Private banks sweating out over deposits

Private banks saw a decline in deposit growth in December last year despite offering higher interest rates, highlighting the ongoing liquidity crisis in the banking system.

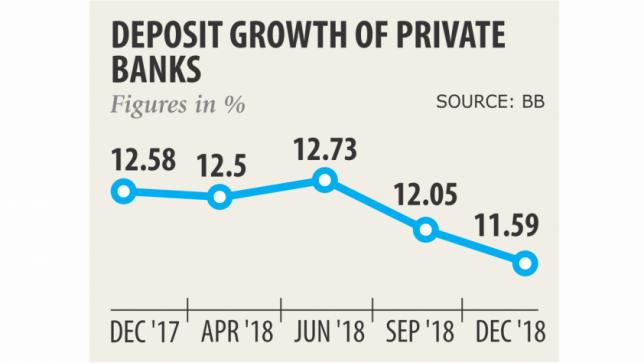

In December, the average deposit growth of private banks stood at 11.59 percent, in contrast to 12.58 percent in December 2017 and 12.73 percent in June last year, according to data from Bangladesh Bank.

The decline in deposit growth pushed the average loan-deposit ratio of private banks beyond the ceiling set by the central bank.

In September, the advance-deposit ratio (ADR) of private banks had come down to the ceiling of 85 percent from 85.56 percent in June. In December, it crossed the limit reaching 85.96 percent.

Most banks are offering more than 9 percent interest for deposits. A dozen banks are also taking deposits at up to 10 percent, according to industry insiders.

However, the banking sector's deposit growth rose in December, thanks to an increase of funds held by the state-owned banks.

The overall deposit growth stood at 11.19 percent in December last year, in contrast to 10.25 percent in September the same year and 11.29 percent in December 2017, BB data showed.

Though the overall deposit growth showed a steady rise, the banking sector is, in fact, facing a dearth of funds as the growth was inflated, according to bankers.

MA Halim Chowdhury, managing director of Pubali Bank, said many private banks took deposits from state-owned banks at the end of the year to temporarily manage their balance.

“So, the same deposits are whirling round in the market.”

It is common for banks to put in more effort in hunting for deposits at the year-end to adjust their ADR, boosting deposit growth, he added.

Nineteen banks had their ADR beyond the authorised limit as of December.

The deposit growth was far lower from the loan growth of 14.89 percent in December.

“Deposit growth should be higher than the loan growth to keep the money market balanced,” Chowdhury said.

He said the scarcity of deposits still prevails in the market, pushing up the cost of funds to up to 10 percent from the beginning of 2019.

Though overall deposits grew in December, the gap between the lending and deposit rates is still higher and it is tightening money circulation in the banking system, said Md Mehmood Husain, managing director of NRB Bank.

The mismatch between the deposit and credit growth is responsible for the liquidity crunch, he said. Husain said private banks were still struggling to mobilise deposits. As a result, the deposit rate increased to 9 percent in January, 9.5 percent in February and went past 10 percent in March, he said.

Deposits in the banking sector totalled Tk 1,115,356 crore in December, according to central bank data.

The excess liquidity fell 21.6 percent to Tk 76,393 crore in December from Tk 97,470 crore in June.

The call money rate rose to 4.53 percent in March from less than 4 percent at the beginning of December.