March was first mean for MFS providers

Given the necessity for public distancing and the push towards digital transactions to avoid the pass on of the highly contagious coronavirus, one would have thought the cellular financial service sector will be having somewhat of a purple patch.

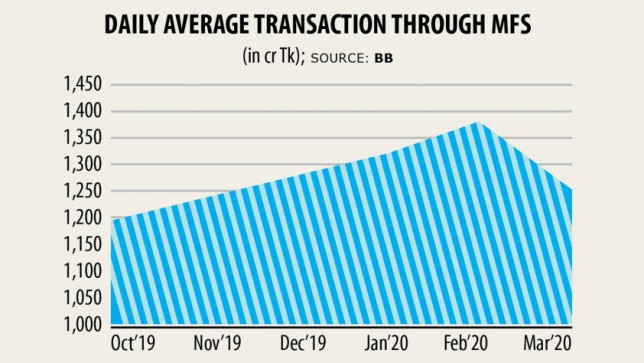

But, March, which marked the first confirmed situations of COVID-19 in Bangladesh, has been a good sobering comedown for the high-flying MFS sector. The common daily transactions on mobile money accounts substantially fell that month.

The first confirmed cases of COVID-19 were announced on March 8 and from the second week of the month the industry got an enormous hit, which is way prior to the government had announced a countrywide shutdown to flatten the curve on coronavirus.

Account-holders transacted about Tk 1,283.39 crore in March, down 11.06 % from February, relating to a Bangladesh Bank report released this week.

Though the application of mobile money has increased among the middle-class or the upper-middle-class through the pandemic, people who are in underneath of the pyramid didn't transact money frequently, industry insiders said.

The people in the bottom of the pyramid take into account the majority of the transactions.

"Transaction volume generally is determined by the country's overall financial situation. As we are passing a tough time, it had been reflected on the MFS deal records," stated Shamsuddin Haider Dalim, brain of corporate communications of bKash.

Although government had declared an over-all holiday from March 26, the problem had already began to become gloomy from the next week of that month, he said.

The outbreak impacted the overall economy and the MFS industry aswell.

In March, the market's leading operator's normal daily transaction was Tk 985 crore and it came right down to Tk 800 crore in April. Daily ordinary transaction volume rose to Tk 1,200 crore in-may.

The government would need to get some credit for the recovery in transaction volume in-may as, thanks to its directive, a huge number of garment factory owners began to disburse wages and salaries among employees and workers through the MFS channel.

In addition, it went for disbursements of its through the digital channel. Remittance channelled through MFS as well got a raise, Dalim said.

Withdrawals fell found in March and it all widened further in April, highlighting the distress the indegent had been going through, industry people said.

Initially, Nagad faced lots of challenges, but the circumstance had improved as time passes, said its Taking care of Director Tanvir Ahmed Mishuk.

With the challenges, some new avenues also opened up in the last three months.

"We are very very much linked with the overall economy and it was apparent that the transaction quantity would be impacted as people weren't coming out for their regular activities."

However, people are employing digital financial services even more for recharging cell phones and making obligations and wallet to wallet transfers.

"We, the MFS service providers, are ensuring citizens' physical distance in the coronavirus period. I believe this is very vital that you prevent the pandemic," stated the most notable executive of Nagad, which started to be the second-largest operator on the market within merely one . 5 years.

Nagad has designed some products and offers extra facilities to compact and medium enterprises. These offers helped a huge number of business entities during the pandemic.

The BB report, even so, didn't show statistics on Nagad, the Bangladesh Postal Service's mobile financial service arm, since it got the licence from the central bank in April.

In line with the BB article, March was the worst month in recent times for the MFS sector in almost all the parameters.

The BB is yet to create April's report. The indicators are surely going to get worse and could be the many awful in every of the last year or two, according to industry persons.

As of March, there was 8.26 crore new users in Bangladesh. Of these, 2.68 crore were active.