Tax News

-

Telcos seek corporate tax cuts

Telecom operators yesterday placed a slew of demands before the authorities, including slashing corporate tax from 40 % and 45...

-

Businesses demand reforms in tax system

Business leaders in Chattogram experience stressed the necessity for reforms found in the tax system, such as for example policies...

-

Tax deal units bar too low, campaigners say

A landmark package struck by rich nations to make multinational companies fork out more tax has been criticised by campaigners...

-

Corporate tax trim won’t pay off

Despite a 2.5 percentage point corporate tax reduction, listed and non-outlined companies might end up having to pay more tax...

-

Continue 0.5pc source tax for 5yrs

Garment exporters yesterday demanded the continuation of the existing 0.5 % source tax for another five years.Apparel manufacturers usually demand...

-

E-payment of land duty, mutation, record costs introduced

The federal government has introduced e-payment system for citizens to be able to pay land development tax, mutation in addition...

-

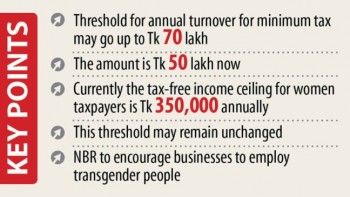

Women entrepreneurs gets tax relief

Women entrepreneurs may get a relief in taxes payment on their incomes from businesses in the approaching fiscal year, said...

-

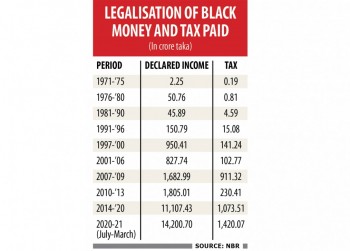

Keep money whitening scope on productive sectors

Businesspeople have urged the federal government never to allow any blanket dark money whitening option, saying the preferential tax treatment...

-

Improve service to get tax benefit

Cellular phone operators should focus more on bettering the caliber of service to get tax exemption, said Posts and Telecommunications...

-

Anti-tobacco activists demand larger tobacco tax

Around 100 anti-tobacco activists all around the country, held a virtual human being chain today (May 5) demanding imposition of...

-

Automation could have boosted tax receipts: NBR

Automating the tax administration could have accelerated earnings collection while enabling home based amidst the pandemic, averting many losses, including...

-

Corporate tax may be cut

Finance Minister AHM Mustafa Kamal yesterday indicated that the federal government may consider reducing corporate tax rates for listed organizations...

-

Any offer should end double taxation

The Maldives wants to sign agreements with Bangladesh which get rid of twice taxation and guarantee and protect investment for...

-

Tax support needed for job recovery

Restructure of corporate tax, improvement in the position of the Simple Doing Business Index, and special allocation for SMEs should...

-

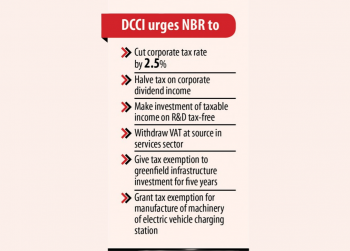

DCCI desires corporate tax cut

The Dhaka Chamber of Commerce & Industry (DCCI) yesterday urged the earnings administration to cut the corporate tax for listed...

-

Kamal irked by delays on NBR’s automation

Financing Minister AHM Mustafa Kamal yesterday expressed his disappointment to the taxmen for failing woefully to keep carefully the promise...