For NBFIs, 2019 was an awful year. And 2020 is definitely poised to be a whole lot worse

The year 2019, it appears, was an annus horribilis for the non-bank financial institutions industry.

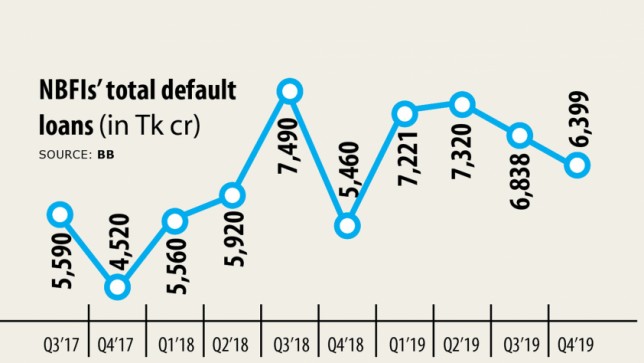

Not only achieved it start to see the fall of an institution, a production that not merely undercut the confidence found in the sector, the entire year as well the industry's default loans soar 17.19 % to Tk 6,399 crore in 2019.

The amount would have been much bigger had the default loans of the fallen People's Leasing and Financial Offerings (PLFS), that have been between Tk 600 crore to Tk 700 crore, were put into the list, said a central bank official.

The NBFI had didn't repay the depositors' funds despite the maturity of the funds. As well, its default loans and net losses were spiralling out of control.

This prompted the finance ministry on June 27 this past year to teach the Bangladesh Lender to shutter the NBFI, which was an initial for Bangladesh's financial sector.

Other than PLFS, practically 1 dozen NBFIs gave away large amounts of loans in breach of regulations, which fuelled the sector's classified loans, according to industry players and BB officials.

The situation in the NBFI sector is yet to boost. In fact, many of them possess plunged into deep difficulties because of the ongoing monetary fallout due to the coronavirus pandemic.

The NBFI sector started facing problems because the middle of 2018 when the banking sector felt the pinch of liquidity crunch, said Arif Khan, taking care of director of IDLC Finance, among the big titles in the sector.

Earlier in January 2018, to rein found in aggressive lending, the BB had instructed conventional banks and Shariah-based banks to lessen their loan-deposit ratios to 83.5 % and 89 % respectively, a move which possessed a domino influence on the NBFI sector.

The NBFIs are reliant on banks and customer deposits because of their funds. The decreasing of the loan-deposit ratio designed banks scale back on their lending to NBFIs, leaving the latter short of funds.

The situation had badly impacted a great number of NBFI clients, who weren't extended fresh credit for want of funds and subsequently became defaulters, according to Khan.

The central bank, nevertheless, backtracked from its decision to lessen the loan-deposit ratio on September 17 since it looked to ease the sector's ongoing liquidity crunch and facilitate a lower interest on lending.

No sooner had the NBFIs got rest from the liquidity shortage that the ongoing monetary fallout hit the financial sector, Khan said.

About 50 per cent of the clients are actually unable to pay back their loans as demand has collapsed everywhere.

Therefore, defaulted loans in the NBFI sector will dsicover a rise in the coming days, he said, adding that it will require at least twelve months for the problem to return to normalcy.

"We should manage those clients because they are not habitual defaulters."

Besides, 5-7 NBFIs violated banking norms even while disbursing loans, which is the key reason behind the escalation of defaulted loans, Khan added.

Defaulted loans won't increase an excessive amount of until September this season as the central bank has got asked NBFIs never to classify any loans during the period, said Mominul Islam, chairman of the Bangladesh Leasing and BOAT LOAN COMPANIES Association, an organisation of the NBFI CEOs.

The central bank in addition has declared several stimulus packages, which can only help NBFIs tackle the economical fallout.

"But the classified loans may sharply rise after September. Therefore the central bank should explore methods to curb the default loans," said Islam, also the taking care of director of IPDC Financing.

The weak NBFIs could follow IPDC's model to lower their default loans.

In 2007, IPDC's soured loans stood at 37 % of its total fantastic credit.

"We implemented various products to boost our financial health in phases. Now, IPDC's defaulted mortgage loan is merely 1.56 %," he said.

The ratio of defaulted loans in the NBFI sector stood at 9.53 % of the total disbursed loans amounting to Tk 67,177 crore as of December last year.

Source: www.thedailystar.net