Prime Bank to can get on agent banking bandwagon this year

Prime Bank plans to step in to the agent banking arena this season as part of its push to widen footprint and cut reliance on branches, said its top executive.

The lender received the agent banking licence from the central bank recently, Rahel Ahmed, its chief executive officer, told The Daily Star last week. "We would choose the implementation this season."

With this, Prime Bank joins an increasing number of lenders who are putting less emphasis on branch-led banking and embracing agent banking within their proceed to reach the rural areas and spend less.

Prime Bank has not opened any new branches within the last four years and has no plans to open any later on either, Ahmed said.

The central bank introduced agent banking in 2013 to supply a safe alternative delivery channel of banking services to the underprivileged, under-served population who generally stay in the remote spots that are beyond the reach of the traditional banking network.

It has so far issued licences to 27 banks for operating agent banking activities. Of these, 22 are functioning.

Bank Asia is a pioneer in popularising the model, followed by Dutch-Bangla Bank.

Agent banking has allowed banks to expand businesses and accelerate financial inclusion using agents as intermediaries, based on the central bank.

It has gone beyond the essential banking services such as for example cash deposits, cash withdrawal, and receipt of remittances. Rather, banks have started giving out small loans through these outlets.

The method is gaining popularity as a cost-effective delivery channel in addition to a convenient method of getting banking services, the Bangladesh Bank said in its sydney for the January-March period.

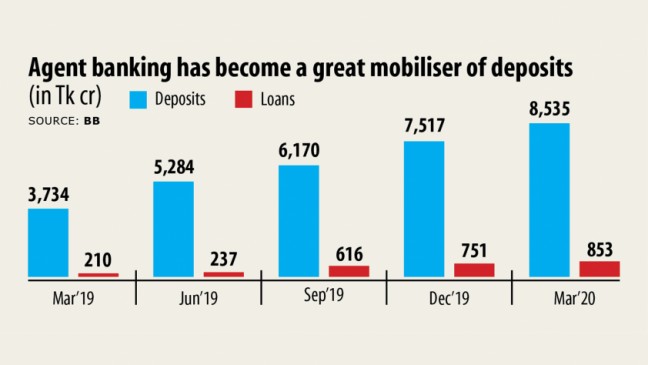

Deposits soared 129 % year-on-year to Tk 8,535 crore towards the end of March, the most recent that data is available. Loan disbursement grew 306 per cent to Tk 853 crore.

As of March, the full total number of accounts, which could be opened with deposits which range from Tk 10 to Tk 100, beneath the programme stood at 2.13 crore and aggregate deposits Tk 2,385 crore.

There are outlets 11,875 under 8,260 agents in the country.

About 65 lakh accounts were opened through the outlets, out which 29.6 lakh are owned by women, BB data showed.

The year-on-year growth of agents, outlets, and accounts in the first quarter stood at 69.8, 51.5 and 123.5 per cent respectively.

Deposit, loans disbursed and inward remittance had a rise of 128.6 per cent, 220.3 % and 172 % respectively.

A staggering 87 per cent of the agents and 88 per cent of the outlets are positioned in the rural area within an indication that banks are contributing drastically to market financial inclusion.

Gender-wise, female accounts constitute 45 per cent of the full total accounts, male accounts 54 % and the remainder 1 % are held by institutions, the BB publication showed.

Of the deposits, 77 % are collected in rural areas. Sixty-six per cent of deposits come from male customers.

More than 70 % of loans were disbursed in the rural area. Of them, 69.4 per cent went to male customers, 5.8 % to female customers and 24.9 per cent to small enterprises.

Dutch-Bangla Bank gets the highest number of outlets with 4,030 outlets, which is 33.9 % of the full total outlets by March, accompanied by Bank Asia at 29.8 %.

Bank Asia has the highest number of accounts at 24.6 lakh accounts, or 37.8 % of the total. In addition, it disbursed the best amount of loan of about Tk 276 crore, or 41 % of the total disbursement by March.

Islami Bank Bangladesh had the best amount of deposit with Tk 2,159 crore and Dutch-Bangla Bank distributed the best amount of inward remittance of Tk 7,526 crore.

The central bank expects that more loans will be disbursed in future when more banks start disbursing loans through agent outlets.

"Thus, agent banking includes a noteworthy effect on financial inclusion and potential to fill the market gap," the BB sydney said.