Tax receipts preserve falling as pandemic lingers

Earnings collection fell massively for the second consecutive month in May as being incomes and demand for things and services crashed because of the lengthy shutdown devote place to battle the Covid-19 pandemic.

The overall closure, from March 26 to Might 31, forced the National Board of Revenue (NBR) to create a poor growth in collection.

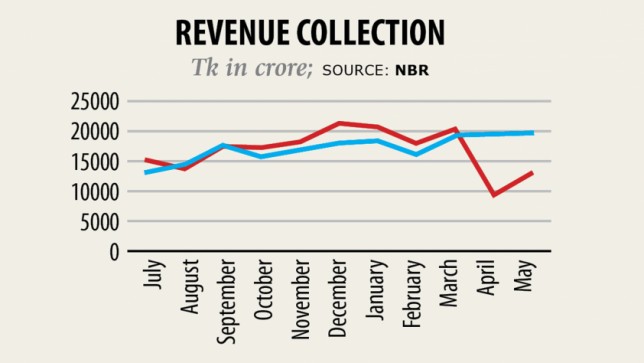

In May, it produced Tk 13,530 crore, which was 33 % down from Tk 20,110 crore this past year.

The collection had crashed 50 per cent year-on-year to Tk 9,975 crore in April.

The biggest earnings collector for the state logged Tk 188,500 crore in the July-May amount of the current fiscal year, down 2 per cent from Tk 193,202 crore a year ago, showed provisional data of the NBR.

With only a month staying of FY20, it is likely that the NBR's collection will be less than the prior year's receipt of Tk 223,892 crore. It could have to generate Tk 35,400 crore in June to equivalent last year's total.

In June last year when the problem was typical along with regular economical activities, the income board gathered around Tk 31,000 crore.

So, the chance of a collection that's higher than the previous year looks bleak beneath the prevailing condition. And if the NBR does not touch last fiscal year's target, it would be the very first time since 1973 that earnings collection would fall from a preceding time.

"The opportunity of growth of earnings collection is unlikely," explained Ahsan H Mansur, executive director of the Coverage Research Institute of Bangladesh, a think-tank.

In a letter to Finance Secretary Abdur Rouf Talukder, NBR Chairman Abu Hena Md Rahmatul Muneem said he predicted that total revenue collection could possibly be about Tk 220,000 crore in FY20, owing to the significant fall in tax receipts due to the pandemic and consequent stoppage of monetary activities.

Until May, only income tax grew marginally while the rest several areas - value-added tax and customs tariff -- declined year on year.

VAT collection dropped to Tk 75,900 crore found in the 11-month period, from Tk 76,870 crore this past year. Collection from customs duty dipped 6 per cent to Tk 54,816 crore.

Tax receipts stood at Tk 57,795 crore, slightly above Tk 57,670 crore generated by the segment from July to May well last year, according to the NBR.

"We can expect the NBR's earnings collection in the current fiscal calendar year to be just about similar to last year's," explained Towfiqul Islam Khan, senior exploration fellow of the Centre for Policy Dialogue, also a think-tank.

"Because of the prevailing Covid-19, the NBR had little options. But as well, we have to also remind ourselves a insufficient implementation of prepared reforms and poor administrative capability contributed to a sizable extent."

Earnings collection from both NBR and other options might flunk of the original total annual target by Tk 125,000 crore, the economist said.

As the economy is reeling beneath the coronavirus-induced slowdown and tax collection plunged, the prospective for the NBR has been fixed at Tk 330,000 crore in FY21, which is 10 % higher from the revised target of Tk 305,500 crore in FY20.

Unfortunately, the cover the FY21 didn't consider these info while setting the revenue mobilisation aim for, Khan said.

"With an array of tax reliefs, you won't be possible to attain the NBR's income target in FY2021. The revenue target for another fiscal year will require serious overhauling because of updated real-time info."

Mansur said the NBR might be able to accumulate at best Tk 260,000 crore up coming fiscal year.

Normally, revenue generation accumulates in Bangladesh mainly because the fiscal 12 months nears its end. During the past couple of fiscal years, the NBR submitted an average earnings generation growth of 13.16 %.

But such development is impracticable this time around.

The pandemic may inflict a minimum revenue loss of 2 % of GDP, said Asian Creation Bank recently.