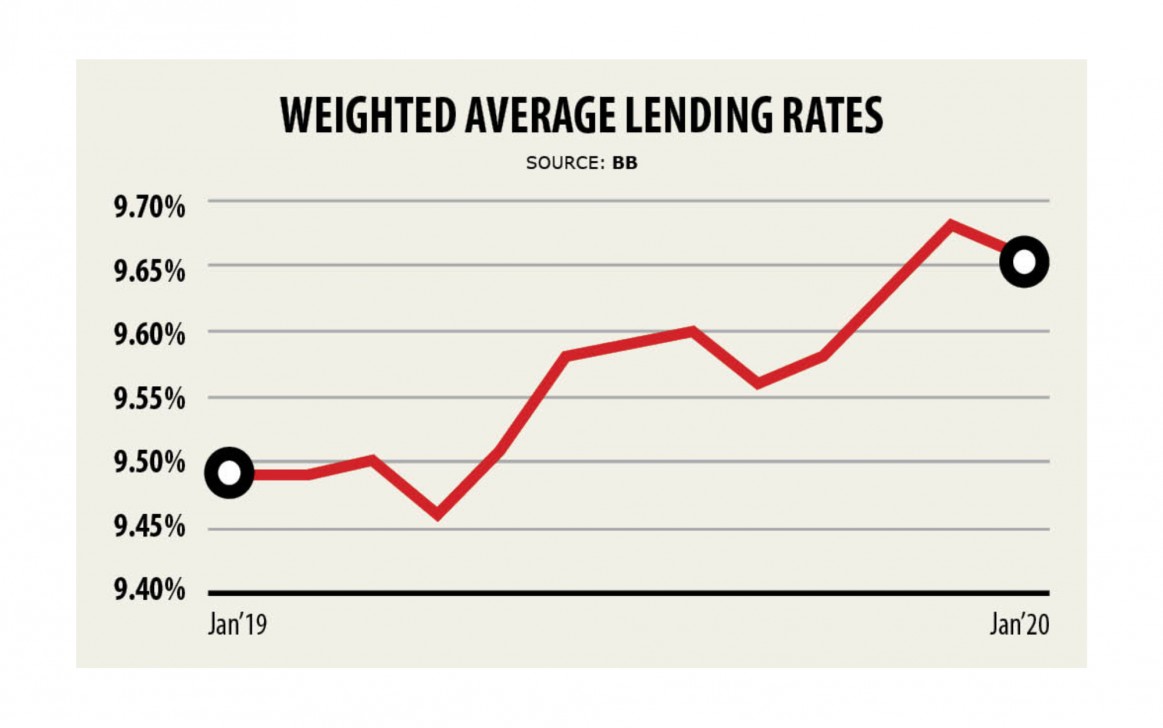

The 9pc lending rate from the following month seems unlikely

Banks' capacity to provide loans at 9 % interest has shrunk even prior to the government-fixed ceiling is implemented as both individuals and corporate institutions are withdrawing deposits to protect themselves from the ongoing economic fallout of the coronavirus pandemic.

The Bangladesh Bank instructed banks on February 24 to set a maximum 9 % interest rate on all loan products save for credit cards from April 1.

Although the central bank has already slashed both policy rate and the money reserve ratio (CRR), this is simply not enough to bring down the interest for loans.

The banking sector offers an additional fund of Tk 6,400 crore through slashing of the CRR by 25 basis points to 5.75 %.

But corporate clients have been recently forced to obtain a large sum of money to pay wages and salaries to employees at the same time when their production has come to a halt.

Similarly, folks are cashing out fixed and deposit pension schemes prematurely fearing the impending health insurance and financial risks.

"Banks in Bangladesh will face liquidity pressure like lenders far away. How can banks lend smoothly then if indeed they do not have adequate loanable funds?" said Syed Mahbubur Rahman, chairman of the Association of Bankers, Bangladesh.

Lenders have been implementing 6 per cent interest rate on fixed deposit schemes since February within their preparation to provide loans at 9 % interest from the following month.

"However the economy is in meltdown. We will need to give our all-out effort to mobilise deposits when the lockdown is lifted."

Banks will face hurdles in attracting depositors at 6 % interest, which will create a stringent situation for implementation of the single-digit lending rate, Rahman added.

The lending rate could possibly be brought right down to single-digit if the central bank implements quantitative easing as per its announcement, said Ahsan H Mansur, executive director of the Policy Research Institute.

On March 22, the BB said it would buy Treasury bills and bonds from banks and non-bank finance institutions to tackle the imminent financial slowdown.

Quantitative easing (QE) is a kind of unconventional monetary policy in which a central bank purchases longer-term government securities or other styles of securities from the open market so that you can increase money supply and inspire lending and investment.

The central bank rarely purchases T-bills and bonds from banks.

The BB must set a roadmap on the amount of cash it'll inject in to the money market within a specific period.

Otherwise, the banking sector won't get the confidence to lessen the interest on lending, Mansur said.

"Lending rate ought to be brought down in the interest of the private sector, which includes been struggling to obtain desired funds for long."

Small and medium enterprises will have to be given more support through loans under refinance schemes because they are being hit hard by the ongoing crisis, said Mansur, also a former official of the International Monetary Fund.

Rahman, also the managing director of Mutual Trust Bank, echoed exactly like Mansur.

He feared that defaulted loans would rise further after June when the central bank's moratorium period for borrowers ends.

Inflation will never be fuelled if the central bank injects money in to the market, said Arif Khan, managing director of IDLC Finance.

Both global and local demand have dry out and the declining petroleum price is a harbinger of the trend, he said.

"Borrowers are now struggling to repay loans, adding a supplementary pressure on lenders. We are not permitted to violate the central bank's instruction to provide out loans at single-digit."

Against the setting, many lenders may adopt a go-slow policy on loan disbursement, putting a detrimental effect on the private sector, Khan said.

"Banks' profitability will dsicover a sharp decline if indeed they give out loans at single digit without managing deposits at 6 per cent," said Emranul Huq, managing director of Dhaka Bank.

The loan-deposit ratio ought to be relaxed along with quantitative easing measure so that you can widen banks' capacity to disburse loans, he added.

The BB has yet to backtrack from its stance, said its spokesperson Md Serajul Islam.

"We are closely monitoring both global and domestic financial situation. And the central bank will need decisions when the lockdown is lifted."