Govt moves to use surplus funds of state organisations

The government yesterday placed a bill in parliament with a view to bringing the surplus money held by 61 state agencies to the national exchequer and utilising the funds to implement development projects.

Finance Minister AHM Mustafa Kamal placed the bill titled “Deposition of Surplus Money of Self-Governed Agencies including Autonomous, Semi-Autonomous and Statutory Government Authorities and Public Non-Financial Corporations to the National Exchequer Bill 2020”.

The bill was sent to the parliamentary standing committee on finance to examine and report back to the house within seven days.

The surplus funds will be deposited to the national exchequer after keeping aside the operational cost, additional 25 percent of the operational cost as emergency funds, money for general provident fund and pension, according to the bill. The respective organisation can estimate its operational cost.

The agencies have been included in the bill and they will have to deposit the funds to the national exchequer within three months of completion of a fiscal year.

If an organisation does not provide correct information about the funds, legal actions will be taken against it, the bill said.

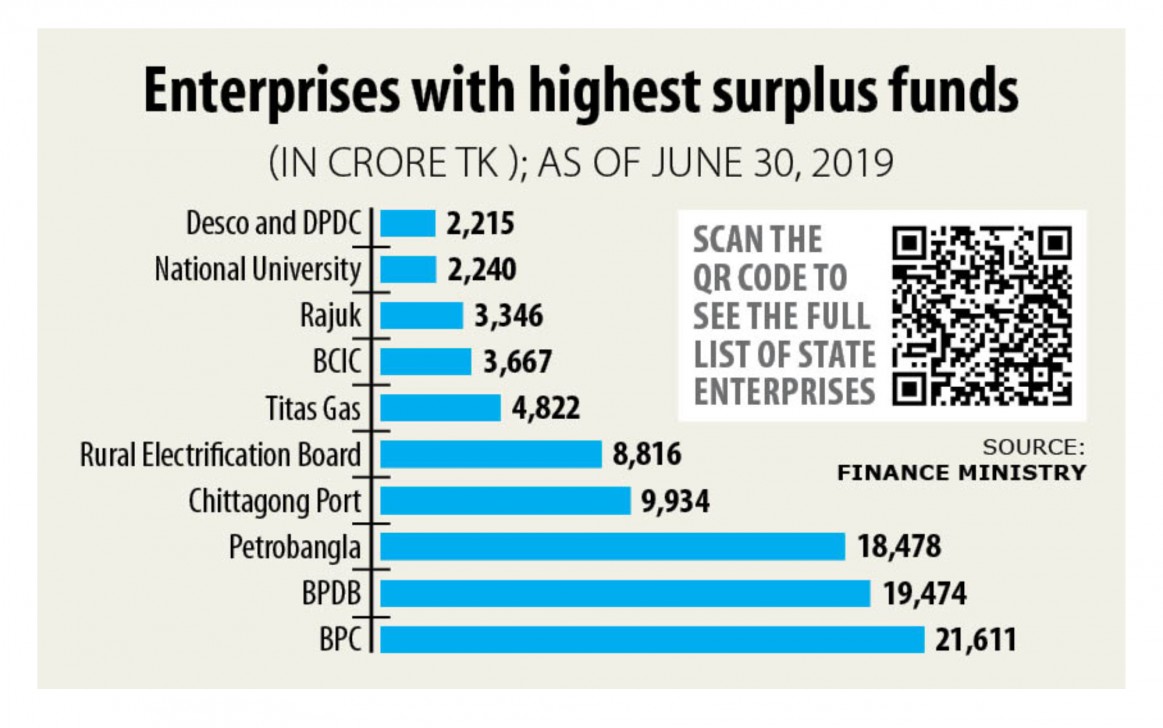

Agencies have parked huge amounts of money in banks as deposits and the government needs the money to finance ongoing development projects, it said.

The money belongs to the people and should be spent for their welfare, the bill said.

The government has undertaken many development projects and only regular revenue incomes is not enough to bankroll them. So, the government utilises the fund for the development projects.

The draft law was approved by the cabinet in early September, when the cabinet secretary said state-owned autonomous organisations held Tk 212,100 crore in deposit in banks as of May last year.

They held Tk 218,839 crore at banks until June 30 last year, according to finance ministry statistics. The cabinet decision, however, evoked reaction from bankers, who fear the law would hit the cash-starved banking sector hard.

The ongoing liquidity crisis would worsen if the government transfers the money from banks to the national exchequer, they said, adding that the move to bring down the interest rate to single digit is likely to face hurdle due to the initiative.