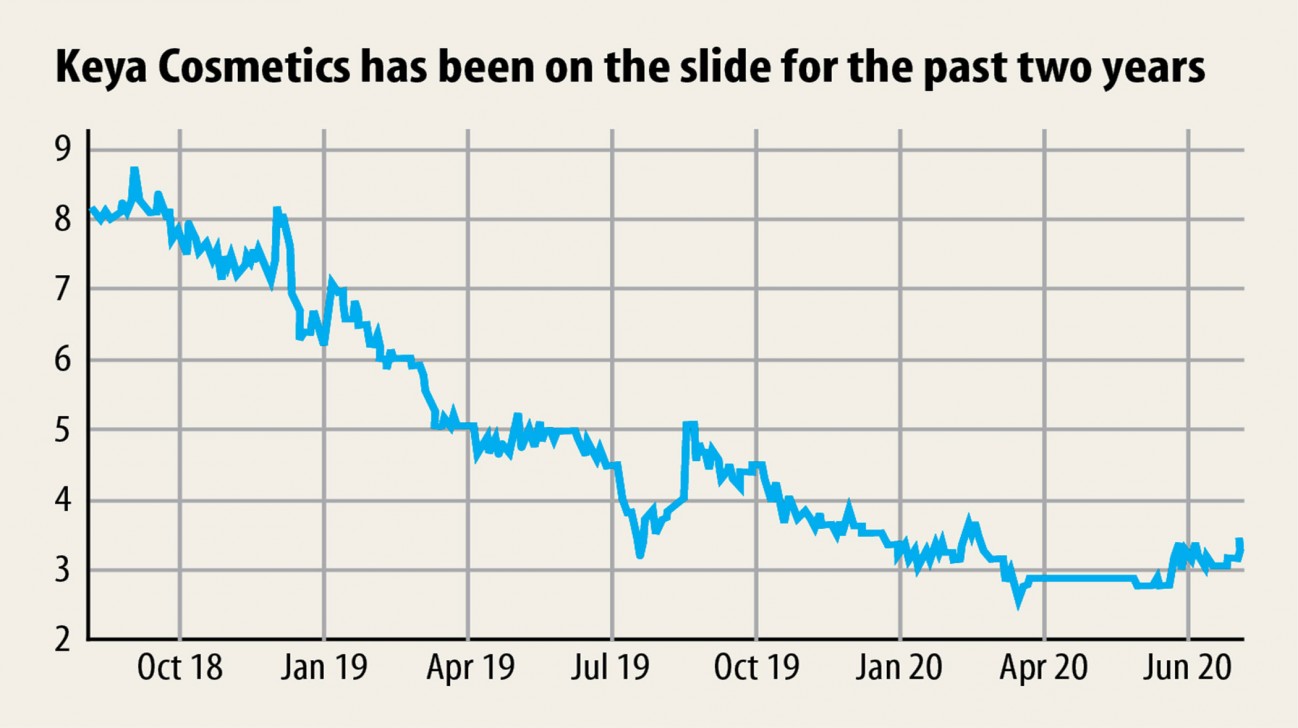

The beautiful fall from grace of Keya Cosmetics, a once beloved brand

Keya Cosmetics becomes a textbook case of what sort of high-flying company falls from grace in fits and starts.

Even though the manufacturers of hygiene products and toiletries were making higher profits because of increased demand due to the coronavirus pandemic, Keya Cosmetics remains an exception and brings no good news for its shareholders.

Reckitt Benckiser Bangladesh, a company of almost the same kind, witnessed a 54 % leap in its profits and 29 % jump in sales in the first half of 2020.

Keya Cosmetics, which had provided 10 to 50 % dividend to its shareholders since its listing with the bourses in 2001, has lately been making no disclosures that may be a sight for sore eyes.

Incorporated in 1996, the company has been announcing repeatedly to its shareholders that its sponsors, including Chairman Abdul Khaleque Pathan, want to offload their shares.

