National Bank under BB scanner

Bangladesh Bank has asked National Lender never to disburse any mortgage loan without its prior approval.

The banking watchdog recently received allegations that the lender had disbursed a good amount of funds sidestepping approval from its board.

This prompted the central bank to issue the instruction on April 5 asking the lender to send by yesterday complete information of loans approved and disbursed since December 26.

However the bank yesterday sought five business days to send the information, saying it was not possible to supply data within only one day, said ASM Bulbul, acting managing director (MD) of the lending company.

He claimed that that they had not disbursed any large mortgage loan, which requires approval from the board, lately.

If zero board meeting is held, the bank has to take on the permission from the central lender.

The central bank in addition has asked National Bank to see whether Bulbul was working under a valid contract.

Bulbul was yet another MD before serving the lending company as acting MD.

He acknowledged that his occupation tenure ended on March 31 but that the bank's authority had previous extended it by a month.

However the board of directors is yet to approve the extension, he said.

The board will give the approval in the quickest possible time, Bulbul said.

The central bank asked the bank never to allow Bulbul to try regular banking activities if he previously not been reappointed.

But yesterday Monowara Sikder, chairman of the lender, issued Bulbul a reappointment letter enabling a one month extension.

National Bank did it on a hurried manner to legalise Bulbul's activities since his contract's expiry, that may also help it to react to the central bank letter, said a BB official.

The lending company has been also asked to supply all papers of any board meeting held since December 26.

The bank's board was restructured following its chairman, Zainul Haque Sikder, passed on on February 10.

Zainul's spouse Monowara Sikder was elected chairman of the board on February 24 but no board meeting has been held since that day.

Despite that, the bank has allegedly disbursed loans breaching the guideline, said a central lender official.

Bulbul claimed that branches of the bank now disbursed small-scale loans which usually do not required prior approval of the board.

The central bank also instructed the bank to send detailed information of loans provided to four companies - Rongdhanu Builders, Desh TV, Rupayan and Shanta Enterprise.

Bulbul claimed that the lending company had previous disbursed loans for Desh Television and Rupayan but did not have any intend to hand out loans to the remaining two.

Md Serajul Islam, spokesperson and an executive director of the central bank, said the BB would take measures after verifying records sent by the lending company.

The financial health of the first generation bank started worsening since 2009 when Sikder Group commenced to manage the board of the lending company.

The central bank earlier discovered several irregularities taking place through the sanctioning and disbursing of loans by National Bank.

The bank had also disbursed a large amount of loans among directors of other banks.

A great number of banks possess been offering such loans under mutual understanding among directors, which has created concern over corporate governance in the banking sector.

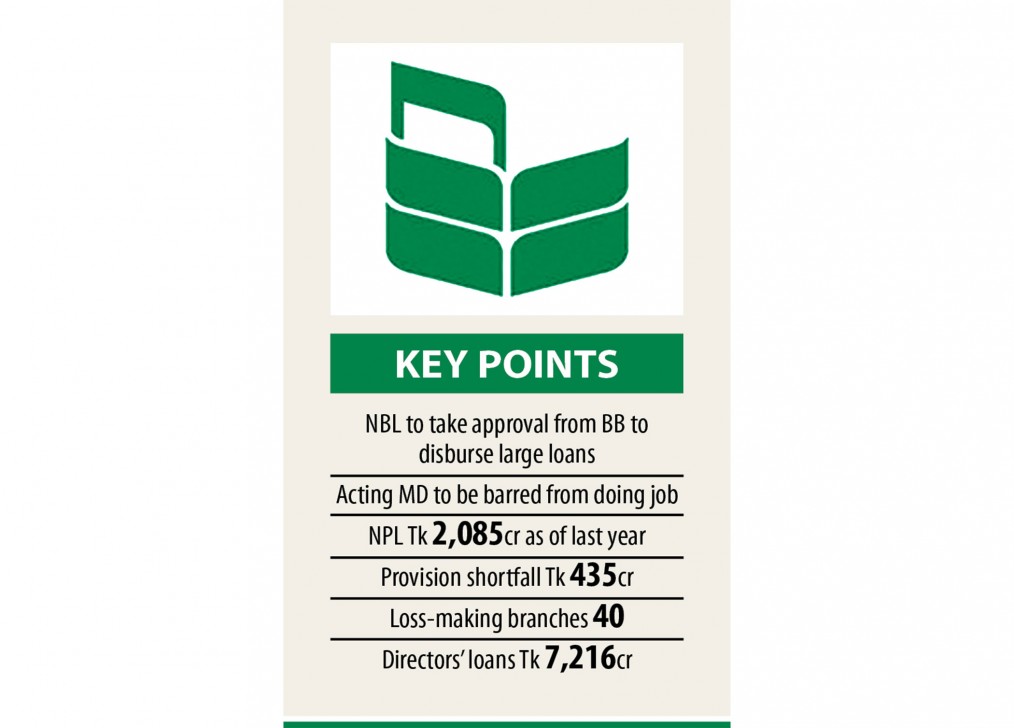

The lender gave out Tk 7,216 crore to directors of other banks, or 18 % of its total outstanding loans as of December last year, showed info from the central bank.

Defaulted loans on the lender stood at Tk 2,085 crore by December last year as opposed to Tk 388 crore in '09 2009.

Non-performing loans on the lender would have been higher than the existing quantity had the lender not written off Tk 2,154 crore last year.

The lender also faced a provision shortfall of Tk 435 crore last year because of its weak financial health.

Furthermore, 40 of its 214 branches are incurring losses.

Six banks found in the country's banking sector will have 40 or more loss-incurring branches.