State enterprises hand govt Tk 16,746cr of their surplus funds

State-owned enterprises possess deposited Tk 16,746 crore to the national exchequer since laws were passed in the very beginning of the year to make it mandatory for them to hand over the idle and surplus cash to the government.

The parliament passed the Deposit of Surplus Funds of Autonomous, Semi-Autonomous, State-Owned, and Public Non-Financial Corporations in to the Government Treasury Act 2020 in January.

Since that time, 13 SoEs have deposited funds to the national treasury, in line with the financing ministry. Nine SoEs deposited a complete Tk 16,046 crore in the last fiscal year.

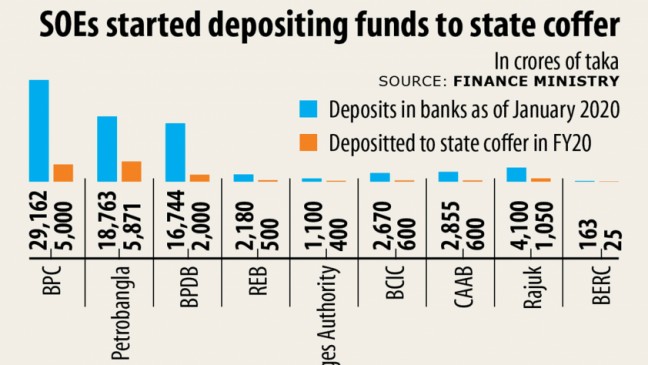

Of these, Bangladesh Petroleum Corporation deposited Tk 5,000 crore against its bank deposits of Tk 29,162 crore by January.

Petrobangla paid Tk 5,871 crore against Tk 18,763 crore parked with banks, Bangladesh Power Development Board Tk 2,000 crore against Tk 16,744 crore and Bangladesh Rural Electrification Plank Tk 500 crore against Tk 2,180 crore.

Bangladesh Bridges Authority had a deposit of Tk 1,100 crore with banks by January and it paid Tk 400 crore to the federal government.

Bangladesh Chemical Industries Company (BCIC) and the Civil Aviation Authority of Bangladesh paid Tk 600 crore every, away of their bank deposits of Tk 2,670 crore and Tk 2,855 crore respectively.

Rajdhani Unnayan Kartripakkha (Rajuk) had a good deposit of Tk 4,100 crore with banks in January and it paid Tk 1,050 crore to the federal government.

In Bangladesh, there are 68 state-owned autonomous organisations, which hold Tk 212,100 crore in blended deposits in banks. The corporations have kept the amount of money as deposit or purchase.

According to the new law, the surplus funds need to be deposited to the status coffer after keeping apart the operational price, additional 25 % of the operational expense as emergency funds, cash for standard provident fund and pension.

The respective organisation would estimate its operational cost. The agencies must deposit the funds within three months after a fiscal year concludes.

If an organisation does not provide correct info on the funds, legal actions will be studied against it, according to the law.

Four more SoEs started depositing cash to the national coffer from the brand new fiscal year.

Of them, the Mongla Interface Authority deposited Tk 100 crore as of August and the Chattogram Interface Authority (CPA) Tk 500 crore. The Export Advertising Bureau (EPB) deposited Tk 100 crore by September.

The Mongla Interface Authority, the CPA and the EPB would need to deposit another Tk 100 crore, Tk 2,500 crore and Tk 200 crore respectively in FY21.

The National University is due to deposit Tk 1,000 crore in today's fiscal year.

The option of funds from the SoEs would provide some breathing space to the federal government at a time when it's facing fund shortage as a result of the squeezing earnings collection due to the coronavirus pandemic and rising expenditure to protect the economy and save lives.

Overall, revenue collection dipped 20.5 % to Tk 200,248 crore go on fiscal year, largely due to the two-and-half-month-long countrywide general shutdown devote place to stop the distributed of the virus.

That is first-ever negative growth in Bangladesh's history.

The federal government has given the National Board of Revenue the mark to create Tk 330,000 crore this fiscal year.

The federal government has unveiled several stimulus packages amounting to a total of Tk 103,117 crore to pull the economy out of your pandemic-induced wreckage.

The government hopes to get Tk 20,000 crore from SoEs in today's fiscal year, said the official of the finance ministry.