Banks' capital base shrinking fast

The banking sector's capital base eroded alarmingly last year on the back of an increase in default loans.

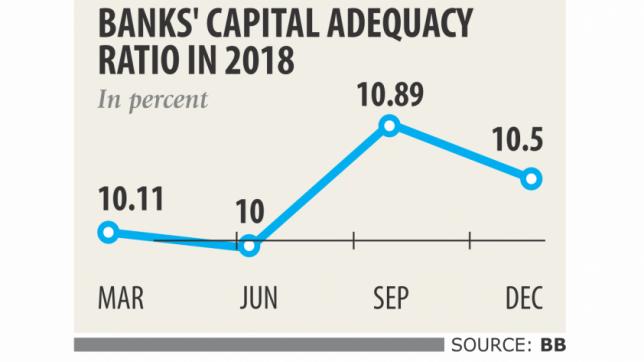

As of December last year, banks' capital adequacy ratio (CAR), which determines the adequacy of banks' capital in keeping with their risk exposures, stood at 10.50 percent, down from 10.83 percent a year earlier, according to data from the central bank.

Banks were required to keep at least 11.82 percent CAR in December last year as per the roadmap set by the central bank for implementing Basel III this year, according to a Bangladesh Bank official.

From the first quarter of this year, their CAR must be 12.50 percent or else they will face trouble in conducting business with foreign banks, experts said.

CAR has to be maintained to safeguard interests of depositors and promote financial stability.

Banks' inability to maintain the minimum CAR will affect their business as their counterpart foreign banks will show reluctance in accepting their letters of credit (LCs), said Khondkar Ibrahim Khaled, a former deputy governor of the central bank.

They will have to turn to the well-reputed foreign banks to endorse their LCs, which will raise their cost.

“If the existing default loan culture continues, the indicators of CAR will worsen in the days ahead,” he said.

The general public have been demanding effective measures against financial scams but the government is still showing nonchalance, said Khaled, also a former chairman of Bangladesh Krishi Bank.

At the end of 2018, the total amount of non-performing loans stood at Tk 93,911 crore, up from Tk 74,303 crore a year earlier. In a further indication of the progressively precarious state of the banking sector, ten banks, including six state-owned ones, ended up with a capital shortfall of Tk 26,690 crore last year.

The banks are: Sonali, BASIC, Janata, Agrani, Bangladesh Krishi Bank, Rajshahi Krishi Unnayan Bank, Bangladesh Commerce Bank, ICB Islamic Bank, National Bank of Pakistan, and AB Bank.

AB Bank entered the negative territory for the first time in recent years as the lender faced a host of financial scams in the last two to three years.

The image of the country's banking sector will become sallow if the capital base is not strengthened, said Syed Mahbubur Rahman, chairman of the Association of Bankers, Bangladesh, a platform of private banks' chief executive officers.

“The foreign banks and businesses will shy away from our financial sector if the unpleasant situation persists.”

He went on to urge the failing lenders to take prompt measures to build up their capital base.

The majority of the private lenders have been able to manage their required capital but the state-owned ones were unable to, casting a pall over the entire banking sector, he said.

The lenders should also issue right shares or offer stock dividends instead of cash to give a boost to their capital base, said Rahman, also the managing director of Dhaka Bank.