Record loan rescheduling at Social Islami Bank

Social Islami Bank rescheduled a record amount of loans in the first quarter of 2019 and yet failed to arrest its default loans from spiralling, in a worrying development for the bank that saw a hostile takeover from a controversial business group last year.

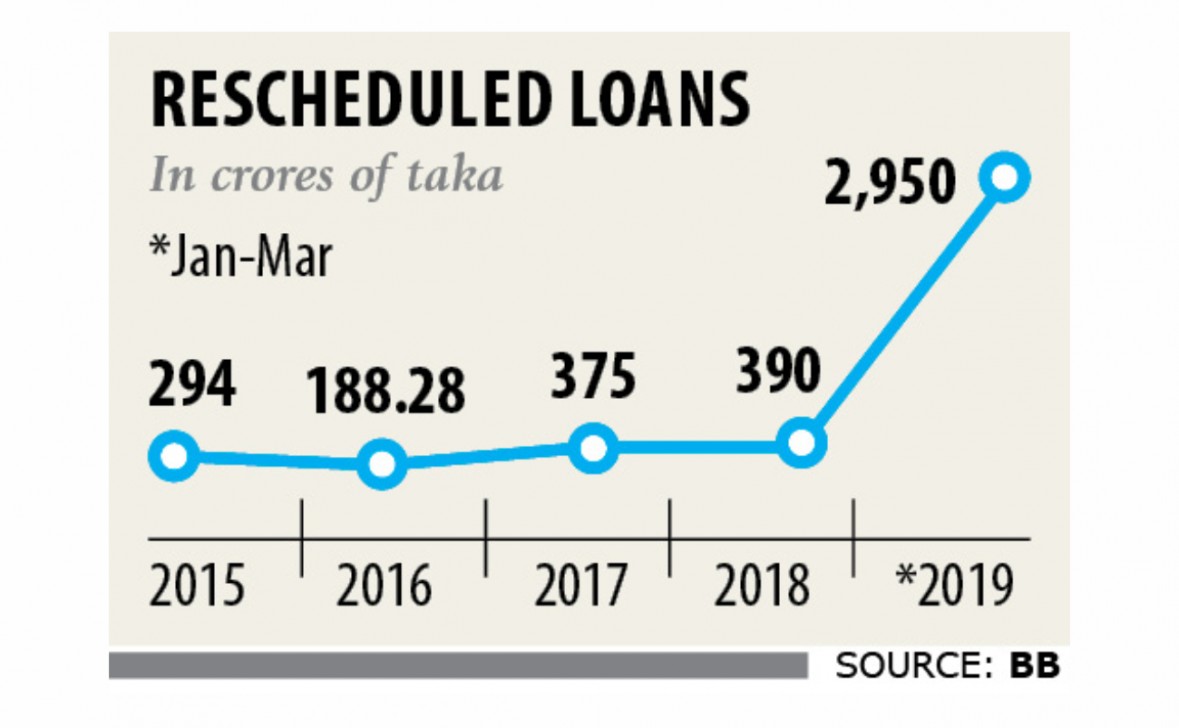

Between the months of January and March, SIBL rescheduled Tk 2,950 crore, which is exponentially more than what it had been rescheduling in a year.

For instance, it rescheduled Tk 390.31 crore in 2018, Tk 375 crore in 2017 and Tk 188.28 crore in 2016, according to data from the central bank.

And yet, SIBL’s default loans are racing ahead: in the first three months of the year its default loans soared 11.70 percent to Tk 1,559 crore.

The bank also failed to keep the required provisioning against its loans -- an indication that its financial health is wobbly.

At the end of March, SIBL’s provisioning shortfall was Tk 275 crore.

The lender took 28 special approvals so far this year from the central bank to reschedule their default loans but those do not amount to Tk 2,950 crore, said a central bank official with strong knowledge on the matter.

“This means the bank regularised a big chunk of its bad loans at its own risk.”

To reschedule a default loan, banks must take down payment ranging from 10-50 percent of the default loan.

But when the lender fails to secure the requisite down payment or wants to set an uncommon repayment tenure it must take special approval from the BB to reschedule the loans, he said.

“Had the lender rescheduled the loans by taking the requisite down payment, its default loans should have decreased and there would not have been a provisioning shortfall.”

A central bank inspection team should look into the matter, the official added.

In October 2017, a Chattogram-based business group took over the bank by replacing the previous board members and high officials. But the loans that got bad or rescheduled were disbursed at least three years ago, according to an SIBL official.

Quazi Osman Ali, managing director of SIBL, did not respond to The Daily Star’s request for comment.

Between January and March, all banks rescheduled Tk 5,839 crore -- and 50.52 percent of the sum is attributed to SIBL.

Never before was such a big sum rescheduled in the first quarter of a year, when banks typically take it slow following largescale rescheduling in the previous quarter to show a flattering full-year performance.

“The wholesale rescheduling that is taking place in the banking sector will have a serious negative impact later on,” said Salehuddin Ahmed, a former central bank governor, adding that ongoing liquidity crunch is because of the rescheduling.

The central bank should have monitored the banking sector more strongly. In its absence the loan disbursement capability in many banks have eroded.

“The banking sector will have to face dire consequences if the central bank continues to maintain its silence on the matter,” Ahmed added.