The surplus money bill has its heart in the right place

The government has passed the act of bringing the surplus money of 61 state and autonomous agencies to the national exchequer in order to ensure accountability and not for drawing funds, said Finance Minister AHM Mustafa Kamal yesterday.

“We did not passed the bill for any bad intention but to establish a financial discipline,” he told a press conference at his office.

Every government owned enterprise have a responsibility to people, so the act is formed appropriately and it will play a meaningful impact.

The finance minister’s comments comes as opposition members of parliament walked out of the assembly the previous day in protest of the bill, which was placed on January 14.

The surplus funds will be deposited to the state coffers after keeping aside the operational cost, additional 25 per cent of the operational cost as emergency funds, money for general provident fund and pension, according to the bill.

The respective organisation can estimate its operational cost.

The agencies, which were mentioned in the bill, will have to deposit the funds to the state coffers within three months after a fiscal year ends.

If an organisation does not provide correct information about the funds, legal actions will be taken against it, the bill said.

The opposition MPs termed the bill “dangerous” and “anti-people”.

At present, Bangladesh’s banking sector has excess liquidity of Tk 116,243 crore, according to Kamal.

“And every bank has excess liquidity,” he said, adding that the funds can be utilised for development works.

Some MPs were saying revenue growth is negative, so the bill was a ploy of the government to draw in money from the state enterprises.

“Yes, the growth is negative if you compare with the target.”

But the growth should be against the target -- it should be against previous year’s collections.

“Because, we set a high target to keep the pressure on our tax officials to raise more revenues,” he added.

The taxmen collected Tk 97,000 crore in the first half of the fiscal 2019-20, up from Tk 91,000 crore a year earlier.

“So, revenue is not on the deficit side. It is our exports that is in the deficit. I believe the negative growth will not persist in the last half of the year.”

There is no country in the world that saw positive growth in exports, be it developed, non-developed or peer countries.

“This is the reality and we have to come out from the situation,” Kamal said, adding that the country’s macroeconomic indicators are not in a bad situation.

Meanwhile, at the annual branch managers’ conference of the Bangladesh Development Bank yesterday, Kamal said the high default loan figure is due to an age-long habit of not lending properly.

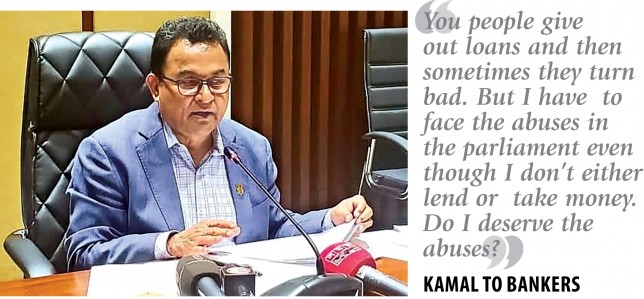

“You people give out loans and then sometimes they turn bad. But I have to face the abuses in the parliament even though I don’t either lend or take money. Do I deserve the abuses?”

THERE IS NO LIQUIDITY CRISIS

Meanwhile, in response to a question from Gonoforum MP Mukabbir Khan, the finance minister said there are some liquidity crises in the stock market but there is no liquidity crisis in the banking sector.

Scheduled banks have extra liquidity even after keeping essential cash reserve ratio and reserving the required statutory liquidity ratio, Kamal told the parliament yesterday.