Mutual fund units popular on hopes of reforms

Investors rushed to mutual funds within the last couple of days on growing hopes that the brand new commission would take reform initiatives to protect the interest of the unitholders.

Their enthusiasm came although the marketplace is yet to overcome the uncertainty due to the coronavirus pandemic.

The DSEX, the benchmark index of the Dhaka Stock Exchange, dropped 19 points, or 0.30 per cent, to 4,963 yesterday. Turnover, an essential indicator of the marketplace, rose 7.12 per cent to Tk 914 crore.

Mutual funds were among the most notable gainers within the last couple of days. Mutual funds are investment tools that gather a fixed pool of money from many investors and re-invest them into stocks, bonds and other assets.

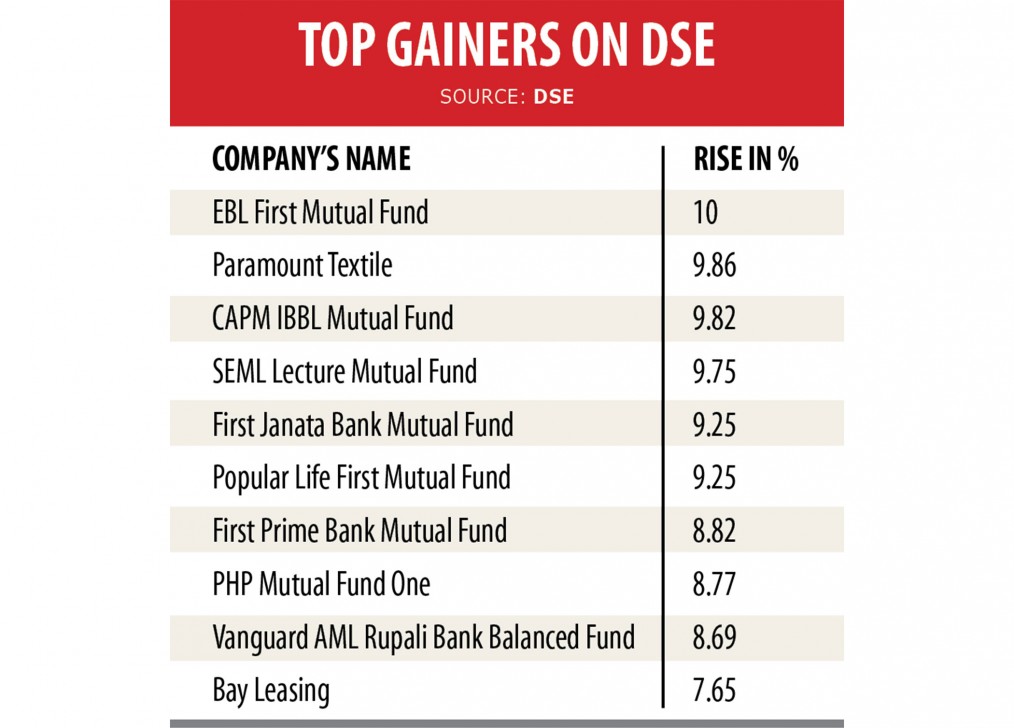

EBL First Mutual Fund topped the pack of gainers yesterday after it rose 10 %.

CAPM IBBL Islamic Mutual Fund, SEML Lecture Equity Fund, Janata Bank First Mutual fund, Popular Life First Mutual Fund, Prime Bank First Mutual Fund, PHP First Mutual Fund, and VAML LR Fund also advanced significantly.

Initiatives taken by the Bangladesh Securities Exchange Commission (BSEC), led by its Chairman Prof Shibli Rubayat-Ul-Islam recently, has instilled confidence into investors.

Investors now hope that the regulator would continue its reform momentum and would take action for the mutual funds. This optimism attracted investors to pour money in to the units, said a high official of a merchant bank.

The official of the commission said the regulator is focusing on mutual fund units. The BSEC hasn't disclosed any plans officially yet.

Among the initiatives could see that the regulator would refuse to extend the tenure of closed-end mutual funds unless they receive approval from unitholders, he said.

Closed-end mutual funds are investment vehicles that gather a set pool of money for a decade from investors and re-invest them into stocks, bonds and other assets. After a decade, they are said to be liquidated and the worthiness of the funds distributed among unitholders.

But on September 16 this past year, following calls from some asset management companies, the BSEC extended the tenure of the closed-end mutual funds by another 10 years.

Subsequently, LR Global Bangladesh Asset Management Company extended the tenure of six of its closed-end mutual funds by ten years. Race Asset Management extended the tenure for 10 of its funds.

The BSEC's decision came under criticism.

There are 37 listed mutual funds. Of them, five are trading above their face-value and the others below the face-value.

Paramount Textile topped the turnover list yesterday after its shares worth Tk 50 crore changed hands, accompanied by Beximco Ltd, Sandhani LIFE INSURANCE COVERAGE, Asia Pacific Insurance, Beximco Pharmaceuticals, Brac Bank, Pioneer Insurance, BD Finance, Republic Insurance and Nitol Insurance.

GQ Ball Pen shed the most, quitting 8.36 %, accompanied by United Airways, Asia Pacific Insurance, Tung Hai Knitting, KBB Power, Provati Insurance, Paramount Insurance, Premier Insurance, Bangladesh Industrial Finance Company, and Appollo Ispat.