Investors flustered by sudden drop in index

Investors were left panicked and disheartened by the steep fall of the main index of the country's currency markets.

They are now losing profits even by investing in well-performing companies.

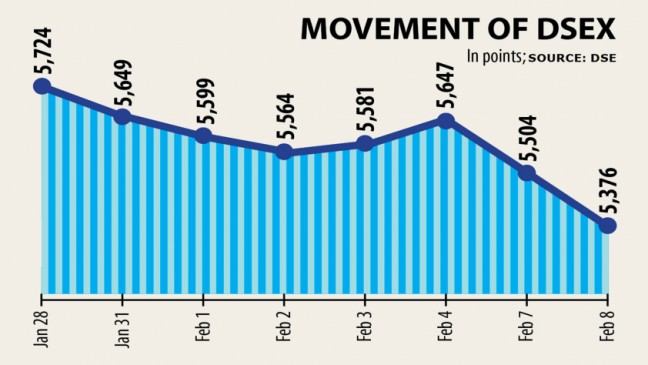

The DSEX, the benchmark index of the Dhaka STOCK MARKET (DSE), nosedived 128 points, or 2.33 per cent, to 5,376.45.

The index shed 4.86 per cent, or 271 points, within the last two days. Over the last two trading sessions, inventory worth dropped by around Tk 20,909 crore.

"I'm really disheartened as the worthiness of the majority of my stocks dropped by a lot more than 30 % suddenly," said Abdul Halim, an investor who gets results at an exclusive bank.

The majority of Halim's investments were found in Beximco Pharmaceuticals, Beximco, Robi Axiata and Bangladesh Submarine Cables.

"My portfolio is exhibiting unrealised losses for typically three companies, which have been dropping suddenly," he said.

Asked why he bought the shares of the companies in particular, he acknowledged that he was led by speculation.

"When I saw the companies were rising and people said these stocks would rise further, I planned to get them," Halim said, adding that Beximco and Beximco Pharmaceuticals contain the potential to create higher profits because of their participation found in the Covid-19 vaccination programme.

On November 5, a trilateral memorandum of understanding was signed among the government of Bangladesh, the Serum Institute of India and Beximco Pharmaceuticals to acquire and distribute three crore dosages of Covid-19 vaccines from the Indian vaccine-maker.

The three crore dosages will be delivered in phases with 50 lakh doses coming on a monthly basis, in line with the agreement. The primary stage of the vaccination program has already started in the united states.

Robi is a good multinational telecommunication enterprise and it has the probable to grow, Halim said. "So, I committed to these stocks."

New companies are always a risky bet and a sustainable selling price does take time to establish.

"But many of our investors are chasing debutant corporations and then they incur losses," a stock broker said.

Investors sometimes neglect to start to see the justifiable price of a good company if it has potential, he said.

"Although a enterprise has potential, shareholders should find its proper valuation because a high cost of a well-performing firm could cause losses."

Robi's show rose around seven circumstances to Tk 70 within significantly less than per month of its trading debut on December. It fell to Tk 39.90 yesterday, DSE data shows.

The shares of Beximco rose four times and Beximco Pharmaceuticals increased 88 %. Both fell 22 % and 40 per cent respectively in the last few days.

Turnover, a crucial indicator of the stock market, rose 2.37 % to Tk 789 crore yesterday.

At the DSE, 23 stocks rose, 236 declined and 91 remained unchanged.

Anlima Yarn Dyeing topped the gainers' list, rising 6.40 per cent accompanied by Savar Refractories, Matin Spinning, PHP First Mutual Fund, and Alhaj Textile.

Beximco topped the turnover list using its shares well worth Tk 140 crore changing hands, accompanied by Beximco Pharmaceuticals, Uk American Tobacco Bangladesh, Robi Axiata and LankaBangla Financing.

Shyampur Sugar shed the most, dropping 9.69 %, followed by Aman Feed, CAPM IBBL Mutual Fund, BD Thai Aluminum, and Prime Insurance.

The port metropolis bourse also dropped. The CASPI, the overall index of the Chittagong STOCK MARKET, fell 396 things, or 2.49 per cent, to 15,519.

Among the 228 traded stocks, 16 rose, 176 dropped and 36 remained the same.