bourse too

All over the globe stocks have already been on slide in recent days as economic costs of the coronavirus pandemic have started to spook investors. The problem is no different in Bangladesh.

Most of the companies in Bangladesh generate their recycleables from China, which has been on lockdown for per month now for the outbreak of the lethal pneumonia-like virus which has already 3,000 lives.

It has halted production, which will affect their earnings in the upcoming quarters, said market analysts.

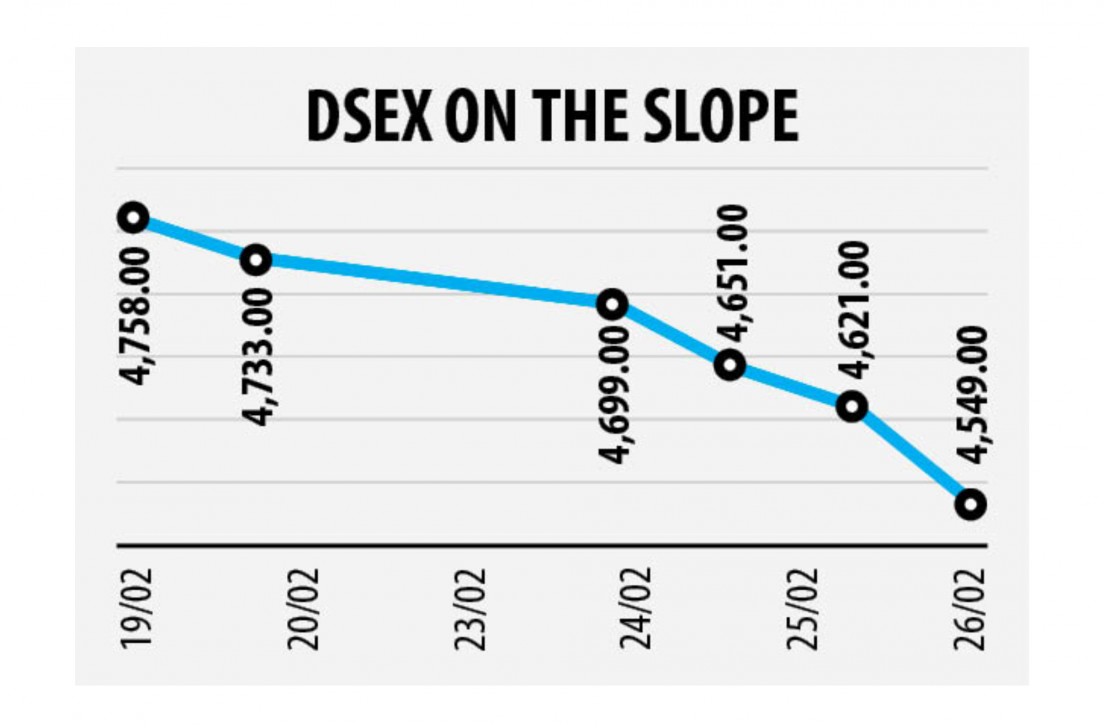

Yesterday, DSEX, the benchmark index of the Dhaka STOCK MARKET, dropped 72.1 points, or 1.6 per cent, to 4,549.11. During the past five days, the index plunged 208.89 points, or 4.4 %.

On Tuesday, the Dow shed almost 900 points, falling a lot more than 3 % to close at 27,081. The S&P 500 also closed a lot more than 3 % lower, as the Nasdaq sank 2.8 %.

In the united kingdom, the FTSE 100 fell almost 2 per cent to a 12-month low of 7,018, while Japan's Nikkei 225 index fell 3.3 %.

Sponsors of a number of listed companies said their production is hampered due to the lack of recycleables. So, they are on the hunt for new sources.

The impact of coronavirus will be felt deeply in the days ahead as all rod makers' raw materials result from China, said RSRM Director Marzanur Rahman.

A sponsor director of a listed textile company echoed the same, saying the textile and garment sector will be impacted mostly because of coronavirus.

"And our productions have been affected," he said preferring anonymity.

However, a merchant banker said not all listed companies import raw materials from China, so they shouldn't be affected an excessive amount of by the coronavirus pandemic.

Apart from the coronavirus issue, the Dhaka bourse is preoccupied with the forthcoming reporting season of banks, he said. "They fear banks' earnings will fall."

When the single-digit rates of interest are implemented almost all of the listed banks' earnings will probably contract as their lending and spread may be squeezed.

Spread may be the difference of in the interest rates for lending and deposits.

The Bangladesh Bank has instructed all banks to charge 9 % interest on all loans except credit cards from April 1.

As the banking sector may be the still the most notable sector in the stock market when it comes to market capitalisation its impact will be expansive, he added.

Among the 30 listed banks, the stock prices of 22 fell yesterday and five stayed unchanged.

Besides, the order from the court that Grameenphone, the major listed company on the bourse, must pay another Tk 1,000 crore next 90 days also dampened the mood of the stock market, said another leading merchant banker.

Grameenphone had deposited Tk 1,000 crore to the state coffer just the prior day.

The payments will eat in to the operator's reserves, meaning the Grameenphone board might opt to announce lower cash dividend come next