Bourses see considerable profit booking

Bourses witnessed widespread profit-booking the other day when the insurance stocks rose the most thanks to a regulatory maneuver on minimum shareholding compliance.

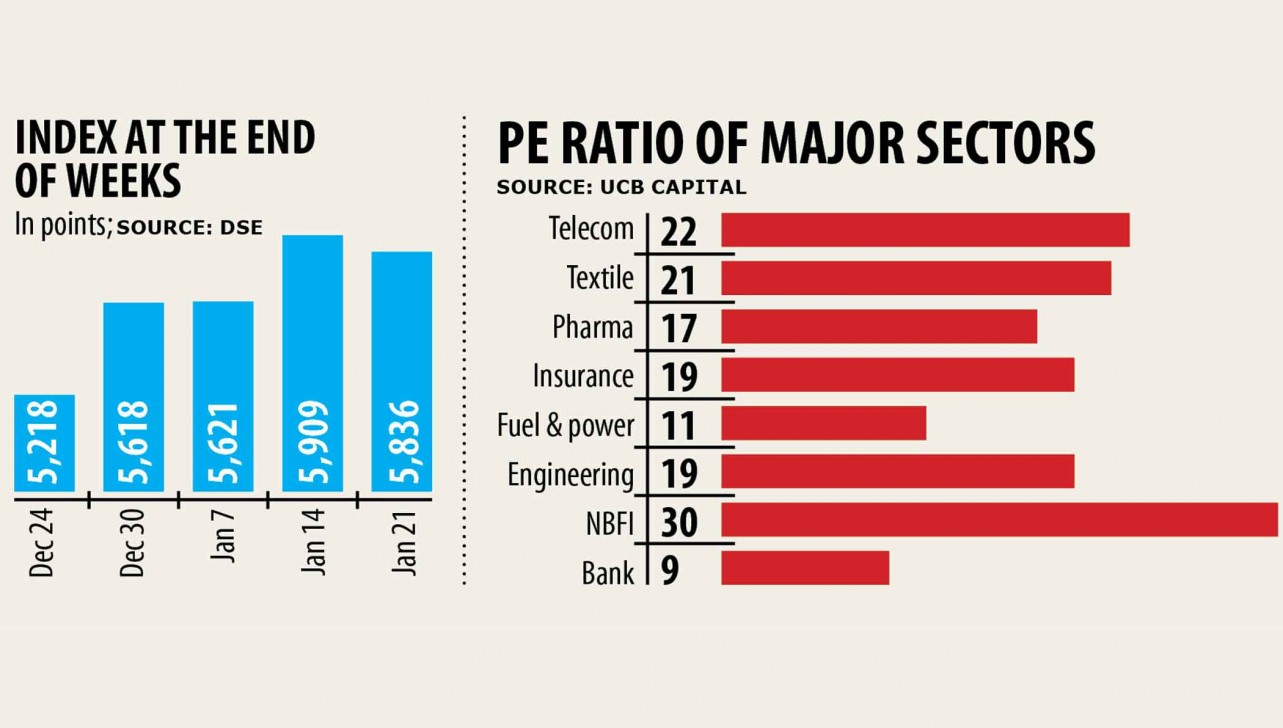

DSEX, the benchmark index of the Dhaka Stock Exchange (DSE), dropped 73.14 items, or 1.24 %, during the week.

Meanwhile, insurance stocks went upward riding on reports that the regulator released letters to all or any the companies to keep a paid-up capital of Tk 30-40 crore.

Almost all the most notable gainers were from the insurance sector. For example, Agrani Insurance rose 21.9 % in the week accompanied by Provati Insurance and Islami Insurance.

The Insurance Production and Regulatory Authority asked all insurance companies to adhere to the minimum shareholding rule of 60 per cent by the sponsors within their respective companies and keep maintaining the very least paid-up capital of Tk 30-40 crore in a month.

Following this the insurance stocks started rising. Among detailed 49 insurance stocks, 37 advanced and 12 declined within the last week.

The IDRA's circular impacted the insurance stocks positively, which saved the index from a massive fall, a stock broker said.

The market fell because of the profit-booking tendency among all sectors while the high marketplace capital-based insurance sector impacted the index positively, he added.

Insurance sector market capitalisation rose 1.6 % within the last week, according to the weekly market overview of UCB Capital Management.

In the last couple of weeks, insurance stocks have already been declining after experiencing a continuous go up for years. However, the IDRA's circular helped it to get again, the inventory broker said.

In the last week, junk stocks got a hit so almost all of the low-performing companies' stocks were crimson. Alltex Sectors shed the virtually all, falling 16.9 % accompanied by LafargeHolcim Bangladesh, Alif Manufacturing, Appollo Ispat, and Jute Spinners.

Investors got a good lesson from the currency markets regulators' step towards United Airways, said a good merchant banker.

On January 12, the Bangladesh Securities and Exchange Commission (BSEC) ordered the Dhaka and Chattogram stock exchanges to transfer United Airways to the over-the-counter plank from the key trading board.

As the company has not been operating since March of 2016 and has little potential to restart procedure, the regulator delisted it from the key trading board.

Various other companies are also there available in the market, which traded at an increased value however they are incurring losses for many years, that the investors fear the same thing will happen with those also, the merchant banker said.

This fear is necessary to tame junk stocks, which are victims of gambling oftentimes, he added.

Meanwhile, the DSE's standard daily turnover, another significant indicator of the market, dropped 16.25 % to Tk 1,565 crore within the last week.

The fuel and power sector dominated the turnover chart, covering 14.3 % of the full total turnover.