NEW MONETARY POLICY: Nothing really new except renewal of old worries

The Bangladesh Bank (BB) has adjusted the monetary programme for the current fiscal year. Although the adjustment is limited to just one component, it is a big one.

Growth in the public sector borrowing has been revised upwards from 24.3 per cent in the original monetary programme to 37.7 per cent in the revised programme. All other monetary policy parameters remain unchanged.

The rise in the public sector borrowing target has increased broad money growth target from the original 12.5 per cent to 13 per cent.

Note that public sector bank borrowing this fiscal year reached Tk 51,740 crore as on January 9, 2020. This constituted 37.8 per cent growth relative to the stock of public sector debt to the banking system as on June 30, 2019.

This is already larger than the total increase in public sector borrowing implied by the revised 37.7 per cent growth target.

So, believe it or not, the BB is expecting the public sector not to borrow any more from the banking system and in fact make a small Tk 242 crore repayment the rest of the year.

While it is heartening that the BB has revised the monetary programme to only accommodate the deviations from the monetary target that has already happened, it is not clear whether the new monetary programme is realistic enough.

It will require some serious fiscal adjustments to enable financing of government spending only from revenues and external sources.

Absent such adjustments, government borrowing will inevitably increase further, creating pressure on interest rates and inflation. The risk of accelerated inflation is even greater if the increased borrowing is from the BB.

Public sector borrowing has already surpassed historic high by a large margin this year. The closest highest level of public borrowing previously was Tk 23,300 crore in fiscal 2010-11 and the next highest was Tk 22,500 crore last year.

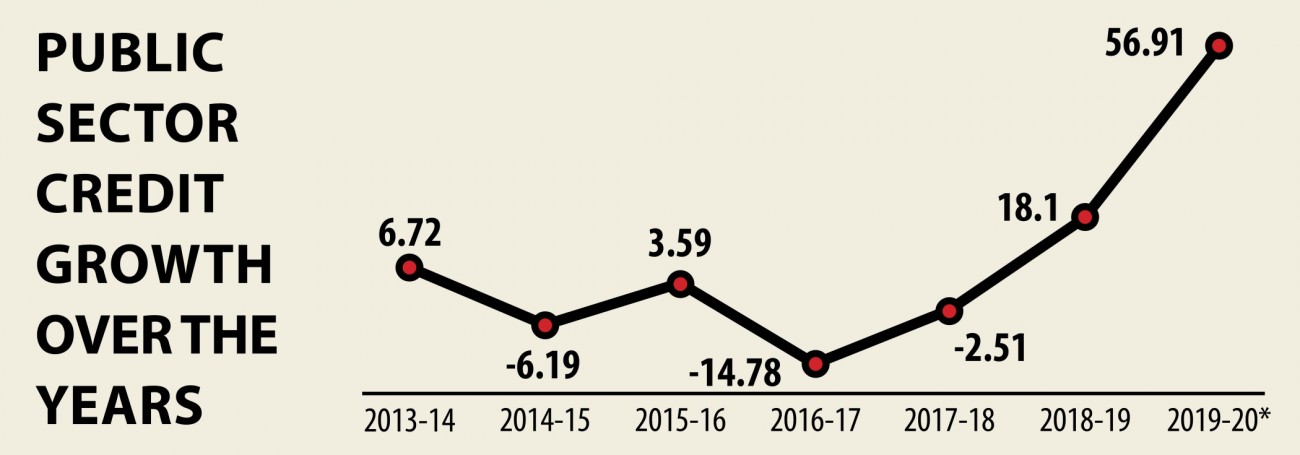

Note that the government reduced the level of debt to the banking system by Tk 22,640 crore during fiscals 2014-15 and 2017-18, a period during which net sales of National Savings Certificates increased by Tk 132,640 crore.

Despite 69 per cent reduction, net sales of NSCs in the July-October this fiscal year were Tk 5,520 crore. Together with large increases in bank borrowing last year as well as this year, clearly, we have entered a phase of rapid increase in domestic public debt.

Public debt has long been an important issue in economic research with a focus on its impact on economic growth.

The conventional view is that in the short-term, aggregate output can be boosted, but in the long-run, investment is reduced, thus hindering economic growth.

There is also a third view suggesting that investment and economic growth are not affected because the private sector responds appropriately to make sure that the future generations do not have to bear any unreasonable burden of public debt.

But this is implausible in countries where a large majority of current generation are constrained by income such that they are not in any position to leave much for the next generation.

Public debt can adversely affect economic growth through several channels.

High public debt leads to higher long-term interest rates, higher distortionary taxation and inflation. High public debt levels constrain discretionary fiscal policies and therefore generate higher volatility.

Even if the magnitude of the harmful effects of debt on growth varies, it is estimated internationally that a 10 per cent increase in debt-to-GDP ratio reduces annual growth by 0.1–0.2 percentage points on average.

There is a more nuanced view that suggests that public borrowing is harmful only when it is used for current expenditure but not when it accumulates public capital.

The purpose, composition and quality of institutions matter in determining the impact of public debt.

The type of interest group activities regarding unlawful and unproductive appropriation of resources can be checked by good institutional arrangements.

The importance of corruption has been widely recognised in many studies. Some items of public expenditure are more attractive than others in acquiring illegal rents and bribes.

Corruption in the bureaucracy distorts the purpose and functionality of the public sector. Studies that look into the effect of corruption on debt argue that a low level of corruption prevents distortionary misallocation of resources caused by public debt.

High levels of corruption tend to shift loan resources away from high-value projects such as health and education into potentially unproductive projects such as fancy infrastructure and bloated public administration.

Over-borrowing caused by corruption harms the whole economy. In any case, corruption plays a negative role in the association of public debt with economic growth.

Public debt itself may not be a big problem but becomes more of an issue when associated with bad institutions.

The rapid rise in public borrowing in Bangladesh in recent years is worrisome because of the factors driving such increases, weak institutions and the effects of public borrowing on interest rates and availability of credit to the private sector.

Increases in recurrent expenditures and unusually large shortfall in revenue collection, coupled with some decrease in external financing (as evident from BB data for the July-October period), have driven such a dramatic increase in domestic borrowing.

Anecdotal stories on wasteful uses of public development expenditures and embezzlement of public funds are plenty and keep coming.

Interest rates on government bills and bonds have risen 3 to 5 percentage points, depending on their tenor, in the last one year and a half. This is a major hindrance in the implementation of the government’s single digit lending rate agenda from April 1.

Growth of credit to the private sector was down to 9.9 per cent in November, the lowest in recent memory. It is extremely hard to argue that the surge in public borrowing had no role in such a slump in private credit growth.

Can the BB stick to the revised monetary programme so as to harden the budget constraint on the public sector, thus forcing efficient fiscal adjustment? Only time will tell.