Special committee to heal stock ills

The government is set to form a special committee to take definitive actions against listed companies that have shuttered and overvaluation of stock price, as part of efforts to win back investors’ confidence.

The Bangladesh Securities and Exchange Commission (BSEC) will form an audit-based committee that will work in tandem with the Financial Reporting Council (FRC).

“The committee will investigate the shuttered factories’ real scenario and the balance sheet of companies going for initial public offering (IPO) so that it can detect distortion,” Finance Minister AHM Mustafa Kamal said yesterday at a press briefing after a meeting with the stakeholders of the stock market.

In the last one month, the stock market slid over 300 points and has been on the downturn in the last few months.

Subsequently, the finance ministry organised the meeting, which was chaired by Md Asadul Islam, senior secretary to the Financial Institutions Division.

There is no alternative to the development of the capital market, so all the divisions of the government will continue their support for the stock market, Kamal said.

“You all acknowledged that all the economic indicators are in a powerful position. We don’t expect more but a stock market that is consistent with the economic development,” he added.

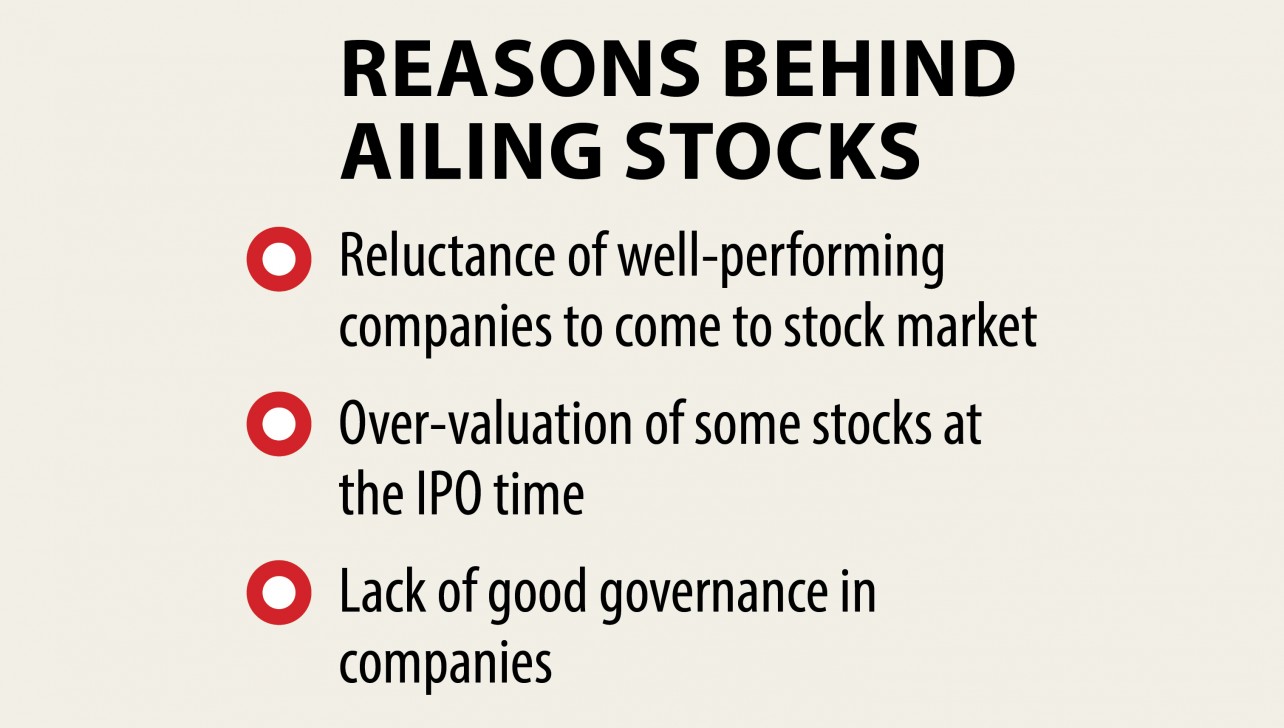

The ministry though has traced some reasons behind the market slump from the meeting.

One of the reasons is the scarcity of good companies in the market.

“We are determined to bring good companies to the market, especially state-run companies. I can ensure that all the public companies will be listed though it may take time for fair valuation of the company’s assets and preparing updated balance sheet.”

New public companies will also be given the condition to get listed.

The last state-owned company to get listed on the stockmarket was Titas Gas Transmission and Distribution Company -- back in 2008.

Then in January 2010, the government had selected 26 state-owned companies and instructed them to offload shares in the next six months.

But that never happened, even though the finance minister then had proclaimed time and again that the state-run companies will offload their shares within a certain period.

Probed, Kamal said he cannot comment on earlier commitments but he will ensure that the state-run companies offload their shares.

“Our prime minister is firm and serious about the listing of the public companies. So, there is none within the government who can change the prime minister’s decisions.”

Another reason for the market slump is over valuation of some stocks at the time of listing.

“We will work on a fair price for the stocks because if a stock is overpriced it is bound to crash and investors will suffer. The committee will work on this ground.”

The government will remove all the hurdles and challenges to ensure that good companies come to the market, he added.

A lack of good governance in the stock market is another reason for low investor confidence.

“I can assure you that we will maintain good governance and you will not blame us. We will take action against those who commit any offence following the rules and regulations.”

The government will win back investor confidence by establishing the rule of law in the stock market.

M Khairul Hossain, chairman of the BSEC; Fazle Kabir, Bangladesh Bank governor; CQK Mustaq Ahmed, chairman of FRC; Md Mosharraf Hossain Bhuiyan, chairman of the National Board of Revenue; Md Shafiqur Rahman Patwary, chairman of the Insurance Development and Regulatory Authority, were present at the meeting.