Tax collection rebounds in August

Revenue collection rebounded in August after remaining downbeat for four months since April, because of recovery running a business and economical activities that buoyed overall receipts.

Provisional data from the National Board of Revenue (NBR) showed that collection grew in every areas, with imports driving the rebound followed by value added tax (VAT) and tax.

In August, taxmen collected Tk 15,406 crore, a growth by 7.85 % from the same month this past year.

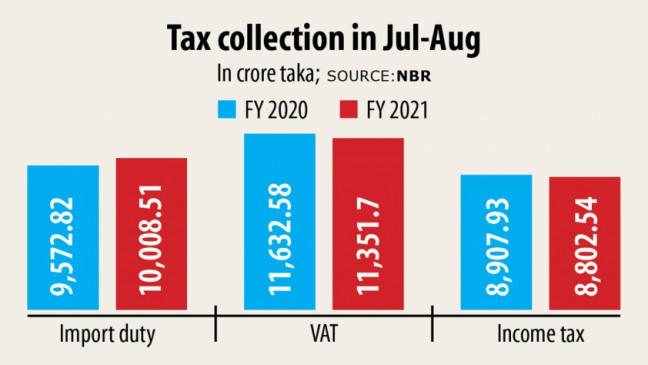

Despite August's recovery, overall collection was practically the same when you compare the July-August period year-on-year.

It has edged up marginally to Tk 30,163 crore from Tk 30,113 crore, data from the NBR showed.

"It really is good to see that earnings collection is regaining pace due to revival of financial activities. Collection will be on the upward when there is no crisis in the coming days," said Md Anwar Hossain, director general (research and statistics) of the NBR.

Revenue collection slumped in April as business and economic activities collapsed after the government declared an over-all holiday and shutdown to slow the spread of the Covid-19 pandemic in the united states.

Collection improved in the later months as businesses gradually reopened.

However, overall tax receipts continued to remain in the negative and the NBR posted negative growth last fiscal year which ended in June, for the first time because the nation gained independence.

In July, tax collection declined 6.7 % from that in the same period this past year.

The NBR data showed that assortment of taxes from import and export activities soared 16.87 % year-on-year to Tk 4,992 crore in August from the same period a year ago.

The VAT collection from domestic monetary activities grew 5 % year-on-year to Tk 5,731 crore in August from that in the same month the previous year.

Income and travel tax also increased in August.

However, income tax and VAT receipts remained below last year's collections of the July-August period.

Assortment of customs duty had been in the upward in the July-August period compared to the same period this past year, showed the NBR data.

For the existing fiscal year, the federal government assigned the NBR to gather Tk 330,000 crore to finance the budget.

And the most recent collection fell short of the target for the first two months of the fiscal year 2020-21.

Towfiqul Islam Khan, senior research fellow of the Centre for Policy Dialogue, said the shortfall of revenue collection will be a major constraint for the federal government.

"The first trends of revenue collection show that the economical recovery has remained fragmented. It is also clear that the fiscal framework, be it income collection, be it public expenditure, will desire a major overhaul," he said.

Khan said if there was no overnight revitalisation of administrative capacity, the pace of economical recovery would determine the earnings outcome.

"The other critical component may be addressing tax avoidance. Nevertheless, the federal government should be ready to adapt its public expenditure by prioritising and avoiding wastages because of scarcity in government revenue," he said.