NBFIs talk with Kamal, seek support

Finance Minister AHM Mustafa Kamal yesterday said the federal government would extend support to the country's 34 non-bank financial institutions to be able to mitigate their ongoing financial woes.

He came up with the decision at a meeting with the Bangladesh Leasing and Finance Companies Association (BLFCA), a forum of the managing directors of the NBFIs, at the secretariat.

"The BLFCA has put four suggestions at the meeting to increase the financial health of NBFIs. And the minister has given assurance to solve the problems," said BLFCA Chairman Mominul Islam.

The minister also told the association that he'd speak to the high-ups of the central bank to come up with necessary supports for them, said Islam, also the managing director of IPDC Finance.

The BLFCA submitted an operating paper to the finance ministry depicting the existing crisis faced by the NBFIs.

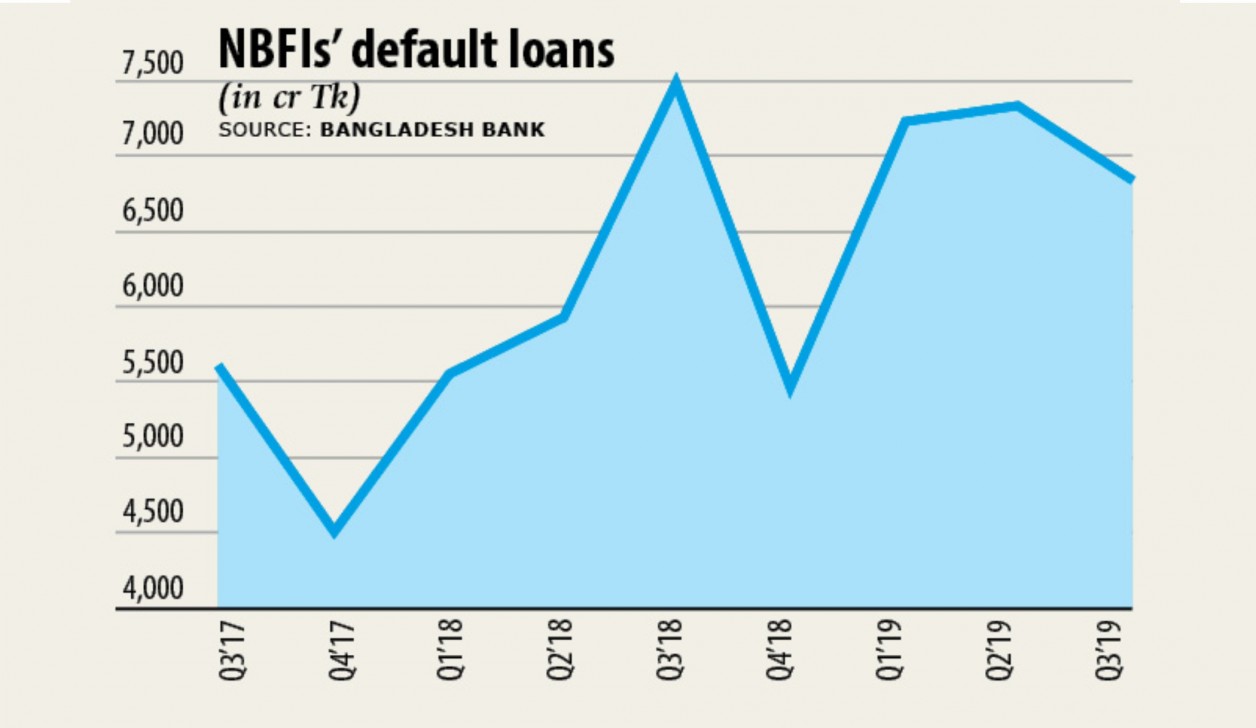

The NBFI sector is suffering from a liquidity crisis, which includes created difficulties for them to run businesses, according to the paper.

The recent decision to liquidate among the NBFIs -- People's Leasing and Financial Services (PLFS) -- has given a negative signal to depositors and banks. This has created a confidence crisis in NBFIs regardless of their financial condition.

NBFIs have proposed the central bank form a particular refinancing scheme of Tk 10,000 crore. Beneath the scheme, five-year term-loans will be extended to them and it'll be repayable on semi-annual installment basis.

The interest of the loan ought to be equal to the six-month Treasury bill rate.

Lenders requested the central bank to extend emergency liquidity support to the NBFIs against the cash reserve requirement and the statutory liquidity ratio, except those struggling owing to poor corporate governance.

The BLFCA has requested the central bank to instruct banks not to withdraw funds from the NBFIs within the next two years. The maximum interest of the funds ought to be fixed at 7 %.

The association proposed the federal government merge the struggling 4-5 NBFIs and the funds of banks and non-banks positioned with these institutions should partially be converted into equity in proportion to their exposure.

Fresh equity from new sponsor-shareholders ought to be injected in the merged institutions, the paper said.

Md Ashadul Islam, senior secretary of the finance institutions division, was also present at the meeting.