Digital financial inclusion may help economic recovery

Bangladesh has embraced a broad range of financial inclusion since 2010 by allowing a huge population to open a merchant account with a short deposit of Tk 10 to Tk 100 seeing that the federal government looked to bring the unbanked beneath the umbrella of the banking sector.

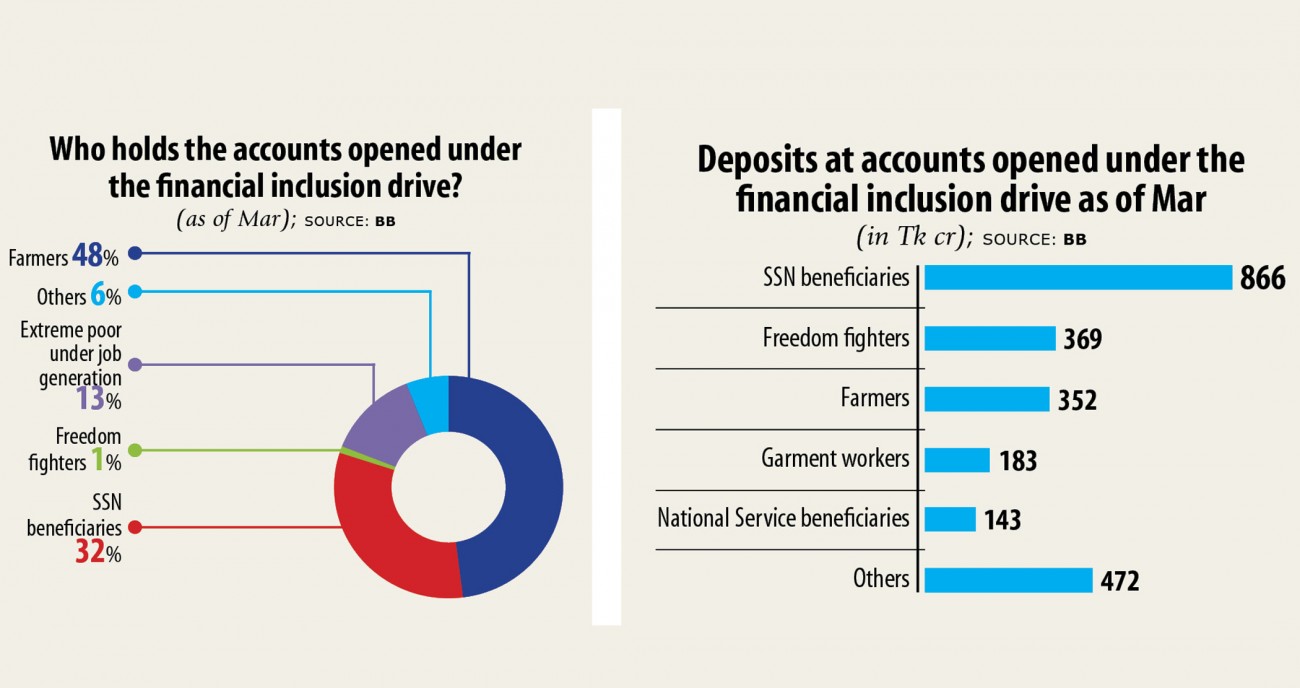

By March 31, banking institutions opened 2.13 crore accounts for many who receive allowances under cultural back-up schemes, farmers and extremely poor.

But now a concern has arisen: just how much a function may be the financial inclusion performing in tackling the ongoing economical maelstrom due to the global coronavirus pandemic?

The International Monetary Fund has said that the countries whose financial inclusion agenda is strong and radiant could absorb the shocks smoothly.

This is good news for Bangladesh given the gigantic number of accounts under the financial inclusion, which is 20 per cent of total accounts of 10.66 crore in the banking sector.

But the IMF study paper -- The Promise of Fintech: Financial Inclusion in the Post-COVID-19 Era -- has also given a message that the original inclusion will be unable to address the crisis.

