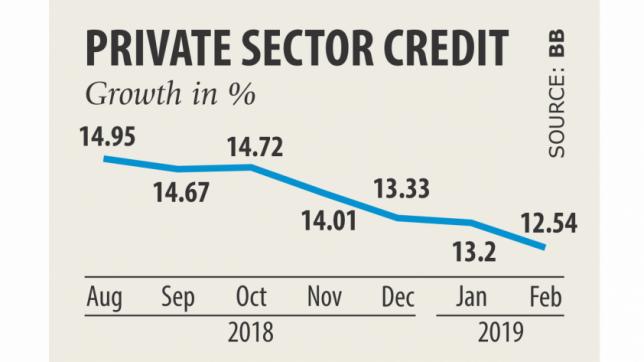

Private credit growth hits 53-month low

Private sector credit growth hit a 53-month low in February thanks to the ongoing liquidity crunch brought about by the rising default loans.

In February, credit growth stood at 12.54 percent, the lowest since October 2014, according to data from the central bank.

The growth was much lower than the central bank's target of 16.5 percent for the second half of fiscal 2018-19.

Scarcity of funds to give loans with, shortage of greenbacks to meet import payments and disbursement of large amounts of loans for the mega infrastructure projects are responsible for the dwindling credit growth, analysts said.

“The growth will be on the decline in the months to come if the existing unpleasant situation persists,” said Ahsan H Mansur, executive director of the Policy Research Institute.

He says deposit growth in banks is lower than the credit growth and that has forced banks to adopt a cautious lending policy.

Net foreign asset in the country's balance of payment is now negative, which has also weakened the deposit base of banks.

In such a situation, a good portion of the deposits has gone abroad to meet the country's foreign exchange liabilities, said Mansur, also a former official of the International Monetary Fund.

“Extensive measures should be taken immediately to recover the default loans as it will help lenders strengthen their capacity to disburse loans.”

At the end of 2018, total non-performing loans (NPL) amounted to Tk 93,911 crore, up from Tk 74,303 crore a year earlier.

At the same time, savers are gravitating towards savings certificates and bonds instead of bank deposits because of higher returns from the former.

“The government should adjust the rate of interest on its tools for the sake of restoring stability in the financial sector,” Mansur added.

The interest rate on deposits has shot up to double digits recently but it has still failed to catch the attention of depositors, said Syed Mahbubur Rahman, chairman of the Association of Bankers, Bangladesh.

“Banks face criticism from different corners when they want to set the lending rate in keeping with the returns on deposits. It is not viable for banks to disburse loans at single-digit interest rate.” So, many banks have almost slowed down their lending to avoid criticisms, said Rahman, also the managing director of Dhaka Bank.

Banks have also been on a dollar purchasing spree from the central bank for months to meet import payments, casting a pall of gloom over their deposit base.

“This is an indication that a dark cloud will hang over the banking sector soon as loan disbursement is the pivotal component for lenders to enjoy profit,” Rahman added.

Lenders had earlier provided substantial credit for implementation of the mega infrastructure projects, a move that has dried up the available liquid funds in banks, said Faruq Mainuddin Ahmed, managing director of Trust Bank.

Confusion has been created for both banks and clients about the interest rate on lending and deposit, which has had a negative impact on the financial health of lenders, he said.