Bourse revving up to fire on all cylinders

The stock market has started to bounce back despite the ongoing pandemic thanks mainly to investors' growing confidence in the brand new leadership at the Bangladesh Securities and Exchange Commission (BSEC) as they took some measures to revive discipline.

In the last 8 weeks, DSEX, the benchmark index of the Dhaka STOCK MARKET, surged 680 points, or 17.1 %, going to 4,633.37 yesterday.

During the period, the market capitalisation rose 13.6 % to Tk 352,219 crore.

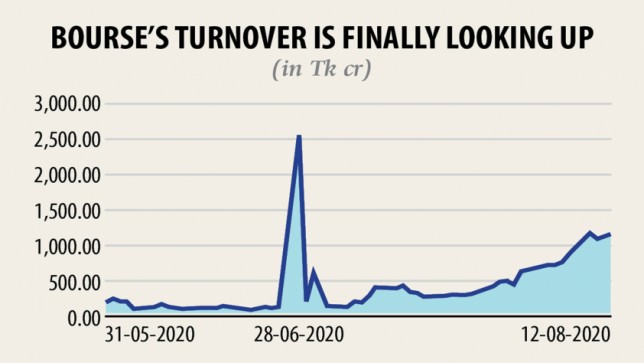

Turnover, another important indicator of the marketplace, reached Tk 1,100 crore in the last three days from Tk 38 crore 8 weeks earlier.

Market analysts say the participation of retail investors in good sized quantities helped the index to spiral.

Exemplary punishment passed out to rogue players, compelling listed companies' directors to carry a minimum 2 % shares individually and 30 per cent shares jointly, buoyant monetary policy, positive export growth and a beginning of an economic recovery are the main reasons for the surge in confidence, they state.

"The regulatory step was crucial for the rise in the confidence of the stock investors, which ready the index," said Md Moniruzzaman, managing director of IDLC Investments.

BSEC hit the proper place by punishing errant directors and brokerage houses and compelling minimum shareholding.

"The expansionary monetary policy also impacted the marketplace positively."

The central bank has reduced the lender rate to 4 % from 5 % and proposed to cut overnight repurchase rate from 5.25 % to 4.75 % to make funds designed for banks at cheaper rates.

The announcement came in the monetary policy going back half of the current year.

The V-shaped recovery of local businesses and export earnings is going on, although it is yet to reach the pre-pandemic level, Moniruzzaman said.

A V-shaped recovery involves a sharp rise back again to a previous peak after a sharp decline.

Exports earnings in July rose about 44 % from the prior month to $3.9 billion, in line with the Export Promotion Bureau.

"The economy did not face the devastation that persons had feared. Folks are optimistic now."

Investors come to the marketplace with money when a rally happens.

"And that's happening now," Moniruzzaman added.

Khairul Bashar Abu Taher Mohamed, ceo of MTB Capital, echoed the same, saying the marketplace has been rising after staying low for years mainly due to the growing confidence in the new commission.

The brand new commission has taken some steps against errant directors of listed companies and voided some initial public offering proposals, sounding out a clear message that it could not be simple to manipulate and bring weak companies to the marketplace beneath the new leadership.

"The message gave confidence and the confidence influenced people to pour money," he added.

In the center of May, Shibli Rubayat Ul Islam, a professor of Dhaka University, was appointed the new chairman of the BSEC along with three new commissioners.

Days gone by commission led by M Khairul Hossain was blamed for creating an opportunity for weakly performing companies to get listed with the bourses, denting investor confidence.

Moreover, rogue directors and players remained almost untouched during his nine-year stint. So, insider-trading, gambling and fall were a commonplace.

A high official of a stockbroker credited the retail investors' investment for the recent rise.

Recently, 15 banks formed a fund of Tk 1,650 crore by firmly taking loans from the Bangladesh Bank through repo agreement. The banks invested about Tk 260 crore in to the market, in line with the central bank data.

"However the institutional investors remain silent."

The currency markets regulator should inquire further why they aren't investing now for the reason that rally wouldn't normally sustain in the long-run if indeed they usually do not come to the marketplace.

Many stocks are in a very lucrative position now and they can invest get them.

Some stocks are rising abnormally, but their earnings would in the end fall amid the pandemic.

Several banks may incur losses in the 3rd quarter of the entire year, which would affect the marketplace in the days to come, he added.