There could have a dependence on digital financial inclusion to handle the pandemic-stricken economy. Such economic climate also helps persons maintain social distancing in order to avoid the deadly pathogen.

Although the Bangladesh Bank does not have available data about how lots of the 2.13 crore accounts opened beneath the drive are lively, there's been a good indication that the majority of them are inoperable presented the amount of deposit craze with the accounts.

The outstanding deposit in the accounts stood at Tk 2,385 crore as of March.

A tiny portion of the accounts is used to get farm loans while the government may make social safety net repayments to the extreme poor, underprivileged populations and freedom fighters through the accounts.

The quantity of accounts beneath the financial inclusion programme has been increasing through the years, but the trend has didn't put a substantial impact on the economy, said two officials of the central bank who will work on the matter.

For instance, in the first one fourth of the year, the marginal people opened up 7.95 lakh accounts, that have been hardly used.

As per the federal government and the central bank instruction, these accounts can not be rendered dormant. Banking institutions treat a merchant account inactive if they are not used for six months in a row.

The accounts will stay inoperable in the coming days if the account holders avoid them digitally like they use the accounts of mobile financial service (MFS).

But this is a tough job as 89.12 % of the accounts have already been opened by state-run loan providers, that have not brought their all branches under online insurance policy coverage.

The higher-ups of the central bank should take an initiative promptly as the post-pandemic-era will be very different from the existing stage, said a BB official.

People from all walks of existence who are actually settling transactions through banking channel are actually increasingly opting virtual banking to protect themselves from the deadly virus. This will type as a behavior and a lot of the buyers will carry out banking from home.

The IMF in its publication gave an anecdote about the future digital financial inclusion and financing scenario.

In a remote location in a low-income country, a female wakes up early each morning and dials her cellular. She actually is borrowing a incredibly small amount digitally to get vegetables from the neighborhood market.

During the day, she'll sell her inventory for her shop located on the outskirts of the city. Some customers will pay her using a cellular wallet and others with income.

She will transfer the money onto her phone at the shop nearby, where the merchant can be a mobile cash agent.

By the end of the day, she'll be able to repay the loan and keep carefully the profit on her behalf mobile wallet. She may use mobile money to cover the gas she uses to prepare dinner, as the utility enterprise has recently linked its payment system to the mobile funds infrastructure.

Such an electronic inclusion is also conceivable in Bangladesh in a single couple of years if required measures are taken right now, countless central bankers say.

The accounts beneath the economic inclusion programmes will have to be linked to cell phones like the operational system of MFS accounts. The customers have to be granted a scope to use the accounts through mobile phones.

The prevailing MFS agents may help them deposits and withdrawals and the government should provide subsidy to them to take action, said the central bankers.

The IMF paper found that adoption of digital payments is considerably and positively connected with growth.

During the pandemic, technology has created new opportunities designed for digital financial companies to accelerate and enhance financial inclusion, amid public distancing and containment actions, it said.

Through the crisis, smooth usage of government electronic devices that are well-included with digital financial companies platforms such as for example fintech firms and digital banking happen to be proving to be critical in providing wide-reaching coverage assist promptly and without get in touch with to the public.

If they are not easily accessible or not well-integrated, fiscal support announcements -- regardless of how large -- will neglect to reach the most vulnerable and needy, the paper said.

The federal government has provided funds to the garment sector under a stimulus package and the wages to the personnel have already been paid through MFS channel.

It should widen the digital financial inclusion for execution of the full total stimulus packages value a lot more than Tk 103,000 crore.

Ahsan H Mansur, executive director of the Coverage Exploration Institute of Bangladesh, echoed.

"The gigantic amount of accounts could be enlisted with the agent banking aswell to expedite the digital personal inclusion," he said.

The central bank is thinking about how precisely to provide a boost to digital financial inclusion to maintain with enough time, said Md Anwarul Islam, general supervisor of the Financial Inclusion Department of the central bank.

The maneuver will be easier if state loan providers embrace online banking in the quickest possible time.