BATBC leads drop in stock index

Stocks of British American Tobacco Bangladesh (BATBC) led the marketplace fall yesterday despite it has the earlier announcement of 600 per cent cash and 200 per cent stock dividends.

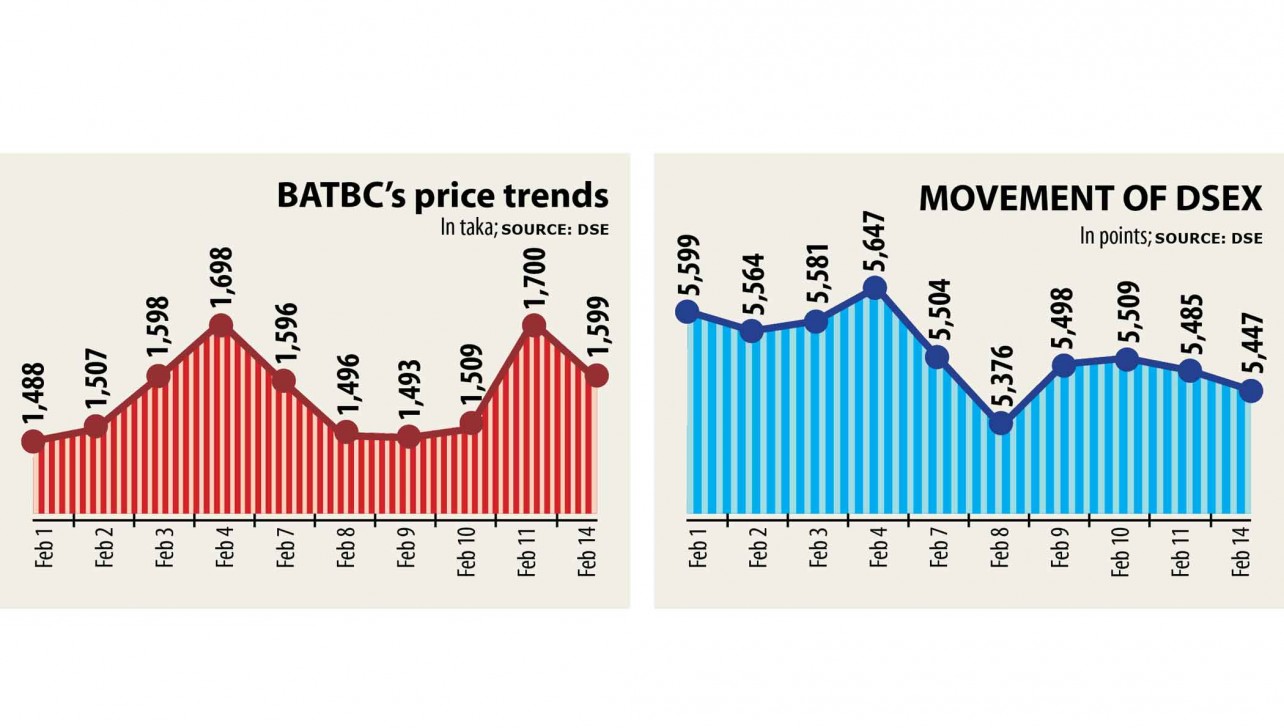

DSEX, the benchmark index of the Dhaka Stock Exchange (DSE), dropped 37 tips, or 0.68 per cent, to 5,557 yesterday.

Investors are now at night about BATBC's dividend adjusted selling price because its value will be lower than the ground price.

Last year, the stock market regulator set a ground price for all stocks and shares so that they can not drop even more amid the Covid-19 pandemic induced economical slowdown.

Whenever a company provides inventory dividends, then its selling price is adjusted proportionately, a secured asset manager said.

"Let's say the closing selling price of a BATBC show is Tk 100 on its record date, the day when the dividend ownership is set, then the company concerns two more shares for a inventory owner as it announced a 200 % share dividend," he added.

Because of this, the stock cost of a BATBC show will be Tk 33, based on the asset manager.

As the business's stock price continues to be over TK 1,600 and it announced 200 per cent inventory dividends with the ground selling price set at Tk 907.60 on March 19 this past year, the adjusted cost must go lower compared to the floor value, he stated, adding the dilemma about BATBC's adjusted price influenced the change found in its value.

Its impact was sharp on the index also, he added.

BATBC alone snared 16 things from the DSEX yesterday, according to info from Amarstock.com, a good currency markets analysis website.

"We don't know whether the stock marketplace regulator would allow the company to are categorized as its floor price to be able to adapt the stock dividend or perhaps remain at floor value," explained Munna Raihan, a stock investor.

"That is a burning issue now and because of the puzzling situation, its share price tag is moving zigzag," he added.

BATBC's dividend announcement was published on the DSE web-site last Thursday, when its share price rose 12 % to Tk 1,700. Yesterday the multinational cigarette maker's stock fell 5.96 % to Tk 1,599.

The regulator can set a fresh floor price for BATBC as the adjustment is essential to obtain a marketplace driven price, said a merchant banker preferring anonymity.

"I actually don't support setting a floor price for any stock even though it impacts the marketplace positively," he stated, adding BATBC's old floor value is no more suitable as it announced an enormous stock dividend.

"If the regulator allows it to continue at the prior floor price, then the price must be overvalued," the merchant banker explained.

BSEC Spokesperson Rezaul Karim said the regulator will need a decision about the matter soon.

Last year, the company logged profits around Tk 1,088.6 crore, up 36.9 % year-on-year.

BATBC declared the benefit shares by taking into consideration the usage of its accumulated income, which stood at Tk 3,213 crore for the entire year that ended on December 31 of 2020, the business said in a disclosure on the DSE website.

It issued stock dividends to attain the optimum capital bottom considering its size and progress.

The bonus shares possess not been declared from the capital reserve, revaluation reserve, any unrealized gain, out of profit earned ahead of incorporation, by reducing paid-up capital, anything else would have put the post-dividend retained earnings in the adverse or a debit balance, it said.

At the DSE, 57 companies' stocks rose, 193 stocks fell, and 101 remained unchanged.

Delta Spinners topped the gainers' list, rising 9.85 % followed by Keya Cosmetics, Taufika Foods and Agro Industries, Beximco and Beximco Pharmaceuticals.

Beximco topped the turnover list, trading value Tk 217 crore followed by BATBC, Beximco Pharmaceuticals, Robi Axiata and LankaBangla Financing.

Primary Insurance shed the most, falling 9.65 % accompanied by Federal Insurance, Peoples Insurance, City General Insurance, and United Insurance.