Due to this fact, the sponsors' shareholding dropped to 46.27 % on 30 June 30, from 62.77 % on 30 June 2017. Now, the sponsors cannot even sell their shares because of a poor demand.

In order to reduce costs, the business also shifted its corporate office from Banani to Gazipur, adjacent to its factory.

As the company is not publishing its quarterly reports because the 2016-17 financial year, the stock market regulator fined its directors Tk 1 lakh each in 2018.

Regardless of that, the cosmetics and toiletries maker did not bring out any sydney as yet, except making an abrupt announcement to provide 10 % stock dividends for the entire year that ended on 30 June 2018.

From then on, it had again gone into hibernation.

In addition, Financial Reporting Council (FRC), the regulator for establishing standards of financial reports in Bangladesh, discovered that Keya Cosmetics announced dividend on the basis of fake earnings.

"Its balance sheet was overvalued by a lot more than Tk 1,000 crore and the amount could possibly be laundered," said Md Sayeed Ahmed, executive director of the FRC.

Keya Cosmetics exported products to its own company in Europe, however the export proceeds have yet to reach.

"Meanwhile, the earnings have already been demonstrated in its profits, so we suspect the amount of money may have been laundered."

When sponsors of a company want to market their shares they have a tendency to overvalue their profits and present stock dividends that are provided in the sort of shares instead of cash.

The FRC asked the business in February last year about the over-valuation of its profits, but is yet to get any response.

The company did not hold annual general meetings in the last 2 yrs showing lame excuses, though listing regulations bind all companies to hold AGM regularly, Ahmed added.

Against the backdrop, stock investors who own 44.48 % shares in the business have been devote a tight corner.

"Why a once-reputed company such as this plunged into such a bad situation should be investigated by the Bangladesh Securities and Exchange Commission," said Md Masud Alam, a stock investor.

The company won the national export trophies in 2002-03, 2003-04 and 2004-05.

"I think it could have fallen into trouble because of amalgamation using its other non-listed ventures," Alam said.

Keya Cosmetics amalgamated with Keya Detergent and Keya Soap Chemicals this year 2010 and with three others -- Keya Spinning Mills, Keya Cotton Mills, and Keya Knit Composite -- in 2015.

Before the amalgamation in 2010 2010, Keya Cosmetics' earnings per share was Tk 5.26, which dropped to Tk 1.55 in 2013.

After 2015, the business became irregular in publishing twelve-monthly reports and holding AGMs.

Ahmed, who's also a former deputy managing director of Pubali Bank, found four reasons for the fall of the business.

Firstly, the business had no corporate culture and it had been run by relatives of the business chairman.

Secondly, the company fell into problems this year 2010 when cotton prices in the world market became volatile and the business purchased plenty of cotton at a very high price.

Thirdly, the company borrowed plenty of money from banks so its debt obligations was skyrocketing along with interest.

The business's long-term loan was Tk 859.85 crore and short-term loan Tk 634.45 crore, according to its annual report for the 2016-17 financial year.

And fourthly, the company's chairman stayed abroad for years therefore local production was not looked after properly.

A number of the products of Keya Cosmetics had won the hearts of customers and they were among the top selling products a good few years ago. However now, their demand has fallen drastically, said a high official of a respected cosmetics producer, requesting anonymity.

The largest blow came when its chairman was arrested by the Anti-Corruption Commission on charges of loan fraud involving Tk 110 crore. The loan was taken because of its concern Keya Yarn Mills from state-owned Bangladesh Krishi Bank.

Pathan, now on bail, did not respond to calls and texts from The Daily Star yesterday.

A high official of the BSEC said they already fined the business for not publishing financial reports.

"The company is under the scanner. We is focusing on it since it is breaching rules again and again," the state said, asking never to be named.

Stocks of Keya Cosmetics, whose paid-up capital is Tk 1,002 crore, closed at Tk 3.10 in the Dhaka STOCK MARKET yesterday, up 6.7 per cent from the prior day.