Stocks fall, Beximco corporations end rally amid earnings taking

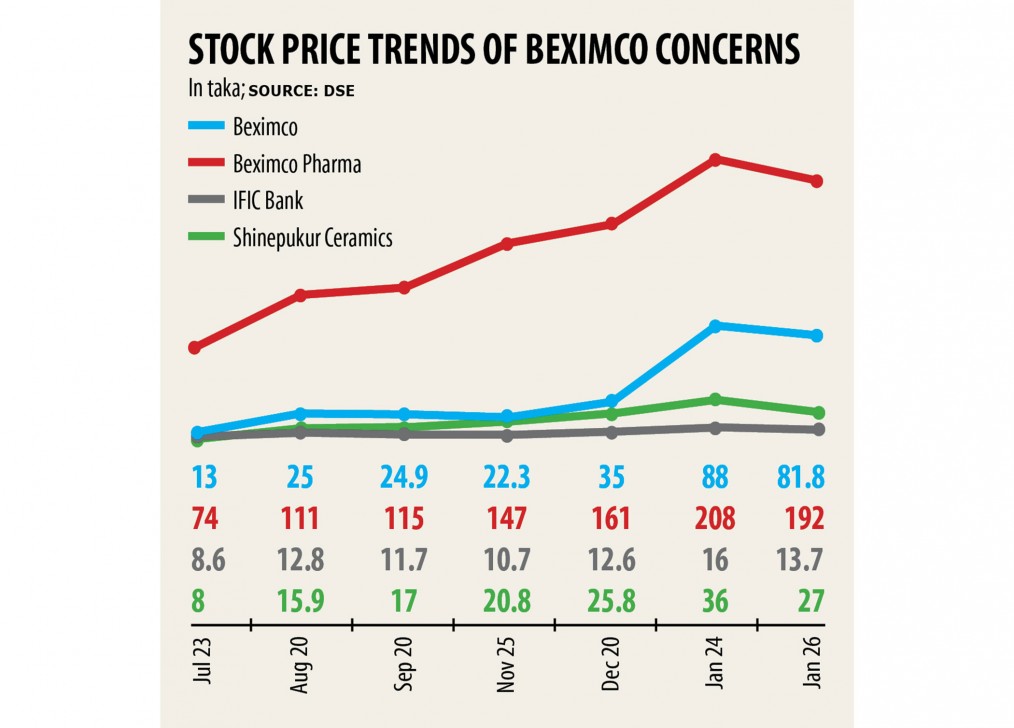

Concerns of Beximco Group witnessed corrections yesterday after leading from leading to improve the benchmark index of the Dhaka STOCK MARKET (DSE) to a three year high only a week ago.

DSEX, the benchmark index of the DSE, dropped 94.55 points, or 1.63 per cent, to 5,695 yesterday.

This year, the currency markets rose because of the run-up of insurance companies along with Beximco Group's concerns, which are now facing a profit booking tendency, said a stock broker preferring anonymity.

Inventory prices of Beximco Small, whose paid-up capital is Tk 876 crore, fell 8.1 % while Beximco Pharmaceuticals with a paid-up capital of Tk 446 crore dropped 4 %.

IFIC Bank, which has a paid-up capital of Tk 1,619 crore, fell 2.84 % and Shinepukur Ceramics, another listed concern of Beximco Group, declined 8.39 %. It includes a paid-up capital of Tk 146 crore.

Among the 49 detailed insurance firms, only 8 rose while 37 dropped.

"As Beximco's concerns will be big, their effect on the index can be large," the stock broker said.

Just because of the drop of Beximco and Beximco Pharmaceuticals, the DSEX shed round 14 points, according to amarstock.com, a stock market analysis-based website.

This is a standard trend of the currency markets because no share can rise without witnessing some corrections, he added.

The stock market has continued to fall going back three consecutive trading days, which continues to be considered as profit booking by industry analysts.

Trigger revenue from some merchant banks is probably the reasons behind the marketplace fall, said a high official of a good merchant lender preferring anonymity.

The regulator fixed the interest on margin loans at no greater than 12 %, and the trigger revenue came due to this fact, he said.

Many merchant banks have no scope of lending at this specific rate as their cost to maintain the fund is larger, he added.

Because of the recent high hop of the index, many scripts have got increased by a lot more than 50 per cent.

"So, investors are acquiring profits and this is a superb sign," another merchant banker explained.

When investors take gains, the marketplace gets its depth for further more rise.

"If investors remain wary of their investment decisions, then they will profit or elsewhere incur damage," the merchant banker explained.

Turnover, among the important indicators of the market, fell 29 % to Tk 1,125 crore.

Beximco topped the turnover list, trading shares worth Tk 142 crore accompanied by Energypac Power Technology, Robi Axiata, LankaBangla Financing, and Beximco Pharmaceuticals.

Jute Spinners topped the gainers' list, rising 7.53 % followed by Agrani Insurance, BATBC, Daffodil Computers, and Green Delta Mutual Fund.

Energypac Power Era shed the most, falling 9.93 % accompanied by Shinepukur Ceramics, Beximco, Robi Axiata and Midas Financing.

The port city bourse also dropped. The general index of the Chittagong STOCK MARKET (CSE), CASPI, fell 299 points, or 1.77 per cent to 16,578 yesterday.

Among the 251 stocks which were traded at the CSE, 22 advanced, 179 fell and 50 remained unchanged.