Agent banking in a roll

Total deposits with agent banking accounts doubled in July compared to the same period a year ago as increasingly more persons are keeping faith with the new banking model.

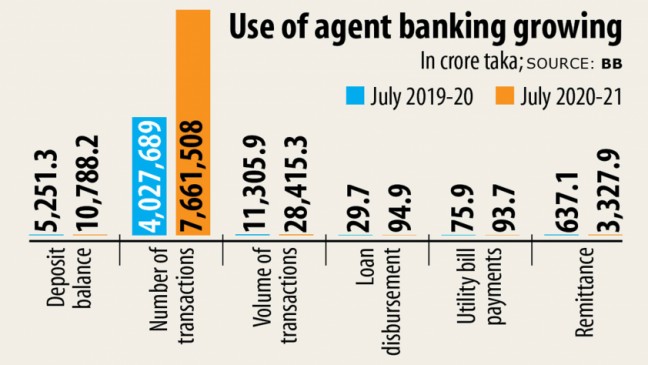

Deposit balance stood at Tk 5,251.3 crore in July this past year and it rose to Tk 10,788.2 crore in the same month this season, Bangladesh Bank data displays.

Bank loan disbursement increased by 220 per cent to Tk 94.9 crore in the same period while domestic bill payments were up 23.45 per cent to Tk 93.7 crore.

Migrant workers used the provider to send home Tk 3,327.9 crore in the first month of the existing fiscal, up 422 % from Tk 637.1 crore year-on-year.

The quantity of transactions rose 90 % to 76,61,508 in July compared to the same month in 2019 and transaction volume swelled by 151 % to Tk 28,415.3 crore.

The quantity of agents jumped by 47.75 % year-on-year to 9,180 in July as the final number of outlets reach 12,861 towards the end of July this year, up 44.91 per cent when compared to same month a year ago, central bank data shows.

While of July, there have been 76,85,990 agent banking accounts found in Bangladesh, which is 115 % higher than in the same month last year.

The quantity of accounts held by men advanced 83 % to 41,62,122 and the number of accounts owned by women went up by an astounding 167.87 % to 33,69,654 in July.

"Agent banking is certainly increasingly establishing itself as an excellent model. People are using it relaxed," explained Md Arfan Ali, taking care of director of Lender Asia, who pioneered the brand new banking unit in the country in January 2014.

He credited banks' occurrence within the reach and the chance to secure banking services as per their necessities for the steady expansion of agent banking.

Barring a few exceptions, outlets have remained open through the pandemic, bringing people's assurance in the agent banking to a higher level, Ali said.

He said when Bank Asia rolled out their agent banking service, two things were considered: promoting entrepreneurship and acquiring banking offerings to the people's doorsteps.

The owners of outlets are also driven to render good service because their success would also rely upon attracting customers and retaining them, Ali said.

The central bank introduced agent banking to supply a safe alternative delivery channel of banking services to the underprivileged, under-served population who generally live in remote locations that are beyond the reach of the traditional banking network.

It has up to now issued licences to 28 banks for operating agent banking actions. Of them, 23 are functioning.

Recently, Prime Lender and NRB Global Lender guaranteed agent banking licences from the central bank.

Agent banking has allowed the country's finance institutions to expand their businesses and accelerate financial inclusion using agents as intermediaries, in line with the central bank.

It has gone beyond the basic banking companies such as for example cash deposits, money withdrawal, and receipt of remittances. Rather, banks have started giving out little loans through these outlets.

In the April-June quarter, agent banking has continued to grow in all dimensions amidst extreme business interruptions due to the Covid-19 pandemic, the central bank stated in its quarterly report.

The model is gathering popularity as a cost-effective delivery channel in addition to a convenient method of providing banking services to the mass people who in any other case have remained beyond the reach of conventional branch banking.