Old interest levels on postal savings from Mar 17

The federal government yesterday walked back on its decision to slash the interest levels on ordinary and fixed deposits in POSTOFFICE Savings Bank, with the previous rates to come back from next month.

"The previous interest rates will be applicable from March 17 whenever we complete the automation of post offices," Finance Minister AHM Mustafa Kamal told reporters yesterday at his office in Dhaka.

The disclosure came fourteen days following the finance ministry slashed the rates of interest on the three-year tenure fixed deposit in postal savings banks to 6 % from 11.28 % -- a move that sparked outcry from various quarters.

Termed as Post Office Savings Bank, there are more than 50 lakh deposit accounts in this bank and marginal and low income persons from rural and suburban areas mostly park their savings here, said officials of the Bangladesh POSTOFFICE earlier.

The finance ministry reduced the interest amid mad dash from a portion of wealthy persons to open accounts in postal savings bank to deposit money after the government tightened rules on investment in the high interest-bearing national savings certificates to avoid abuse of the power distributed by the state to pensioners and middle-income families, Kamal said yesterday.

The rules, which were stiffened this past year, stipulated that savers would have to submit taxpayer identification number (TIN) to get national savings certificates.

The instruments carry rates of interest as high as 11.76 per cent, which is way greater than what banks offer.

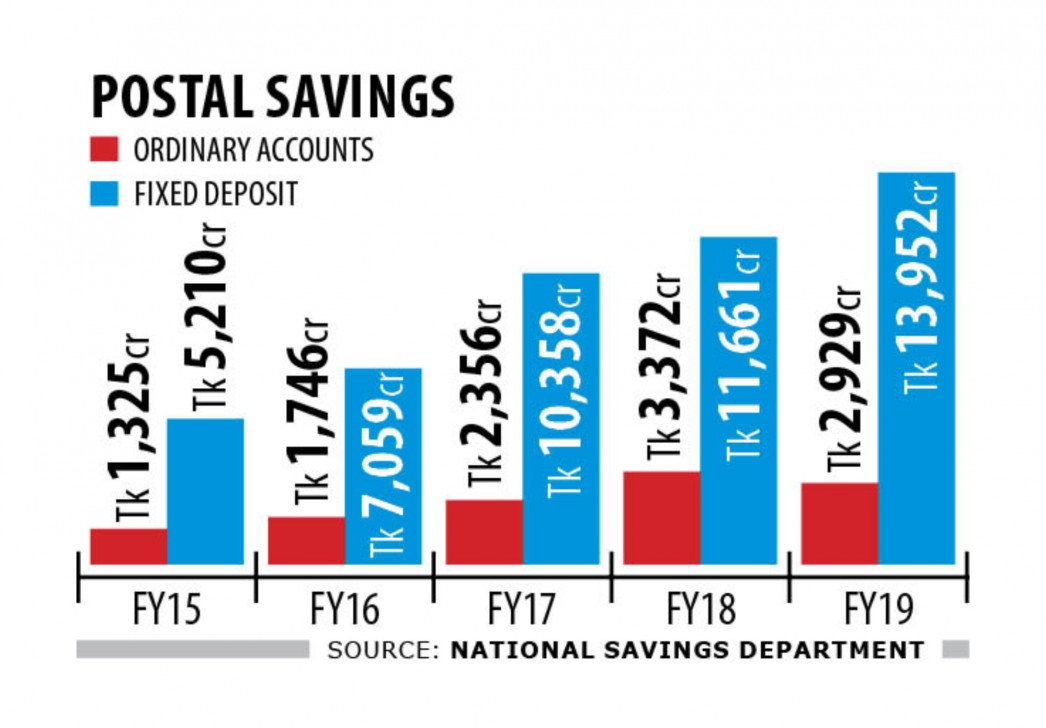

Consequently, fixed deposits in postal saving bank soared 66 per cent year-on-year to Tk 11,730 crore in the first half of the fiscal year, according to data from the BPO.

At the same time, investment in savings certificates sold by post offices plummeted 88 % to Tk 1,870 crore.

"Whenever we saw all were running to post offices, we had to think about controlling the rush. And the interest cut was among the tools," Kamal said.

As the automation of post offices is underway and will probably complete by March 17, Kamal said depositors in postal savings accounts will dsicover the previous interest rates.

"We will ask for the national identification number and TIN after the automation. You want to know the folks who are keeping money there. That is to avoid the misuse of the benefit," he said, adding that the ceiling for the best deposit by a person would remain unchanged at Tk 30 lakh.

The government, however, won't want to see documents of the savers maintaining to Tk 2 lakh in deposits and they'll get a lot more than 11 per cent interest rate.

The exemption will get considering the condition of many people, like the elderly, he said.

The federal government offered higher interest on savings certificates for the benefit for marginal people.

"However the scope was misused. Those who were entitled to the power were not setting it up. Instead, others benefitted."

The automation has recently taken place at banks. It has slice the scope for misuse.

"None can exceed the investment limit in savings certificates," he said.

The ceiling for the best investment in savings certificates doubled to Tk 50 lakh for individuals and Tk 1 crore under joint names. The investment ceiling for pensioner savings certificates will double to Tk 1 crore.

When asked why persons retiring from private jobs have been discriminated in favour of men and women retiring from public services, the finance minister said: "We won't have the ability to afford all of them."

Prior to the briefing of Kamal, the Directorate of National Savings (DNS), which oversees savings certificates and deposits in Post Office Savings Bank, clarified that the interest rates for savings certificates have not been reduced.

The rates of interest on the ordinary and fixed deposits in postal savings bank have been cut consistent with a government directive, which is wanting to lower the lending rates at banks to single digit with a view to encouraging investment.

The deposits in the Post Office Savings Bank were greater than a fifth of Tk 83,630 crore of investment created by people in a variety of types of savings certificates, bonds and government schemes in fiscal year 2018-19, data from the DNS showed.

The deposits accounted for 14 per cent of the government's accumulated liabilities by June 30 this past year.