Banks in Bangladesh have got the cheapest capital base found in South Asia

The capital base of Bangladesh's banking sector is much weaker than in peer countries -- a predicament that not merely highlights its frailty but also the heightened vulnerability amid the coronavirus pandemic.

Capital adequacy ratio (CAR) may be the reflection of all personal indicators of banks, like the ratio of defaulted loans, the ability of keeping provisioning against standard and categorized loans and the actual problem of corporate governance.

The CAR is a measurement of a bank's available capital expressed as a percentage of risk-weighted credit exposures.

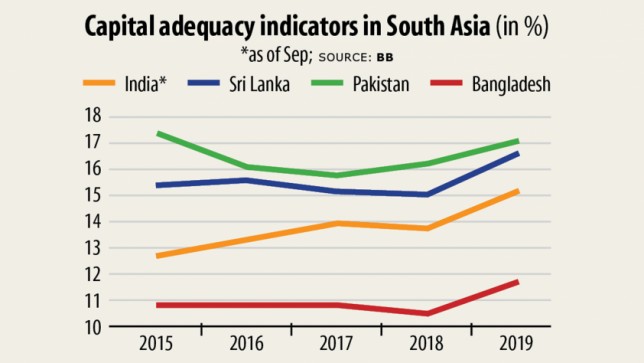

Banks found in Bangladesh maintained the automobile at 11.60 % last year, way significantly less than 17 % in Pakistan, 16.5 % in Sri Lanka and 15.1 % in India.

This means the banking sector is weaker compared to the loan providers in neighbouring nations. But banks will be in a better job to deal with the ongoing economical fallout due to the coronavirus pandemic if indeed they could manage a solid capital base.

"Capital adequacy may be the topmost element of the CAMELS ranking for banks. Which reflects the entire financial health of lenders," stated Salehuddin Ahmed, a past governor of the Bangladesh Lender.

CAMELS -- which means capital adequacy, asset quality, management, income, liquidity and sensitivity -- is a recognised international score system used to charge financial institutions as per six elements represented by its acronym.

The high level of defaulted loans is the key reason behind the low CAR in Bangladesh, according to Ahmed.

Banks have to keep a large volume of provisioning against the defaulted loans that in the end hit the administrative centre base. This has also tarnished the picture of the sector among foreigners and the lenders of the exterior world will exhibit reluctance in employing local banks aswell, he said.

The BB took initiatives to implement the Basel III guidelines by 2019 within its effort to strengthen the banks' capital base.

Basel III can be an internationally agreed set of measures produced by the Basel Committee on Banking Guidance found in response to the global financial meltdown of 2007-09 to boost restrictions, supervisions and risk operations within the banking sector.

As per a roadmap unveiled by the BB found in 2014, banks were likely to drive up the minimum CAR to 12.5 % by December 2019 from 10 % then.

Of the 58 banks, 43 met the standard by the deadline. By December, the automobile of foreign banking institutions was 24.45 %, private banks' 13.62 per cent and state banks' 4.99 %, info from the central bank showed.

State-run banks are largely accountable for the lower CAR on the banking sector.

"This is not the true picture of the automobile as the indicator would have worsened even more if banking institutions had followed the guidelines and regulations on bank loan classification and provisioning properly," said Ahsan H Mansur, executive director of the Coverage Exploration Institute of Bangladesh.

Defaulted loans hadn't increased too much on the banking sector last year as a result of the central bank's relaxed rescheduling facility and specialized permission given to regularise defaulted loans, he stated.

Banks experience widened the administrative centre base on the trunk of the relaxed mortgage rescheduling insurance plan, which allowed defaulters to reschedule classified loans with a good deposit of 2 per cent of the outstanding volume rather than existing 10-50 %.

The central bank also allowed banks to reschedule a big amount of defaulted loans by granting special permissions on a case-to-case basis.

Last year, an archive Tk 52,770 crore was rescheduled. Of these, Tk 13,284 crore has turned sour once again, BB data showed.

This means practically one-fourth of the rescheduled loans slipped in to the bad category again.

Defaulted loans stood for Tk 94,313 crore towards the end of 2019, up 0.42 % year-on-year.

Banks should now begin preparing to increase the capital base while there will be an uncertainty found in the times ahead due to the twists and turns of the pandemic, said Mansur, also a ex - official of the International Monetary Fund.

"The personal health of banking institutions will deteriorate in the coming times if the economy faces more storms," he ADDED.

The weak CAR has indicated that the financial health of the banking sector in the neighbouring countries is more robust than Bangladesh, said Syed Mahbubur Rahman, managing director of Mutual Trust Bank.

"The CAR would have been 15-16 % if the state banking institutions could keep up with the requirement according to the Basel III rules," he added.