Stated banks bleed in H1. But the market isn't too fussed

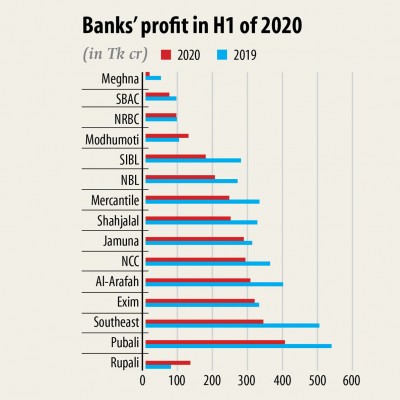

Most banks' operating revenue declined 20 to 30 % in the first 50 % of 2020 as a result of the paralysed economy but the fall did not reflect properly within their stock prices owing to the floor price.

The Bangladesh Securities and Exchange Commission set the ground price for all stocks on March 19 predicated on previous five-times' average prices to avoid the freefall in share prices seen around the world amid the fast-spreading coronavirus.

The operating revenue of lenders dropped in the January to June period as a result of the lending fee cap and the depressed economy, according to bankers.

The ceiling on the lending and deposit interest levels at 9 and 6 % respectively arrived to effect from April. And they were implemented almost in tandem with the government-announced months-long general vacation to support the contagion.

The shutdown brought the economy to a screeching halt, with the movements of people generally suspended and all establishments, factories and shops closed for a good 8 weeks until partial easing of restrictions on May 31, offering incredibly thin business to the banking sector.

Banks' lending fee dropped to 9 % from 11 to 12 % which impacted their business, said Syed Mahbubur Rahman, managing director of Mutual Trust Lender.

In the 1st half, export and import also dropped, so banks' commission business took a beating aswell.

"All sorts of incomes for banking institutions plummet during the time. We still have no idea when the pandemic will peter out, hence we come to mind that banking institutions' incomes would fall even more in the next half of the year," he added.

It had been expected the banking sector would announce lower profits. Therefore, banking stocks were likely to fall, explained a merchant banker requesting anonymity.

The floor price averted the slump, he said, adding that investors tried to sell the banking stocks that made lower profits nevertheless they didn't find any buyers.

"Whenever someone found clients, they purchased shares. We bought some banking shares whose functionality was better despite the pandemic," the merchant banker added.

The banking sector was the top-traded sector on the Dhaka STOCK MARKET (DSE) yesterday, as investors rearranged their portfolio following the disappointing performance of finance shares.

The turnover in the banking sector was Tk 16.72 crore, accounting for 21 % of the full total turnover found in the country's premier bourse, which is greater than the 3 % registered in the last session.

Banks announced their earnings scenario through newspapers yesterday which prompted investors to market or buy the stocks according to the overall performance, said a good stockbroker. Among the detailed 30 banks, Social Islami Bank, Pubali Lender and AB Lender rose, seven fell and the others were unchanged.

"Investors didn't find buyers, so most of them didn't sell. They feel that banks' performance would worsen even more in the upcoming months due to the lingering pandemic," the stockbroker added.

Investors are looking forward to a noticable difference to the coronavirus circumstances, said UCB Capital in its daily market analysis.

The floor price system remains a bottleneck for the marketplace liquidity as buyers aren't willing to purchase almost all of the shares at the artificially-set rates.

DSEX, the benchmark index of the DSE, dropped 2.35 points, or 0.06 %, to close the day at 3,986.74.

Turnover, another important indicator of the marketplace, fell 85.39 % to Tk 81.2 crore.

Pubali Bank was the most notable gainer closing 7.7 per cent higher, accompanied by Dacca Dyeing, Keya Cosmetics, Tallu Spinning and AB Bank.

Beximco Synthetics was the most notable loser shedding 7.46 %, accompanied by C&A Textile, Familytex BD, Islami Bank and Beximco Pharmaceuticals.