DSE profits contract as investors flee

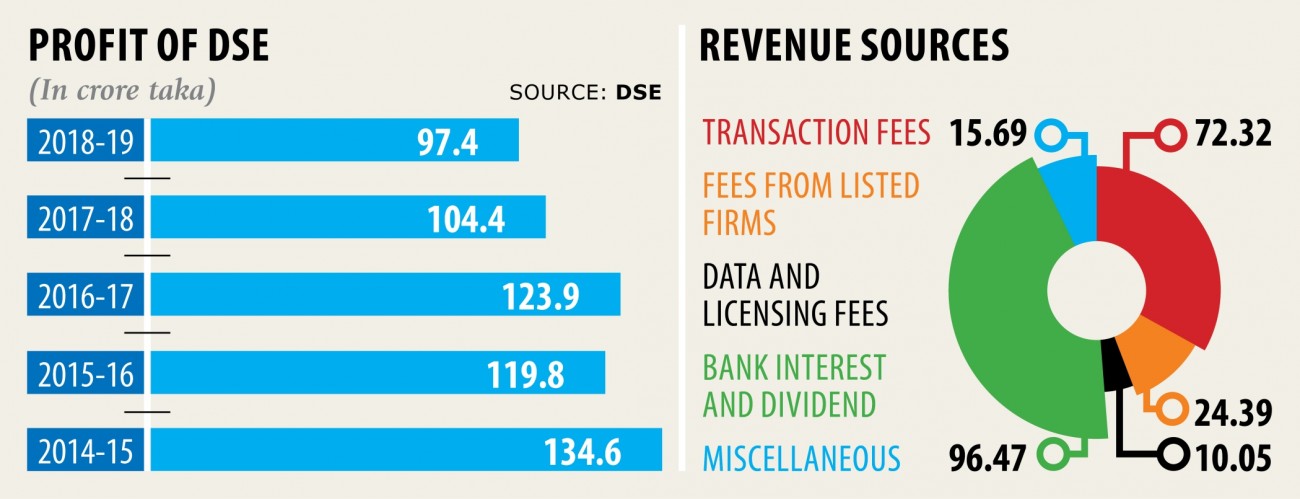

Dhaka Stock Exchange’s profits dropped 6.70 percent year-on-year to Tk 97.4 crore in fiscal 2018-19 as a narrow product range and lacklustre stock market ward off investors.

“This is the lowest in 10 years,” said Mizanur Rahman, a stock market analyst.

The premier bourse is heavily dependent on bank interest income: about 43 percent of its revenue in fiscal 2018-19 came from bank deposits.

In contrast, the neighbouring country’s Bombay Stock Exchange logged only 5.67 percent of its total revenue from this source for the year that ended on March 31.

The rate is much lower in the US stock exchange Nasdaq, which registered only 0.23 percent of its income from bank interest as of December 31 last year.

“Interest income-based profit is not a good indicator for any stock exchange,” said Rahman, who is a professor of accounting and information system at the University of Dhaka.

The DSE’s second highest income came from transaction fees, which was Tk 72.32 crore.

The bourse failed to bring in new products and jump start the bond market, Rahman said, adding that many left the market too.

The bourse’s daily average turnover also fell 5.25 percent to Tk 613 crore though the number of shares rose.

The stock market has been suffering from a lack of confidence for the last few years, so its turnover is still very low, said a high official of DSE requesting anonymity.

The DSE has been running for around 60 years, but it is only an equity-based stock exchange, said a stock broker, who is also one of the shareholder members of the bourse.

“None worked for product diversification sincerely,” he added.

The bourse is trying to ease the bond market problems, but there are some regulatory barriers as well, said the DSE official, adding that the recently launched SME platform and the alternative trading board may add some revenue in future.

The two platforms will facilitate the small and medium companies to come to the stock market and the other will tempt non-listed companies to trade their stocks. People’s participation in the stock market is very low, which ultimately deters the market from expanding, he said.

“And people are not coming to the market because they think the stock market is full of gambling and lacks good governance.”

The total number of beneficiary owners’ account is 25.78 lakh, which is about 1.50 percent of the total population of about 17 crore, according to the Central Depository Bangladesh.

“Only the listing of solid companies and good governance can change the scenario,” he added.