Banks charge importers more for greenback

Banks do not follow the exchange rate they set every day in a deviation that inflicts additional costs on importers and may fuel inflation.

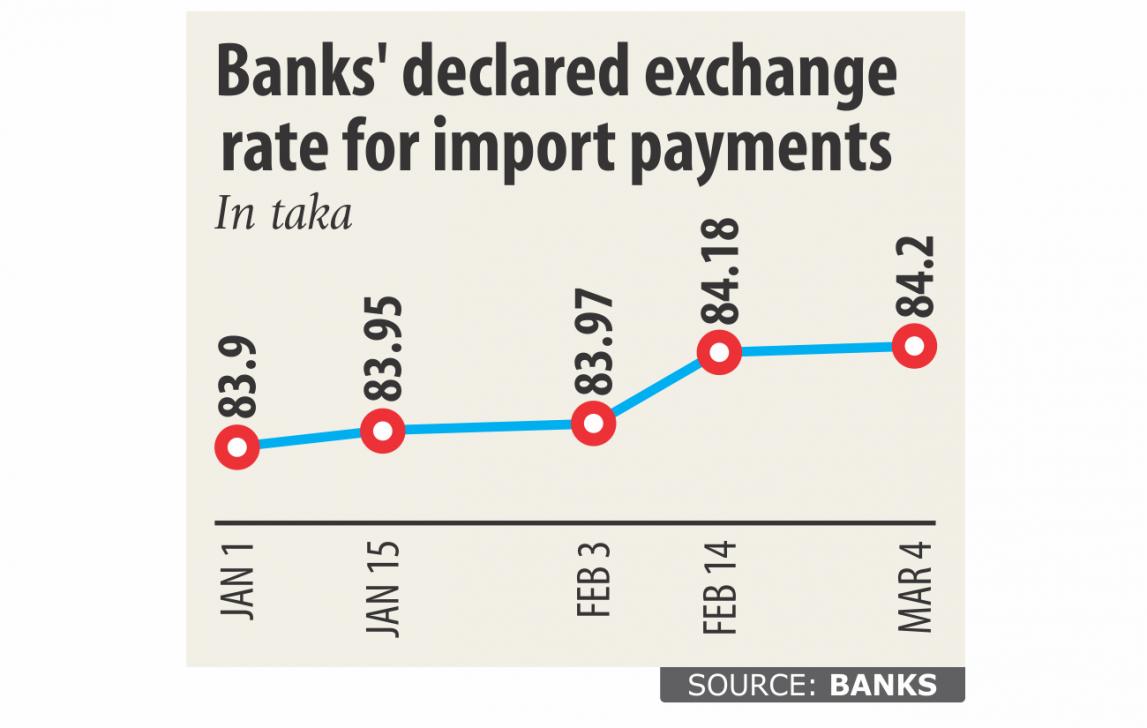

Data from the Bangladesh Foreign Exchange Dealers' Association showed that banks fixed the average exchange rate for bills for collection (BC) sale, at which lenders make import payments, at Tk 84.20 per US dollar for the last week, but a majority of the lenders ignored the rate while making payments on behalf of importers.

Bankers blame it on the gap between supply and demand of the dollar. They say the spending spree of the government for implementation of the mega projects has created a fresh demand for the greenback.

City Group, one of the biggest commodity importers and processors in the country, was forced to pay banks Tk 84.70 to Tk 85.05 a dollar in the last two weeks to settle import payments, up by a minimum Tk 0.50 per USD than the rate set by banks, said its director Biswajit Saha.

An increase of Tk 0.50 per USD may sound insignificant for many, but it can be huge for importers who buy goods in bulk amount. For example, the settlement of $20 million import payments will require an importer an additional Tk 1 crore because of the rise.

Asked why City Group had to pay more, Saha said banks informed that they did not have adequate foreign currencies. “If we try to bargain with banks and ask to follow the declared rate, they tell us to manage the dollar on our own.”

Authorities should take immediate measure to cool down the exchange rate considering the upcoming Ramadan, which is likely to begin in the first week of May. Otherwise, an inflationary pressure will hit the commodity market, he said.

Meghna Group of Industries, another large commodity importer, is a bit lucky as many banks offer them good rate for being a top client.

“We also do forward exchange contract to avert the impact of fluctuations,” said a senior official of the group. A forward foreign exchange is a contract to buy or sell a set amount of foreign currencies at a specified future date and at a predetermined price.

The central bank has ordered banks verbally to keep the BC selling rate at a tolerable level to protect the interest of importers, but lenders hardly listen, said a senior official of the Bangladesh Bank, wishing not be named.

“Ignoring the declared BC selling rate is a punishable offence and the central bank earlier warned a number of banks for breaching the rate. Punitive measure will be taken against the wrongdoers if anyone complains,” he said.

The central bank is selling the greenback to banks to address the shortage of the currency.

It has injected $1.68 billion this fiscal year so far, but the move did not yield the desired result because of a large gap between demand and supply.

The official BC selling rate stood at Tk 83.95 per dollar on January 1 and it has been on the rise since then.

The interbank exchange rate also shot up to Tk 84.15 on March 1, up from Tk 82.96 a year earlier.

The ongoing tight situation in the foreign exchange market may not ease in the near-term as a major portion of the country's import payments has been used for infrastructure projects, said Md Arfan Ali, managing director of Bank Asia.

“My bank has almost stopped opening letters of credit for luxurious items in order to tackle the foreign exchange pressure,” he said.

Syed Mahbubur Rahman, chairman of the Association of Bankers, Bangladesh, said both export earnings and remittances have to be increased to reduce the current account deficit.

The foreign exchange market will operate properly if the deficit in the current account lessens, he said.

The stagnant foreign currency reserve will dwindle in the coming years if export earnings do not pick up keeping pace with import payments, said Rahman, also the managing director of Dhaka Bank.

Since 2016, the foreign exchange reserve has been hovering between $30 billion and $32 billion.

Between July and December, imports rose 5.73 percent to $27.82 billion and exports fetched $20.16 billion, up 16.75 percent year-on-year.