Beximco Pharma shares perk up on vaccine deal

Beximco Pharma has been the most notable choice for stock investors in the last few weeks because they believe the drug maker will make higher profits in the days to include the administering of a good Covid-19 vaccine found in Bangladesh.

Stock selling price of the neighborhood drug maker rose 58 per cent to Tk 174 in a span of days gone by three months.

Piggybacking in the upward pattern in pharmaceutical and insurance sectors, the DSEX, the benchmark index of Dhaka STOCK MARKET, rose 110 points or 2.16 per cent before closing the week at 5,218.

Through the period, average daily turnover, another significant indicator of the stock market, rose around 23 % to Tk 1,124 crore from that the prior week.

Business for pharmaceutical businesses didn't fall, rather their leads rose because of the emergence of Covid-19 and thereby rates of their shares increased, said Md Sayedur Rahman, managing director of EBL Securities.

"Alternatively, stock of Beximco Pharmaceuticalswas undervalued considering its revenue," he said.

Net revenue of the company-that keeps an 8.5 % share of the country's Tk 230 billion pharma market-rose 12.3 per cent year-on-year to Tk 2,561 crore in 2019-20.

Its profit rose 16.6 % year-on-yearto Tk 354 crore in the last financial year, regarding to its gross annual report.

In addition, Beximco Pharma's vaccination contract with the federal government boosted investors' self confidence, he said. "Its value has been rising because the last couple of months and previous week had not been an exception."

On November 5, a trilateral memorandum of understanding (MoU) was signed among the federal government of Bangladesh, Serum Institute of India and Beximco Pharmaceuticals to accumulate three crore doses of Covid-19 vaccines from Serum.

Pune-based Serum comes with an agreement with AstraZenea to manufacture the vaccine being produced by the Oxford University.

After the vaccine is approved for human request, Beximco Pharma will acquire each individual dose from Serum for $4 and then source it to the federal government for $5.

The three crore doses will be delivered in phases with 50 lakh doses every month, based on the agreement.

In a Daily Mail survey that was posted on December 21, the Medicines and Healthcare goods Regulatory Agency (MHRA) is doing its final overview of the vaccine for three weeks right now since November 27, with a decision predicted by next week.

Beximco Pharmaceuticals launched Bemsivir which acquired some impact for the treating Covid-19.

Beximco, that holds around 29 lakh shares of the drug building business, topped the turnover set of the DSE the other day accompanied by Beximco Pharmaceuticals, IFIC Lender, LafargeHolcim and Orion Pharmaceuticals.

Beximco led the gainers' list also with a good 44 % rise in share selling price in weekly while Dominage Metal shed the most with a great 18.78 % fall.

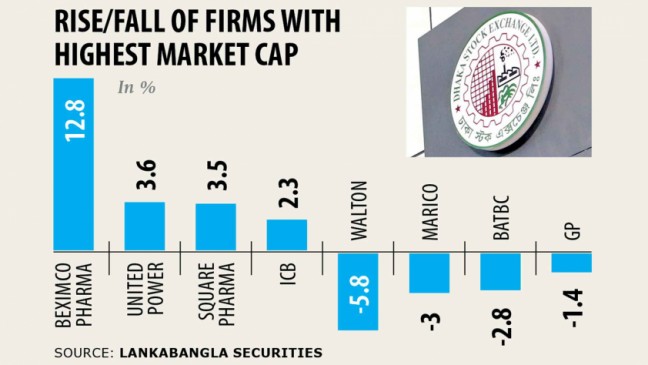

Among the marketplace capitalisation leaders, Beximco Pharmaceuticals rose 12.8 % and Square Pharmaceuticals 3.5 % last week.

Among the sectors, non-life insurance firms topped the gainers' list. Stocks and shares of the insurance sector rose 6.38 % while pharmaceuticals soared around 3 %.

The insurance industry has been experiencing an anarchy, which includes been solved recently, said Rahman, also president of Bangladesh Merchant Bankers' Association.

Agent commission in the industry has been hovering between 60-70 % for years, which used to consume up a huge pie of the insurance company's profits, he stated.

Point started changing when the insurers started abiding by the regulator's buy to disburse highest 15 % commission to the agents, he said.

Monitoring became easier when the Insurance Advancement and Regulatory Authority managed to get mandatory to get the insurers to shell out agent commission through lender accounts, he said.

The insurance regulator has also brought in various other reforms, which improved investors' confidence to an excellent extent, added Rahman.