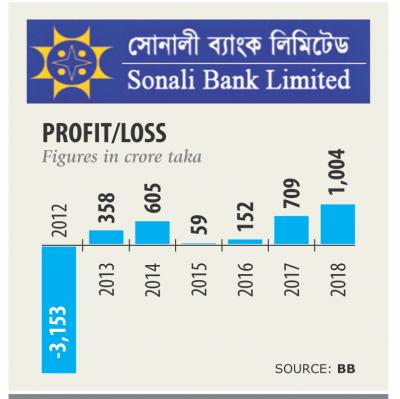

Sonali's profit hits 7-year high

Sonali Bank logged the highest net profit in seven years thanks to its deposits with different banks and massive drives to recover funds from loan defaulters.

The state-owned financial institution's net profit rose 41.60 percent year-on-year to Tk 1,000 crore in 2018, according o Bangladesh Bank data.

Of the total profit, more than 40 percent came from the investment in short-term deposits with different banks, said Nurul Islam, general manager of the bank.

“The massive recovery drive aimed at loan defaulters also helped the bank improve the financial health,” said Islam, who is in charge of the business development and recovery divisions of the state lender.

The liquidity crunch in private banks throughout 2017 opened up the opportunity for cash-rich Sonali to make some profits from the money market. He said the bank had an investment of more than Tk 53,000 crore in the market as of December.

“So the bank went for depositing funds instead of expanding its lending activities.”

Some other state banks—which had been suffering from fund crisis because of loan scams—also borrowed money from Sonali, Islam added.

Sonali is the biggest source of fund now as it sat on a deposit base of Tk 108,629 crore last year, according to the bank statement.

The advance-deposit ratio (ADR) of the bank was 42.69 percent last year, far below compared to the regulatory ceiling of 85 percent. The ADR is used to assess a bank's liquidity by comparing its total loans to its total deposits.

If the ratio is too high, it means that the bank may not have enough liquidity to cover any unforeseen fund requirements. Conversely, if the ratio is too low, the bank may not be earning as much as it could be.

Last year, the loan growth of Sonali was about 9 percent whereas the average private sector credit growth was more than 14 percent throughout the year.

It recovered around Tk 3,770 crore from defaulters in 2018, up from Tk 1,091 crore a year ago. The bank managed to earn a significant amount from the large borrowers, including Beximco Group, Islam said.

The bank's default loan rate also declined to 30.06 percent last year from 38.11 percent in 2017, the central bank data showed.

Sonali itself was embroiled in huge scam. The Hallmark loan scandal involving Tk 3,500 crore was a major setback for the bank, which sank it to a loss of Tk 3,153 crore in 2012.

Since then the bank has remained shy when it comes to lending and has rather been trying to overcome the loss from other banking functions such as treasury management and investment, Islam said.

The bank, however, could not recover a single penny from Hallmark last year, he said.

Though the bank made hefty profit, it has a provision shortfall of around Tk 3,600 crore last year, according to data of the banking regulator.

The bank will seek provision forbearance from the central bank, Islam said.

Forbearance is refraining from the enforcement of something such as debt or obligation that is due.

The bank has already sought a capital support of Tk 6,000 crore from the government, he said.