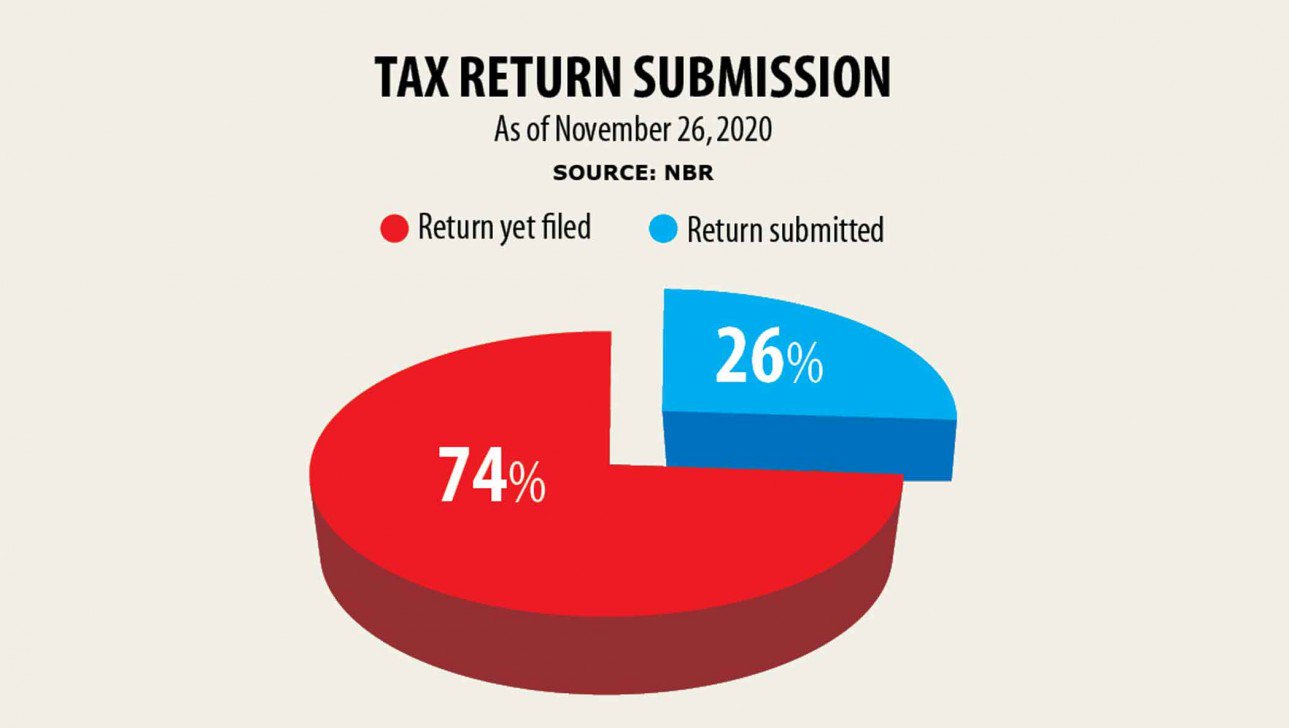

One-4th of taxpayers filed returns up to now

Just one-fourth greater than 50 lakh registered taxpayers in the united states filed their annual tax returns by the finish of last week.

However the National Board of Revenue stated that it could not extend the deadline for submission beyond November 30. This means that taxpayers who neglect to file their come back by the finish today will have to submit their returns by trying to find period from the field office buildings of taxes.

Besides, holders of Taxpayer Identification Figures (TIN), except for certain cases, will face fine because of their failure to furnish income tax returns this year.

This became apparent following the NBR yesterday said that it would not prolong the deadline despite the fact that there were demands from taxpayers for an extension as the quantity of Covid-19 positives began to improve for the last weeks, forcing many individual taxpayers to stay in isolation.

Giving an answer to reporters, NBR Chairman Abdominal Hena Md Rahmatul Muneem explained the coronavirus 's been around for practically one year, during which most regular activities continued.

"All had to continue our activities, come to be it business or regular. So, we usually do not think the coronavirus has generated a barrier for filing returns. There could be a problem in some cases and those who are facing problems may apply to the commissioners for time extensions," he said.

He said the commissioners were currently advised to grant period for all applications. They have also been advised to be delicate on imposing penalties on taxpayers, the NBR chief said at the press briefing.

The tax collector organised the press briefing at its headquarters to talk about some of its plans.

The NBR said that the number of taxation statements filed increased 5 per cent year-on-year to 13.20 lakh as of November 26, up from 12.57 lakh a year ago.

"We hope a good number of taxpayers will submit returns within the last two days," said NBR Member (Tax Insurance policy) Md Alamgir Hossain.

The official time for tax return filing starts from July 1 annually and ends on November 30, referred to as Tax Day.

For the existing fiscal, the NBR manufactured the submission of tax returns compulsory for all taxpayers, aside from credit cardholders with no taxable income, persons who got TIN for advertising land and non-people who don't have any fixed base in Bangladesh, in line with the NBR.

Muneem said a sizable part of TIN holders might not file returns this season on the assumption that there will be no legal measures from the taxes authority.

"They will realise only when they will face fines.

"We have made go back filing mandatory for all taxpayers. Those that won't submit return will deal with action according to rule," he said.

Income tax is the second biggest way to obtain earnings collected by the NBR, and companies take into account more than 60 % of the direct taxes collected.

Last year, practically 22 lakh taxpayers filed returns as the submission was not mandatory. This season, taxmen expect to get a higher number of returns as a result of changes in regulations brought while passing the national cover fiscal 2020-21.

The tax department aims to log Tk 105,475 crore through the current fiscal year. The collection aim for is 32 per cent of the total target of Tk 330,000 crore. By October, taxmen had realized nearly one-fifth of that yearly target, NBR data shows.