Gamblers at it again again, insurance shares soar on rumours

Insurance stocks came beneath the spotlight again yesterday in spite of generating less premium salary amid the ongoing coronavirus pandemic.

These stocks and shares are being toyed with by gamblers, so they rose during the last couple of months, a stock broker said.

Prices of many stocks from this sector have significantly more than doubled even though the firms had informed that that they had no undisclosed, selling price sensitive information.

The currency markets regulator identified rumours to have fuelled the rise of the companies. The upward style in the sector has been halted within the last couple of weeks.

Now, they are going to become active once again, he added.

DSEX, the benchmark index of the Dhaka STOCK MARKET (DSE), rose 1 stage, or 0.02 per cent to 5,413 yesterday.

Among 49 listed insurers, 43 rose, five remained the same and the rest of the one dropped yesterday, DSE data displays.

Of the full total 345 stocks, 41 % fell while 26 % rose.

These stocks have been victimised as there is absolutely no significant reports for the insurance sector that could have resulted in the recent go up, said a top official of a merchant bank.

However, the commission salary for insurers can rise because they are providing their agents less cut on commissions as directed by the Insurance Advancement and Regulatory Authority (IDRA), he added.

In 2010 2010, the IDRA issued a circular stating that insurance firms could no longer pay more than 15 % of the high grade as commission to their agents.

But since most insurers disregarded the directive, the IDRA issued another find in later 2019, urging insurance firms to comply for the sake of the sector's well appearing.

Previously, many companies offered as much as 60 per cent of the top quality as commission in a bid to secure business which hurt the industry's overall revenue, according to industry insiders.

"But that will not mean that these stocks deserve to go up by around twofold amid the pandemic," the merchant banker said, adding that the pandemic has had a negative effect on their premium.

Premium salary of non-lifestyle insurers decreased 7.46 % year-on-year to Tk 4,366 crore in 2020, according to IDRA info.

In the same way, the premium income of life and non-life insurers as a whole fell 3.46 per cent year-on-year to Tk 13,821 crore.

Turnover, a crucial indicator of the market, dropped a lot more than 8 per cent to Tk 631 crore yesterday.

At the DSE, 93 stocks rose, 138 declined and 114 remained unchanged.

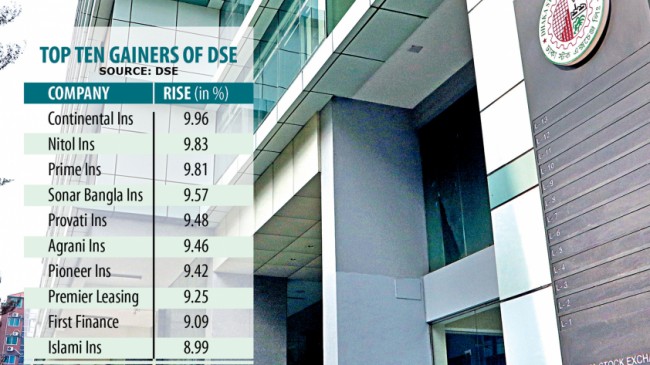

Continental Insurance topped the gainers' list followed by Nitol Insurance, Prime Insurance Company, Sonar Bangla Insurance and Provati INSURANCE PROVIDER.

Beximco topped the turnover list with trade value Tk 61 crore followed by Beximco Pharmaceuticals, Robi Axiata, LankaBangla Finance and Uk American Tobacco Bangladesh.

Aziz Pipes shed the most, falling 6.64 per cent accompanied by Rahima Food Company, NRB Professional Bank, Anlima Yarn Dyeing and Fine Foods.

The port metropolis bourse fell yesterday.

CASPI, the overall index of the Chittagong STOCK MARKET, dropped 4 points, or perhaps 0.05 %, to 9,453.

Among 233 stocks to undergo trade, 77 advanced, 97 dropped and 59 remained unchanged.