Most banks find their operating profits fall

Operating profits of most banks in the only concluded year possess shrunk on the back of a organization slowdown due to the ongoing coronavirus pandemic.

However, top executives are finding the sector's profits quite satisfactory, provided the gravity of the economic hardship.

The Daily Star talked to at least seven managing directors who came clean on having apprehensions beforehand of a year-on-year profit decline.

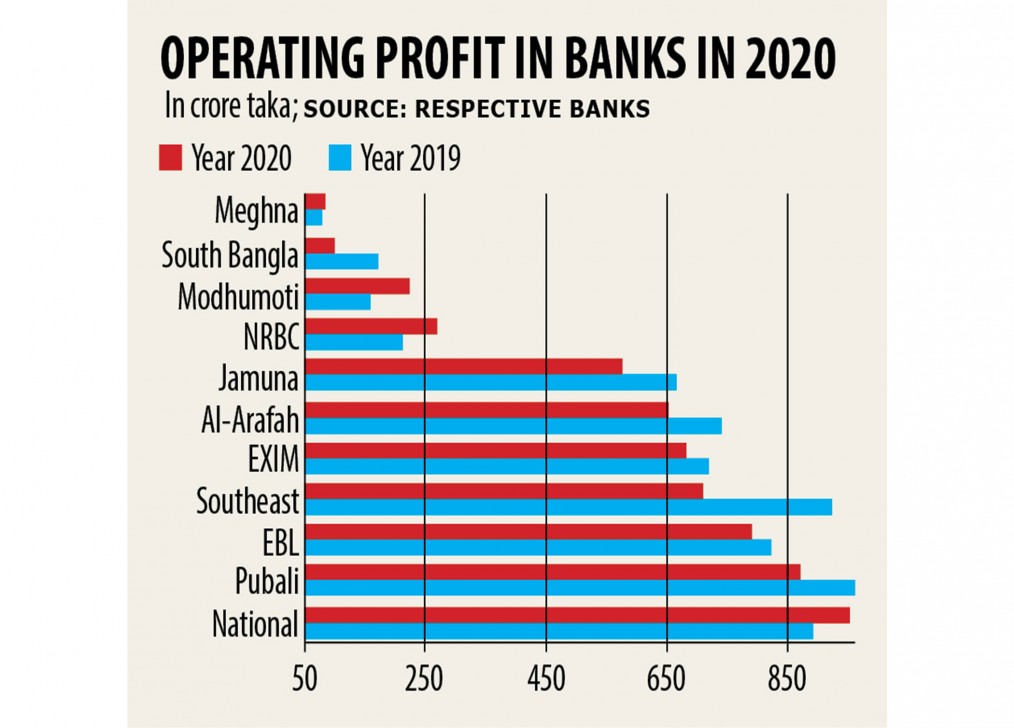

Pubali Bank witnessed a fall from Tk 1,025 crore to Tk 935 crore, Eastern Bank Tk 885 crore to Tk 850 crore and Southeast Bank of 22 %, right down to Tk 770 crore.

Although a good number of banks didn't declare operating profits until 8:00pm yesterday evening, officials of most banks might end up having to digest such a downing.

Branches of some banks found in 64 municipalities had remained opened yesterday to facilitate election applicants in making deposits of their security cash, creating a roadblock in finalising profit statements.

A major part of the profit should be maintained in the form of provisioning against both defaulted and unclassified loans, that will ultimately rot the profit base.

A good number of banks possess transferred their accrued interest, which is but to be realised, with their income segment, which includes as well helped them inflate their profit for the moment.

The central bank has declared financing moratorium facility for all borrowers throughout this past year so as to come to aid from clients affected by the financial meltdown.

It has helped banks lower their defaulted loans as well reduced the money necessary to be kept as provision. Non-carrying out loans stood at Tk 94,440 crore by September last year, down 1.74 % from that three months earlier and 18.73 % year-on-year, showed data from Bangladesh Bank.

From this backdrop, the central bank recently asked banks to keep yet another 1 % provision against all sorts of unclassified loans of theirs to soak up the downside risks posed by any organization slowdown in the days ahead.

The banks need to reserve around Tk 10,000 crore to adhere to this central bank instruction.

Net revenue will finally undergo a massive decrease following the provisions are actually secured and taxes paid.

The interest on lending nosedived this past year, putting an adverse effect on the profit, said M Kamal Hossain, managing director of Southeast Bank.

Nearly all businesses possess adopted a go-slow policy in establishing new industrial units and expanding existing kinds because of the ongoing crisis, he said.

This has had a detrimental impact on the need of businesses to borrow funds, Hossain said.