Stock brokers in dire need of incentives

Currency markets investors and intermediaries are actually in real peril as the index of the country's bourses have sunk along with turnover during the past few months of the coronavirus pandemic.

The solution they state are sustenance incentives in the upcoming budget of FY 2020-21.

"Many stock brokers who get brokerage charge from trading will be compelled to shut their business if the existing situation continues plus they don't get incentives," said Sharif Anwar Hossain, president of the DSE Brokers' Association (DBA).

"We need incentives desperately because stock brokers are suffering for the last five years because of low turnovers," he said, adding, "Now the problem has intensified."

Currency markets trading was suspended for the past two months consistent with a nationwide shutdown targeted at containing the coronavirus outbreak in Bangladesh.

Although the marketplace opened on June 1, average turnover on the Dhaka Stock Exchange (DSE) slumped to Tk 120 crore as of yesterday.

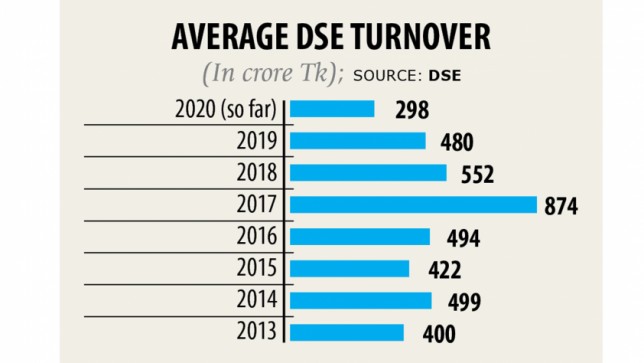

Prior to the pandemic, average yearly turnover had kept below Tk 500 crore for days gone by seven years, apart from 2017 and 2018.

Despite the fact that turnover is low, the amount of brokerage houses isn't. There are already 238 members under the DSE and 136 under the Chittagong Stock Exchange.

Many brokerage houses are struggling to pay staff salaries, said Hossain who is also managing director of Shahidullah Securities.

Many brokerage houses borrowed money from relatives to pay staff and office rent with hopes that the marketplace will turn around however now that hope is flickering, he added.

The DBA already sought a motivation package, including concessional loans, to bear office expenses and pay employee salaries. They expressed intent to repay the loan within 2 yrs at 3 % interest.

The DBA called for lowering advance tax on share trading to 0.015 % from the prevailing 0.05 %.

The federal government imposed higher taxes predicated on a higher turnover in 2010 2010 but from then on year's boom turnover fell, the taxes remained the same, said another stock broker.

The association urged for incentives for investors aswell because they are also struggling with ailing stocks for a while.

It requested the government to scrap the provision for paying twelve-monthly BO account fees and provide refinancing facilities to investors who are margin loan members to greatly help prevent themselves from choosing forced sales.

The refinancing facilities have to come at 3 per cent interest rate for 3 years.

Sorkar Joynal Abedin, a stock investor, said he has been observing the horrible bleeding in his portfolio since last February.

During this time period, the benchmark index of the DSE dropped 17 % to 3.956 points.

Following the historic market crash of 2010, the index has already reached a fresh low while remaining bearish almost all the time, for which investment slowly eroded in the last one decade, said Abedin, an MBA-degree holder who works at a private company.

"Now the situation has deteriorated to the cheapest point, for which the federal government can consider providing some incentives to investors and listed companies," he added.

The DBA also urged the Bangladesh Securities and Exchange Commission to refrain from charging yearly broker and dealer fees of the existing year.

From the DSE, it sought scrapping yearly subscription service fees and the authorisation of representative charges so that brokers can give various facilities and services to the investors to bring them back again to the market.

Merchant banks are also in big trouble as a result of bearish market.

"The number of merchant banks is huge compared to the market size so many merchant banks neglect to process any issues in a year," said a high official of a respected merchant bank, preferring anonymity.

Merchant banks manage initial public offerings and give the service of under writing and advocacy in investment.

In 2019, 10 IPOs were approved whereas there are 62 merchant banks now in the united states, in line with the BSEC data.

The asset management companies are also not in a favourable position amid the bearish market.

"Most of the asset management companies which manage mutual funds are struggling to find funds and they'll face a major challenge now," said Shahidul Islam, ceo of VIPB Asset Management.

The government provides refinance schemes for them to ensure that they can survive, Islam said, adding that the mutual funds were very crucial for a sustainable market.