AB Bank puts Aman Feed’s factory and land on sale for failure to pay loans

AB Bank has put the factory of Aman Feed and its own collateral on sale for its failure to pay Tk 268.40 crore in loans and interest within the sanctioned timeframe of July.

"We gave them enough time and talked to them on several occasions, but to no avail. That is why we've put their factory and lands in Sirajganj and Gazipur on auction," said AB Bank's President and Managing Director Tarique Afzal.

The lender estimates that the approximate value of the house, like the factory in Sirajganj and lands in Sirajganj and Gazipur, is more than Tk 70 crore.

Aman Feed, a concern of Aman Group, got the revolving loans to get capital machinery and raw materials in 2006 when it began commercial production to make poultry, fish, shrimp and cattle feed to cater to the burgeoning poultry, aquaculture and dairy industries, officials said.

Bangladesh needs practically 65 lakh tonnes of feed per year and the poultry industry is the key consumer.

Aman also offers business in poultry breeding and hatchery.

AB Bank said it filed cases against Aman Feed under negotiable instrument law earlier and arrest warrants were also issued against the officials of the company.

The lending company had granted Aman Feed time to repay the loans in a bid to lessen its non-performing loans and improve overall financial health.

"But, as the business did not pay back the loans, we've put all its enforceable mortgages on auction," Afzal said.

The lender published notices for selling the property proven as mortgage by Aman Feed's Managing Director Md Shofiqul Islam.

Bangladesh Securities and Exchange Commission had also fined all the directors of Aman Feed except the independent director Tk 25 lakh each in January for violation of securities rules.

Aman Feed got listed with the stock exchanges in 2015 after floating two crore shares to the public and raised Tk 72 crore to utilize the fund for expansion, loan repayments and as working capital.

The business, however, in its IPO utilisation report submitted to the currency markets regulator said all of the loans as per the proposal in the original public offering (IPO) were repaid to AB Bank.

The lender in October last year issued a legal notice to Aman Feed saying the business has failed to pay the monthly instalments of loans.

A particular audit report of MBS and J Partners Chartered Accountants said the business had not used the amount of money properly and provided false information to the currency markets regulator.

The bank gave Aman Feed various opportunities, including loan rescheduling facility and interest waiver, Afzal said, terming the business a wilful defaulter.

Aman Feed's Chairman Rafiqul Islam didn't respond to calls and text messages from The Daily Star yesterday.

In the financial year that ended on 30 June 2019, Aman Feed reported Tk 621.68 crore in sales, up 15 % from a year earlier.

The business's sales rose 20 per cent year-on-year to 160,870 tonnes in its 2018-19 financial year, according to its gross annual report for 2019.

Aman Feed's net profit dropped 11 % to Tk 47.87 crore in the 2018-19 financial year from a year earlier, while earnings per share also declined.

The company offered a 13 % cash dividend in 2019, down from 20 per cent cash and 10 % stock dividend announced in the last year.

As on 30 June, sponsors held 63.26 % shares of the company while public 24.24 % and institutional investors the others, in line with the Dhaka Stock Exchange.

"As both AB Bank and Aman Feed are listed companies, we will have if they are doing everything according to the securities rules. We will need steps if they do anything wrong," said Mohammad Rezaul Karim, BSEC spokesperson and executive director (current charge).

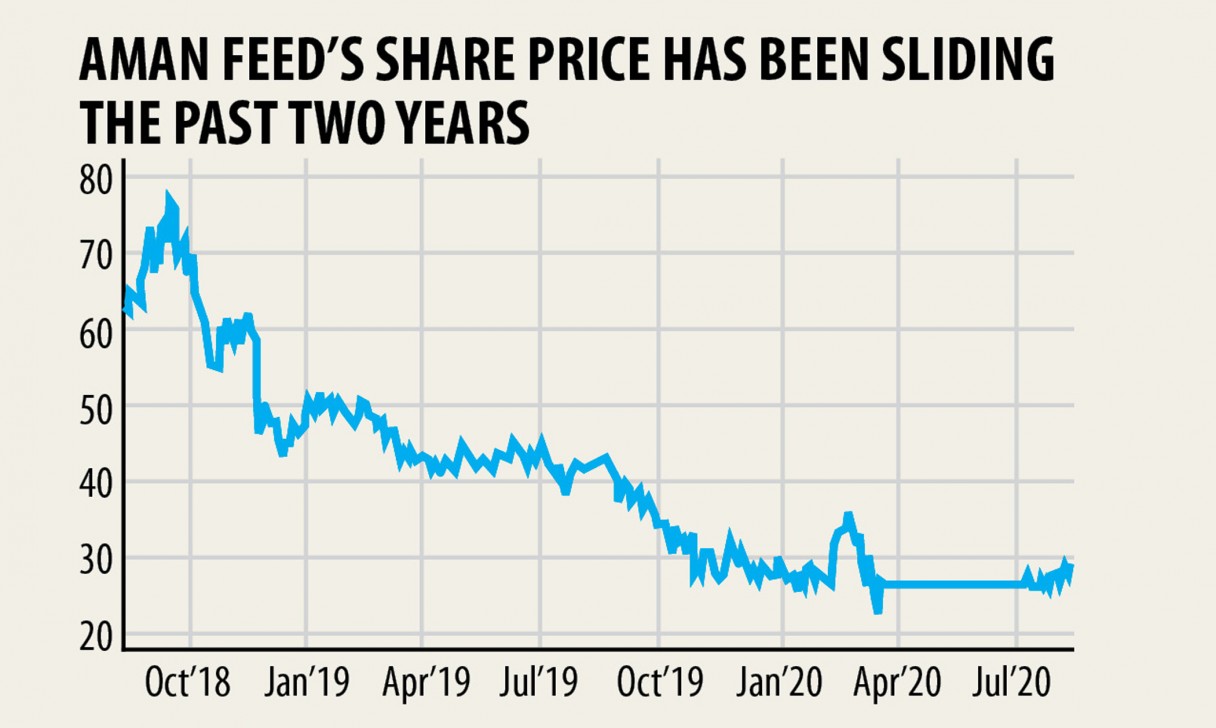

Stocks of Aman Feed closed at Tk 29.5 on the DSE on Thursday, up 3.5 per cent from the previous day.