Hall-Mark may get a lifeline

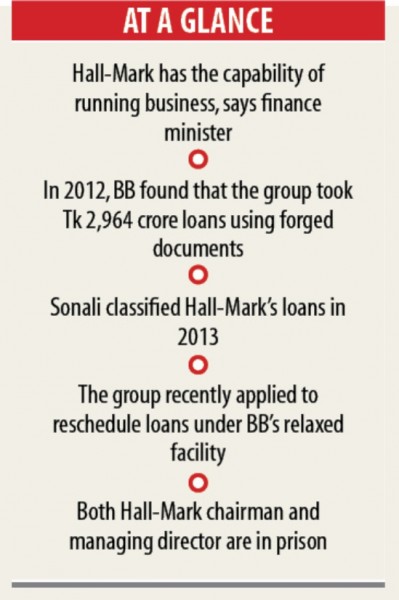

In the most absurd turn of events, Finance Minister AHM Mustafa Kamal yesterday said steps are on way to defibrillate the disgraced Hall-Mark Group that made off with about Tk 3,000 crore from Sonali Bank.

Although he remained circumspect about the steps being taken to resuscitate the duplicitous business group, Hall-Mark’s recent moves suggest it is pushing to avail the Bangladesh Bank’s relaxed loan rescheduling policy for defaulters.

Hall-Mark has appealed to Sonali Bank to reschedule its default loans amounting to Tk 3,000 crore.

But the group does not want to give fresh down payment to reschedule the loans.

In an audacious move, Hall-Mark has requested the bank to consider its previous payments against its loans -- as down payment.

But under the central bank’s relaxed policy that is currently open, defaulters must make a 2 percent down payment to reschedule their loans for 10 years, including one year’s grace period, at 9 percent interest rate.

Kamal’s proclamations yesterday indicate Hall-Mark’s wishes would be granted -- a development that can create moral hazard for the banking sector.

“You have to believe that Hall-Mark will pay back the money. They will start business again,” he told reporters after a meeting of the cabinet committee on economic affairs.

Earlier in the day, he held another meeting with Sonali Bank Managing Director Ataur Rahman Prodhan, Banking Division Senior Secretary Asadul Islam and representatives of the Hall-Mark Group to discuss the issue.

“Hall-Mark still has the capability to run a business. And we cannot create new businesspeople -- we will have to patronise the existing ones.”

Asked what type of new arrangement would be taken for Hall-Mark Group, he said, “You all would know in due time when the measures would be taken.”

“I want that they will pay back the bank loan and live their life smoothly,” Kamal added.

Between 2010 and May 2012, then little-known Hall-Mark Group took loans amounting to Tk 2,964 crore between 2010 and May 2012 from the then Ruposhi Bangla Hotel branch of Sonali Bank by perpetrating a host of financial irregularities.

The irregularities, which were discovered by a Bangladesh Bank investigation in 2012, left central bankers, bankers and the government higher-ups dumbfounded.

Hall-Mark started its journey in 2006 by buying just 36 decimals of land from Janata Housing at Hemayetpur. It set up its first factory, Hall-Mark Fashion, on the plot in 2007, the year it started banking with the Sonali branch.

In 2008, the group set up Boby Fashion, Wall-Mart Fashion, Hall-Mark Style, Boby Denim and Hall-Mark Design Wear with loans from the state bank.

There were no new factories built in the next two years. But in 2011, the company suddenly got hold of a source of money and set up 27 factories that year. The money came from Sonali Bank in the form of short-term loans for 120 days, a gross violation of banking rules.

A number of Sonali Bank officials, including its deputy managing directors, were suspended for their alleged involvement in the scam and are now facing court cases. Hall-Mark Group’s Chairman Tanvir Mahmud and its Managing Director Jasmine Islam have been in prison for the last seven years for the fraud.