Borrowers jump for joy at 9pc interest

Sadrul Hasan Ripon’s dream of building his own home on a piece of land he purchased in Keraniganj six years ago is set to materialise now thanks to the slash in interest rate to single-digit for borrowing from April 1.

“I am pleasantly surprised,” said the mid-level executive at an insurance company, who until now thought a house on his land was unfeasible given his low savings and the high bank interest rates that go up to 15 percent.

But thanks to Prime Minister Sheikh Hasina that house-building plan no longer seems unworkable.

Initially, Finance Minister AHM Mustafa Kamal negotiated with banks to extend 9 percent interest on loans to the manufacturing sector from today.

But the prime minister demanded single-digit interest rates for all loans.

The decision is not only a huge blessing for individuals like Ripon but also for hundreds of thousands of entrepreneurs who have long been demanding single-digit interest rate to further their businesses.

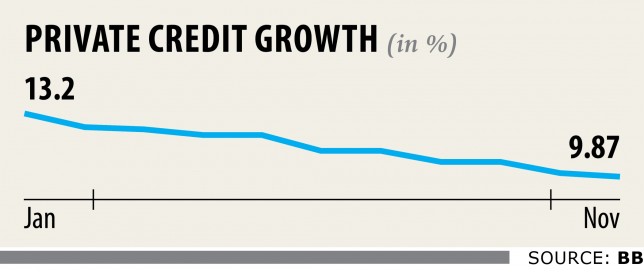

The double-digit interest rate is often cited by experts and businesses as the main reason for the declining trend of private sector credit growth in the last 21 months.

Business leaders, however, welcomed the out-of-the-box move of the government cautiously as sponsors of banks had previously gone back on their word to bring down the interest rate to less than 10 percent by August last year despite bagging a number of facilities for this end.

The benefits include a reduction of cash reserve ratio -- which is the percentage of total deposits banks must maintain in the form of cash reserve with the central bank -- and repo rate -- which is the rate at which the central bank lends money to banks.

“This is a good decision, but we are observing it cautiously,” said Sheikh Fazle Fahim, chairman of the Federation of Bangladesh Chambers of Commerce and Industry. He, however, said such decisions should not be implemented by issuing a notice.

“We should ensure an ecosystem, ranging from banks and businesses to savers and common people, for bringing down the lending rate.”

A complete business model is important for materialising the issue, Fahim said, adding that the interest rate on credit card also should be brought down.

But Rubana Huq, president of the Bangladesh Garment Manufacturers and Exporters Association, expressed her dissatisfaction with the new move.

“The rate should be implemented from today, the first day of the new calendar year,” she said.

As per the decision, it will take three months more to implement the single-digit lending rate, which will be too late given the existing feeble situation in the industrial sector.

But the BGMEA, the Bangladesh Knitwear Manufacturers and Exporters Association and the Bangladesh Textile Mills Association, the three trade bodies in the apparel sector, want them from January 1, as previously stated.

The three jointly wrote to the finance minister yesterday urging the implementation of the single-digit interest rate for lending without further delay. Entrepreneurs would be hugely benefitted from single-digit interest rates, said Mustafizur Rahman, a distinguished fellow of the Centre for Policy Dialogue.

“But it is difficult to lower the lending rate right now.”Besides, banks will have to cut down on their default loans significantly to be able to give out fresh loans.

“The government should give all-out effort to decrease the inflation in order to attract savers to banks. Or else, liquidity crisis will hit lenders if depositors shy away from banks,” Rahman added.