Online Account Opening: More banks jump on the bandwagon

People can open lender accounts from anywhere due to an increasing quantity of lenders have made digital possibilities, helping consumers avail financial products and services without visiting branches through the coronavirus pandemic.

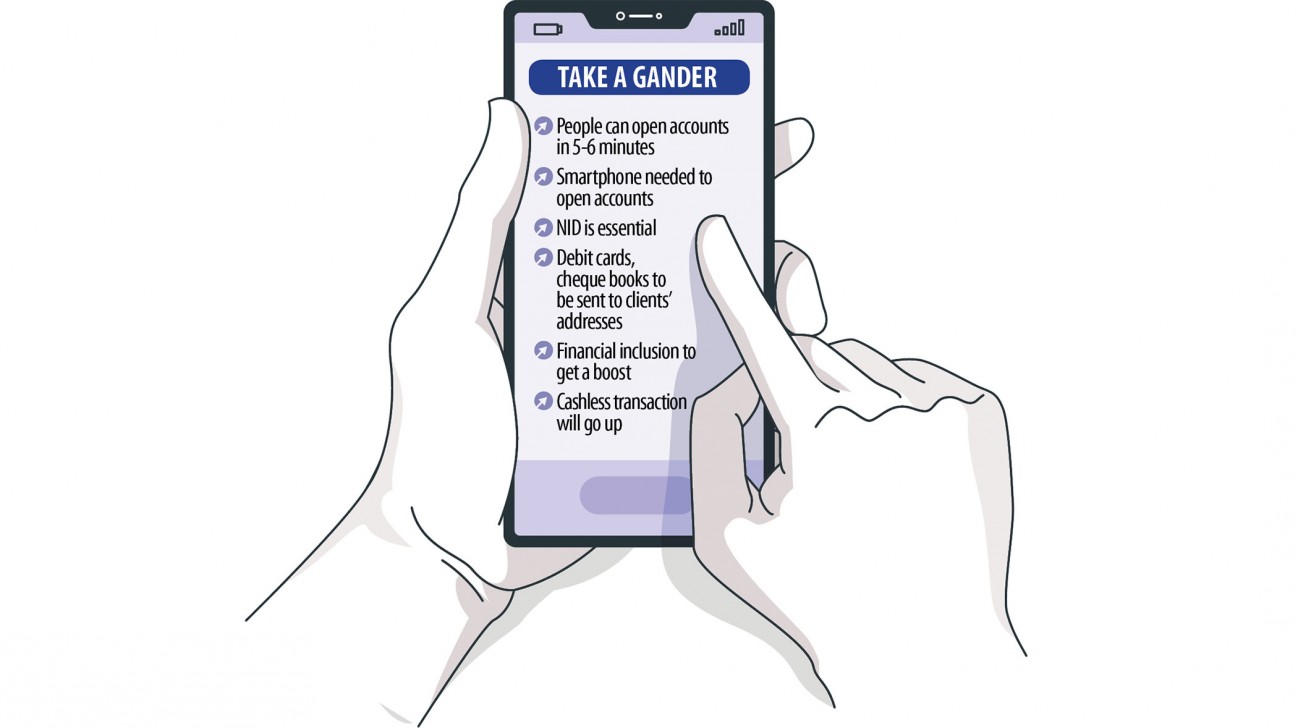

Digital accounts opening that requires a maximum of 6 minutes has end complete paper documents and highlights the improvements on the behaviour of banks and buyers brought in by the unprecedented crisis. Many persons are nervous about leaving their homes, let alone visiting bank branches. They have moved to digital platforms to do the job, shop, communicate and acquire entertained.

It prompted various banks to embrace the new system based on the central bank's e-KYC (electronic know your visitors) guideline unveiled found in January last year.

The guideline, which was formulated just 8 weeks before the pandemic hit the country, came in handy since it let the banks and other finance institutions open accounts to help people access the fundamental service throughout the crisis period.

Persons earlier had to complete some papers, including KYC, and submitted many documents to the bank to have an account.

Dhaka Lender rolled out the opening technique titled "ezyBank" the other day, allowing clients to open a merchant account on smartphones.

Clients have to download the lender's cell banking iphone app "Dhaka Bank Head out" to take pleasure from the service.

"This helps the potential customers maintain a optimum degree of social distancing and steer clear of exposure to the deadly flu," said Emranul Huq, managing director of the exclusive commercial bank.

A willing customer must take a picture of his or her passport-sized photograph and the national identification cards using the smartphone. The images must be uploaded to the app.

The person must insert some information required by the app, like the name of the nominee.

The account-holder and the nominee will need to to remain a paper, take the snapshots of them, and upload them on the app.

Banks can complete the process after verifying the client's NID facts with that of the Election Commission's (EC) data source.

The EC has recently allowed banks to gain access to its NID database in order that they are able to check customer facts while opening a merchant account or settling any financial transaction.

Clients must keep a short deposit of Tk 1,000 with Dhaka Bank.

After the account is open up, the lender will send the debit cards and cheque book to the account-holder's address without the charge, said Huq.

Customers will not need to state the info on their other lender accounts in the brand new form, based on the e-KYC rules formulated by a good government-formed committee comprising officials of the financing ministry, the central lender and banks.

If the monthly transaction through an account crosses a lot more than Tk 1 lakh, the account-holder will have to visit a branch to give a signature personally, Huq said.

Mutual Trust Bank introduced an instant bank-account opening product named "MTB Simple Account" previous month, said its Managing Director Syed Mahbubur Rahman.

The account can be opened from any digital devices such as for example smartphone, laptop and desktop. The debit cards will be delivered to clients' address.

"This has helped persons to a huge extent perform hassle-free banking from their house or perhaps offices," Rahman said.

The digital account opening can help create a less-cash society in the quickest possible time and give a boost to branchless banking in future. The digital financial inclusion program of the federal government will get a shot in the arm as well."

The number of deposit accounts in the banking sector stood at 12.23 crore by December last year.

Eastern Bank Ltd introduced the merchandise several months ago, said Ahsan Ullah Chowdhury, brain of its cards and digital banking section.

The private commercial bank is operating the digital service beneath the brand name "EBL Insta Account".

"We have received a huge response from clientele since rolling out the product," Chowdhury said.

City Lender launched the digital account-opening product "Ekhoni Profile" in September last year, explained Mashrur Arefin, managing director of the lender.

Some 17,000 clientele have up to now opened accounts from your home, he said.

Abul Kashem Md Shirin, managing director of Dutch-Bangla Bank, said his bank came up with the digital product 8 weeks ago.

Bank Asia, Mercantile Lender, and Southeast Lender have previously rolled out the provider, said bankers.

IFIC Bank can be offering the services, according to its web-site.

Brac Bank, South Bangla Agriculture and Commerce Bank, and Jamuna Lender are set to make the digital account opening service designed for its customers within a month. Premier Bank and NCC Bank intend to roll it out shortly.

Prime Bank features completed the planning to introduce the merchandise, which may to enter the market within the next two months, an official of the lender said.