Credit growth rises in spite of pandemic

Banks managed to post 8.95 % credit growth in the last fiscal year despite a steep fall running a business within the last quarter owing to the coronavirus pandemic.

The credit expansion improved as the lenders disbursed even more funds from the stimulus packages that the federal government announced to greatly help ailing businesses shrug off the jitters.

The country's 58 banks disbursed Tk 1,064,713 crore in fiscal year 2019-20 combined, data from the central bank showed.

State-run banks lent a complete of Tk 199,919 crore in the last fiscal year, up 10.58 per cent year-on-year.

Forty private commercial banks disbursed Tk 796,952 crore, which is normally 9.04 % greater than in the same period this past year.

Foreign banks were very cautious within their lending: nine international banks operating in Bangladesh only disbursed Tk 38,065 crore, up 0.30 per cent from a year ago.

Lending by two state-run specialised banks - Bangladesh Krishi Lender and Rajshahi Krishi Unnayan Lender - grew 7.83 % to Tk 29,775 crore within the last fiscal year.

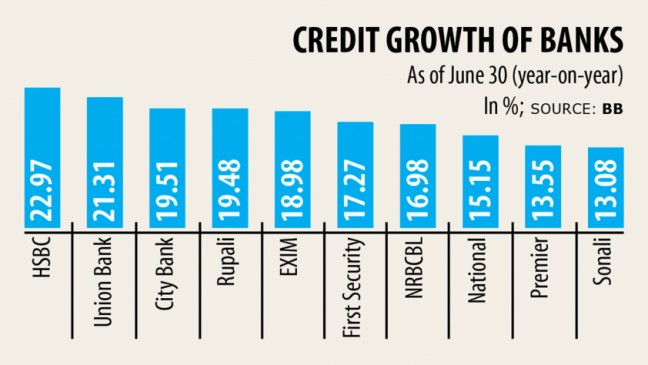

HSBC's financing rose the best 22.97 % among all banks, accompanied by Union Bank 21.31 per cent, City Bank 19.51 %, Rupali Bank 19.48 per cent, Exim 18.98 % and First Security Islam Bank 17.27 %.

NRB Commercial Bank's financing grew 16.98 % year-on-year, National Bank's 15.15 per cent, Premier Bank's 13.55 % and Sonali Bank's 13.08 per cent.

Islami Lender Bangladesh disbursed the highest Tk 87,980 crore last fiscal season, up 10.50 % year-on-year.

Sonali Bank arrived second with the financing of Tk 53,697 crore, followed by Janata Bank Tk 52,313 crore and Agrani Bank Tk 46,828 crore.

First Security Islam Bank lent Tk 38,932 crore, National Bank Tk 37,867 crore, Exim Bank Tk 36,821 crore and United Commercial Bank Tk 31,425 crore.

Among foreign banks, Typical Chartered disbursed the best Tk 17,523 crore, followed by HSBC Tk 10,975 crore.

Citi NA's lending contracted the virtually all among all the banks, by 36.28 %. Woori Bank's credit rating fell by 23.17 per cent, BB data showed.

National Bank of Pakistan, Habib Bank, Regular Chartered, Jamuna, Bangladesh Commerce, ICB Islamic, BASIC Lender, and One Lender also saw a poor credit growth in the last fiscal year.

Zaid Bakht, chairman of Agrani Lender, said financing by the state-run banking institutions rose as they disbursed more cash from the stimulus packages and they are financing at within the central bank's ceiling of 9 % interest rate.

The state-banks also lent more to the tiny and medium enterprises, he said.

Due to the lower lending prices, many large borrowers have switched to state banks from exclusive ones, said Bakht.

"Banks are lending cautiously due to the coronavirus-induced uncertainty," said Syed Mahbubur Rahman, managing director of Mutual Trust Lender.

The sustainability of credit growth would depend on how exports pick up, he said.

"If the coronavirus pandemic is not brought under control at home and overseas, the uncertainty would linger," said Rahman.

Personal banks are also concerned as much of their loans risk turning sour because of the troublesome business condition, said another banker.

The central bank has set a public sector credit growth target of 44 per cent for fiscal 2020-21 and kept unchanged the private sector credit growth target at 14.8 per cent.

The advance-to-deposit ratio (ADR) of state banks stood at 60.06 % last fiscal year, exclusive commercial banks 83.29 %, foreign banks 58.22 % and both specialised state banks in 77.39 %.

ADR can be used to assess a bank's liquidity by comparing a good bank's total loans to its total deposits for the same period.

If the ratio is too much, it means that the lender may not have sufficient liquidity to cover any unforeseen fund requirements. Conversely, if the ratio is usually too low, the lender might not exactly be earning as much as it may be, according to Investopedia.