DCCI desires corporate tax cut

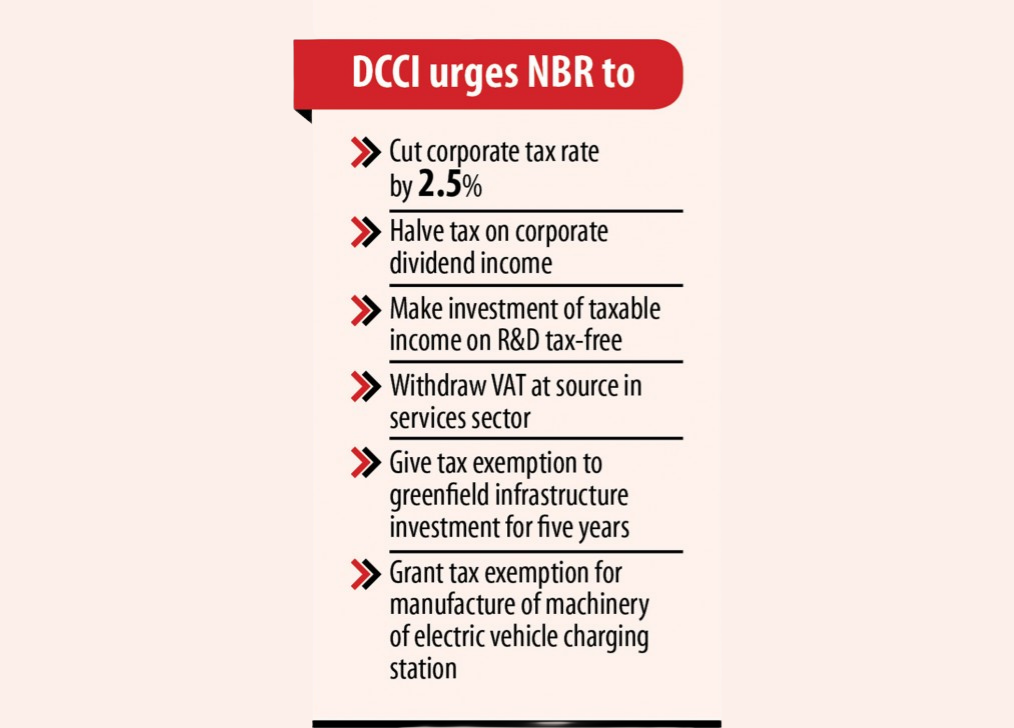

The Dhaka Chamber of Commerce & Industry (DCCI) yesterday urged the earnings administration to cut the corporate tax for listed and non-listed companies by 2.5 % in the next fiscal year.

It demanded a 5 per cent and 7 % reduction in the organization tax level in the fiscal years of 2022-23 and 2023-24, respectively.

"If the federal government cuts the corporate tax rate, it will boost local and foreign investment," said Rizwan Rahman, president of the DCCI, in a press release.

The businessman located the chamber's budget tips for another fiscal year to National Board of Revenue Chairman Abu Hena Md Rahmatul Muneem at the latter's office in the capital yesterday.

The proposals were targeted at reviving organization confidence in the post-pandemic period, creating a business-friendly tax structure, widening tax and VAT net, ensuring export diversification, encouraging industrialisation, and facilitating an investment-friendly environment.

The chamber called for halving the tax on the income of corporate dividend to 10 per cent from 20 per cent now.

Besides, if a company invests 5 per cent of its taxable profit on research and expansion, this investment ought to be tax-free, Rahman said.

In Bangladesh, only 24 lakh taxpayers submit returns away of 50 lakh authorized taxpayers. This prompted the chamber to propose to automate the earnings structure fully.

The DCCI demanded a withdrawal of value-added tax (VAT) at source in the service sector. It urged the NBR to impose the turnover tax based on the value-addition of goods or revenue for the firms that are out of VAT net.

The DCCI said an excise duty have been imposed twice in case of getting a loan from banks. "The machine ought to be withdrawn."

The chamber recommended tax exemption over the investment on greenfield infrastructure projects at least for another five years.

With greenfield investing, a company builds its, completely new facilities from the ground up.

In the set industry, the organization tax for listed firms is 25 %, and for non-listed firms 32.5 %. So that you can diversify exports, the chamber proposed to lessen the rate and invite them the possibility to renew the relationship licence for 3 years like that enjoyed by the garment industry.

The DCCI called for a tax exemption for native suppliers of machinery and accessories used for electric vehicle charging stations.

Muneem urged industries and businesses to be more compliant, that will boost confidence between your businesses and the earnings administration.