Bourses at all times the environment bounce after historic rout

The Dhaka bourse witnessed a dead cat bounce yesterday along with global marketplaces though the reason is not the same.

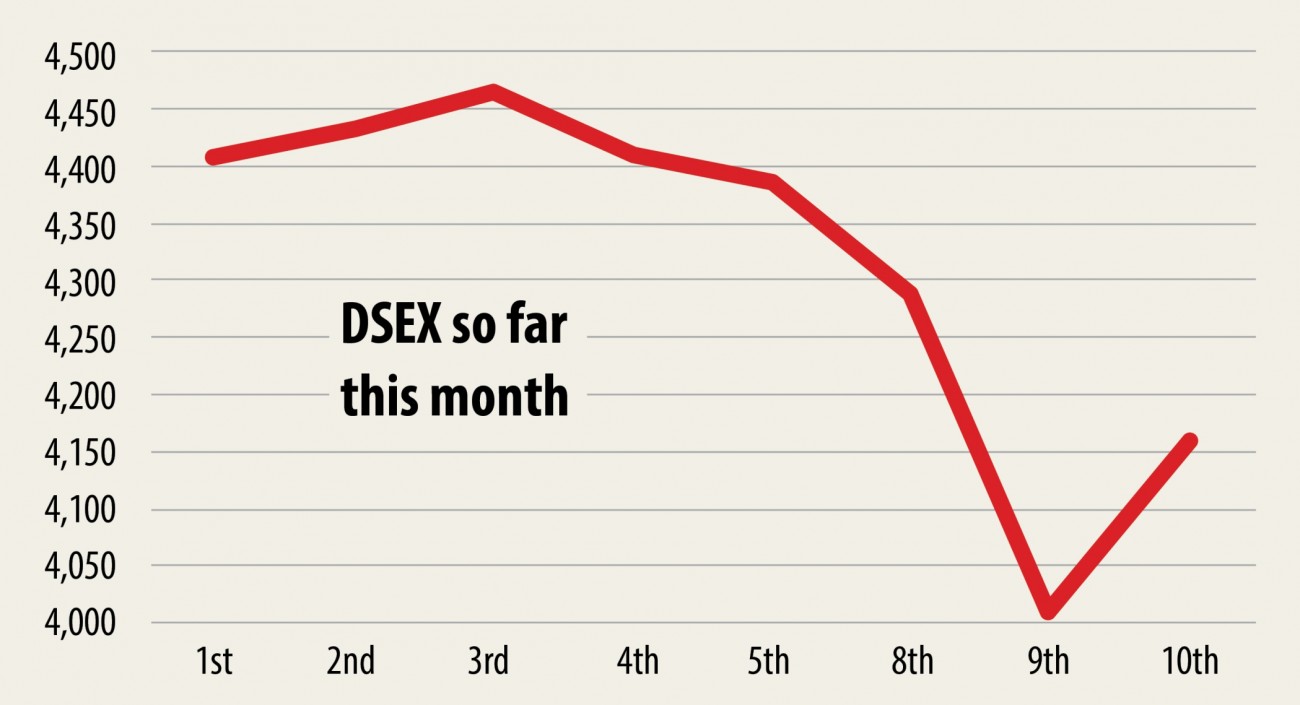

DSEX, the premier index, surged 148.26 items, or 3.69 percent, to close your day at 4,156.32, riding on the news headlines that that the Dhaka STOCK MARKET operations would sit with banking institutions to persuade them to take through to the Bangladesh Bank's package for the stock market.

Previous month, the central bank declared a Tk 200 crore fund that banks can borrow to purchase stocks to prop up the ailing market.

Banks can borrow in 5 per cent interest for a good five-time period through repurchase agreements (repo) against treasury charges and bonds they own.

Thus far, almost all of the banks have already been reluctant to have up the loan. Up to now, around five have applied for the benefits.

"The banking institutions want to support the marketplace, hence we said if they are facing any difficulty they can resolve it by discussing with the central bank," explained Kazi Sanaul Hoq, managing director of the DSE.

The bourse can be willing to consult with BB about the banking institutions' problems, he said, adding that some banking institutions will make an application for the funds after getting approval from their boards.

"So, I hope we will see the results soon," he added.

Meanwhile, bourses all over the world bounced again after among the worst routs because the 2008 financial crisis after objectives of significant stimulus methods to soften the economic blow from the global coronavirus outbreak.

Japan's Nikkei 225 shut your day 0.85 % higher, while Hong Kong's Hang Seng climbed 1.4 %. Australia's benchmark S&P/ASX 200 index rebounded to up close 3.1 %.

The Shanghai Composite Index gained 1.8 % as Chinese President Xi Jinping found its way to Wuhan for a surprise visit.

This is his first visit to the epicentre of the coronavirus epidemic because the health crisis began, and comes as China reports a steep decline in the number of new cases.

President Xi's trip to Wuhan is declaring China has largely brought the coronavirus in order, according to analysts. Such outings bring hope among inventory investors.

European markets were surging too, led by a growth greater than 2 % in London.

During writing, London's FTSE 100 was up almost 2.6 %. Germany's DAX rose 0.7 %. The Stoxx Europe 600 jumped 1.9 %.

On Wall Road, the S&P 500 rose more than 3 %, Nasdaq 2.4 % and the Dow Jones commercial average 2.5 %.