Tax collection jumps in September

Tax collection jumped in September as the country's businesses and economical activities continued to pick up despite all of the uncertainty due to the ongoing Covid-19 pandemic.

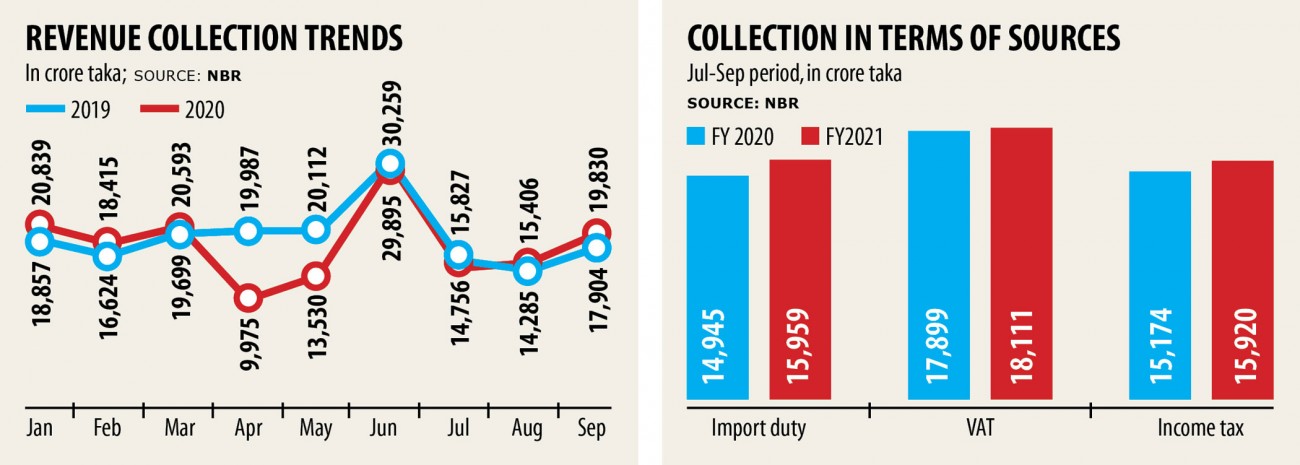

Last month, the National Board of Revenue (NBR) collected Tk 19,830 crore as tax, an 11 % increase compared to the same period this past year, when it had been Tk 17,904 crore, in line with the NBR's provisional collection data.

Thanks to an increased assortment of income tax, import duty, and value-added tax (VAT), overall tax collection rose in the July-September period.

"Increased assortment of VAT from domestic sources is a positive sign," said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh (PRI).

"It indicates that real financial activities are picking up when compared to the same period of last year," he said.

This was the next consecutive month when earnings collection grew after remaining in the negative for four months since April, owing to the coronavirus-induced shutdown and slump in domestic and global demand.

The amount of tax collected reached Tk 9,975 crore in April, the cheapest since January 2019.

Mansur, a former economist at International Monetary Fund, expected that activities would grab as businesses such as for example restaurants were reopening.

"There has also been a significant increase in road traffic," he said.

During the July-September period, taxmen collected a complete of Tk 49,990 crore, up 4 % from Tk 48,017 crore in the same month in the year prior, the NBR data shows.

Import duty payments by businesses soared 7 percent year-on-year to Tk 15,959 crore in the July-September period (the first quarter of the fiscal year) compared to the same period this past year.

Taxmen also collected an increased amount in taxes from individuals and companies during the same period.

Collection of VAT, the largest source of revenue, have been downbeat until August this season.

However, VAT collection soared in September, enabling the NBR to create a 1.19 % higher assortment of the indirect tax in the first 90 days of fiscal 2020-21.

Until the July-August period, income tax receipts have been in the negative. In September, assortment of the direct tax soared 14 per cent.

From this backdrop, overall income tax collection grew 5 per cent year-on-year to Tk 15,919 crore in the July-September amount of fiscal 2020-21 in comparison to a year ago, in line with the NBR data.

However, VAT receipts must grow by 10 % this fiscal for the economy to grow by 4 %, Mansur said.

Md Anwar Hossain, director general (research and statistics) of the NBR, said close monitoring by the revenue authority enhanced the growth of revenue.

Imports drove the earnings collection growth and more imports will eventually lead to increased assortment of VAT and tax, he added.

Despite the increased collection, the gap between collection and target has further widened.

The NBR lagged behind by Tk 13,724 crore from its collection target of Tk 63,714 crore in the July-September pewriod, according to its provisional data.